Bitcoin (BTC) surpassed the $66,000 mark on July 17 for the first time in weeks, reversing a bullish trend that began with the legal actions against former President Donald Trump, a U.S. presidential candidate. This price surge has reignited optimism among BTC holders for a potential rally. Despite the price increase, there remains curiosity about whether the bears will make a move to regain control. So, what is currently happening in the Bitcoin landscape?

Current State of Bitcoin Investors

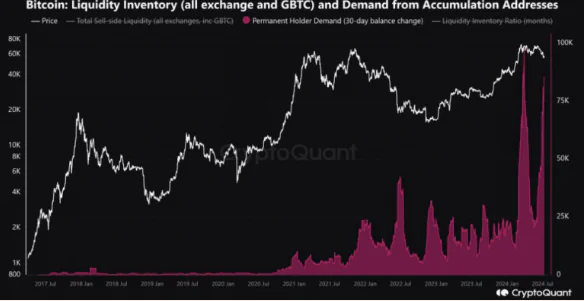

Recent data on Bitcoin reveals a low participation rate from retail investors in the recent price surge. In other words, it wouldn’t be inaccurate to say that whales and institutional buyers have been the primary drivers of the rally over the past two weeks. This situation indicates that retail investors have generally stayed on the sidelines in recent weeks, likely due to concerns about the German government’s potential sell-off and the impending payments to Mt. Gox creditors.

The most evident market observation today is that Bitcoin is over $8,000 short of its all-time high (ATH). However, it’s accurate to state that there are several resistance zones between the current level and the ATH. Conversely, investors who bought the dip might create some resistance and potential pullbacks in the coming days as they take profits.

The significant interest from institutional investors in Bitcoin ETFs mitigates the potential selling pressure from retail investors. In recent weeks, BTC dipping below $60,000 has presented an unexpected buying opportunity for many whales and retail investors to add to their positions.

Current State of Bitcoin

The downtrend throughout most of June and the first week of July caused concern among retail investors. This situation, combined with the apprehension of individual investors, might explain why interest in BTC waned during this period.

However, the current interest from institutions and the positive inflow of funds into ETFs since last week could revitalize the market. It’s also accurate to say that long-term investors are making strategic moves and adopting a more forward-looking approach in their investments.

The actions of institutional investors, whales, and long-term investors driving the market upwards might induce a sense of FOMO (Fear of Missing Out) among retail investors in the coming weeks, potentially paving the way for BTC prices to climb even higher.