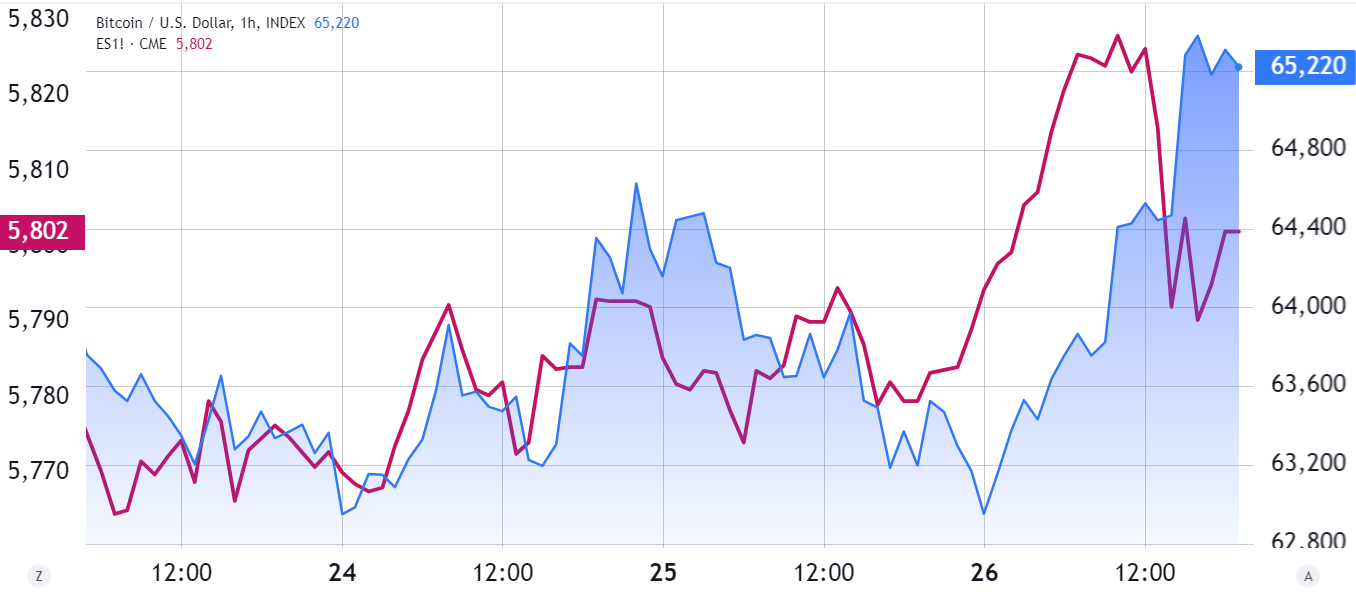

Bitcoin fell to $62,700 in the early morning of September 26, temporarily dampening investor hopes after the $64,000 resistance level was rejected for the third time in four days. However, the mood changed when the US stock market opened, pushing the S&P 500 to a new record high. Shortly thereafter, Bitcoin rose more than 3%, returning to $65,000.

Some market experts believe that Bitcoin’s rally to $70,000 has been bolstered by macroeconomic factors, including interest rate cuts in the US and growing interest from long-term institutional investors. In addition, concerns about a stock market bubble have gradually dissipated as signs of a strong economic recovery, combined with US housing prices reaching new highs.

Tech Stocks Rally

The rally in tech stocks and changes in monetary policy have boosted investor sentiment. The tech sector has played a key role in driving the global stock market rally, with many companies posting gains of more than 30% over the past six months. Notable names include Alibaba, Tesla, Nvidia, Taiwan Semiconductor, and Apple. Michael Matousek, head of trading at US Global Investors Inc., told Bloomberg:

“AI is here to stay, but I think people have gotten too excited and hyped up about what we can expect in the near future.”

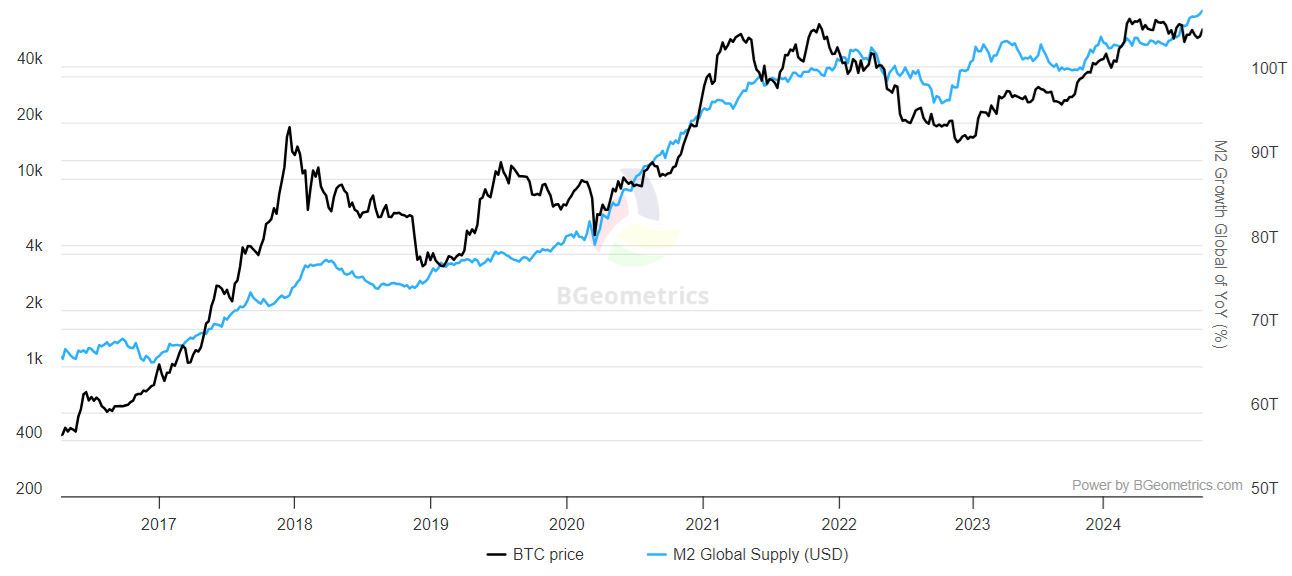

On September 24, Lyn Alden, an investment researcher and founder of Lyn Alden Investment Strategy, highlighted that Bitcoin is the asset most closely correlated to movements in the global monetary base (M2). Historically, Bitcoin has risen in price in 83% of cases over a 12-month period as liquidity is added to bank deposits and circulating money. Gold, meanwhile, has only reflected M2 movements in 68% of cases over the past decade.

This data suggests that Bitcoin has the advantage, especially as governments begin to implement stimulus packages after an 18-month hiatus. However, the stock market has also benefited. The S&P 500 index shows an 81% correlation to movements in the monetary base, according to the same research. So rather than becoming an irrelevant asset, this cycle could further solidify Bitcoin’s position as a hedge against governments’ relentless money printing.

US Stocks Rally

The sharp rally in US stocks on September 26 was largely driven by memory chipmaker Micron, a key link in the artificial intelligence technology supply chain. Micron revised its quarterly revenue forecast upward to $8.9 billion, up from its previous estimate of $8.5 billion. The company expects demand for chips for AI data centers to grow fivefold by 2025, providing some reassurance to investors, especially those with a heavy reliance on the technology sector.