Popular crypto analyst Rekt Capital has made a bullish prediction, based on the 21-week EMA of the bull market.

What is the current market sentiment?

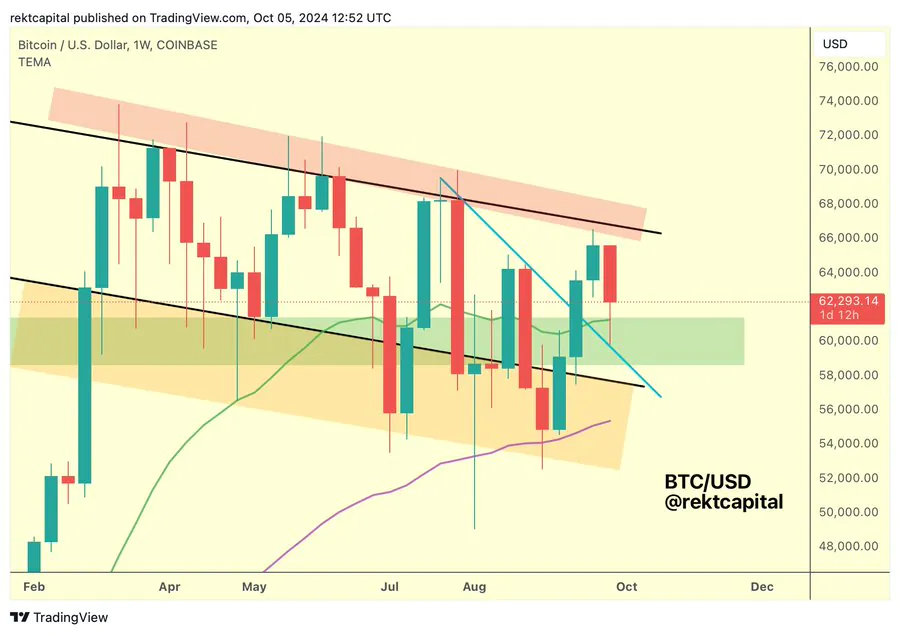

In his analysis, Rekt Capital pointed out that the 21-week EMA has been successfully tested as support. BTC remaining above this level is a sign that the market sentiment remains positive, reflecting the participation of buyers and the price trend continuing to favor the growth momentum.

According to Rekt Capital, BTC has broken through the downtrend line, which has acted as resistance for the past several months. This action is a positive signal, signaling the end of the downtrend and a possible change in market dynamics.

Therefore, if BTC continues to close above the 21-week EMA and confirms a breakout from the long-term downtrend, this could mark a new bullish run, especially if the weekly close surpasses the $62,000 – $63,000 threshold.

What does the Bitcoin chart show?

Without a doubt, the analysis from Rekt Capital has brought a very optimistic outlook for Bitcoin (BTC). Therefore, it is important to evaluate other market indicators to get a more comprehensive view.

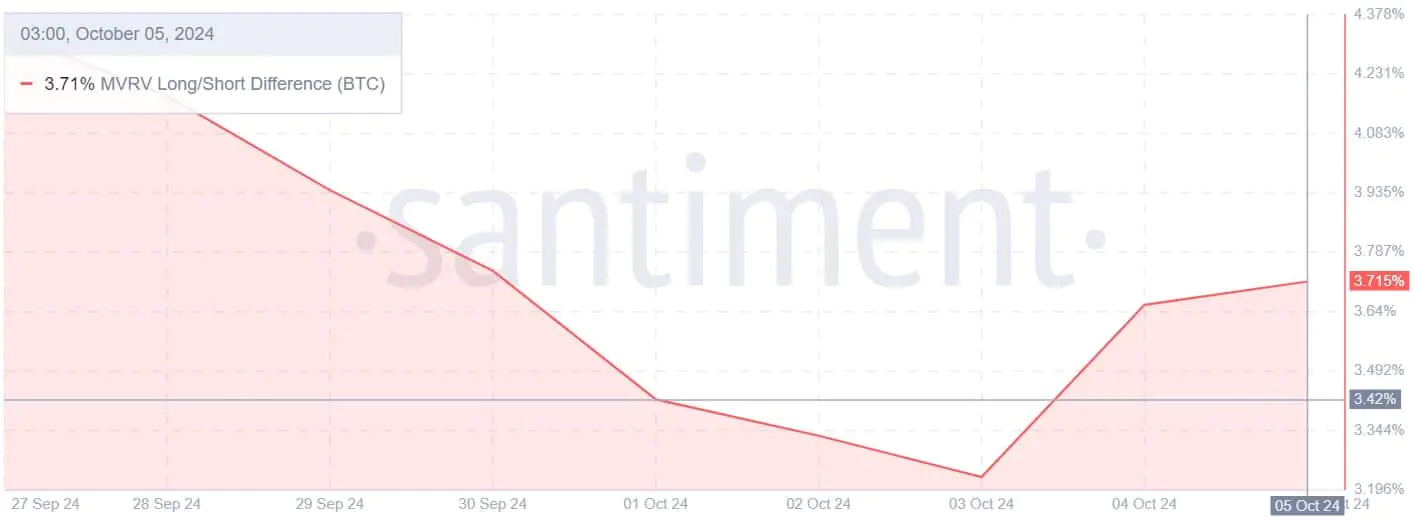

The first indicator to note is the long-term and short-term MVRV difference of Bitcoin, which shows that the trend has shifted from bearish to bullish. This difference has been increasing since September 4, after a period of decline before that.

This reflects the growing confidence of long-term investors in their positions, as they are less inclined to sell even when they have profits. As the MVRV spread increases, it shows that long-term investors believe in the growth potential of the market.

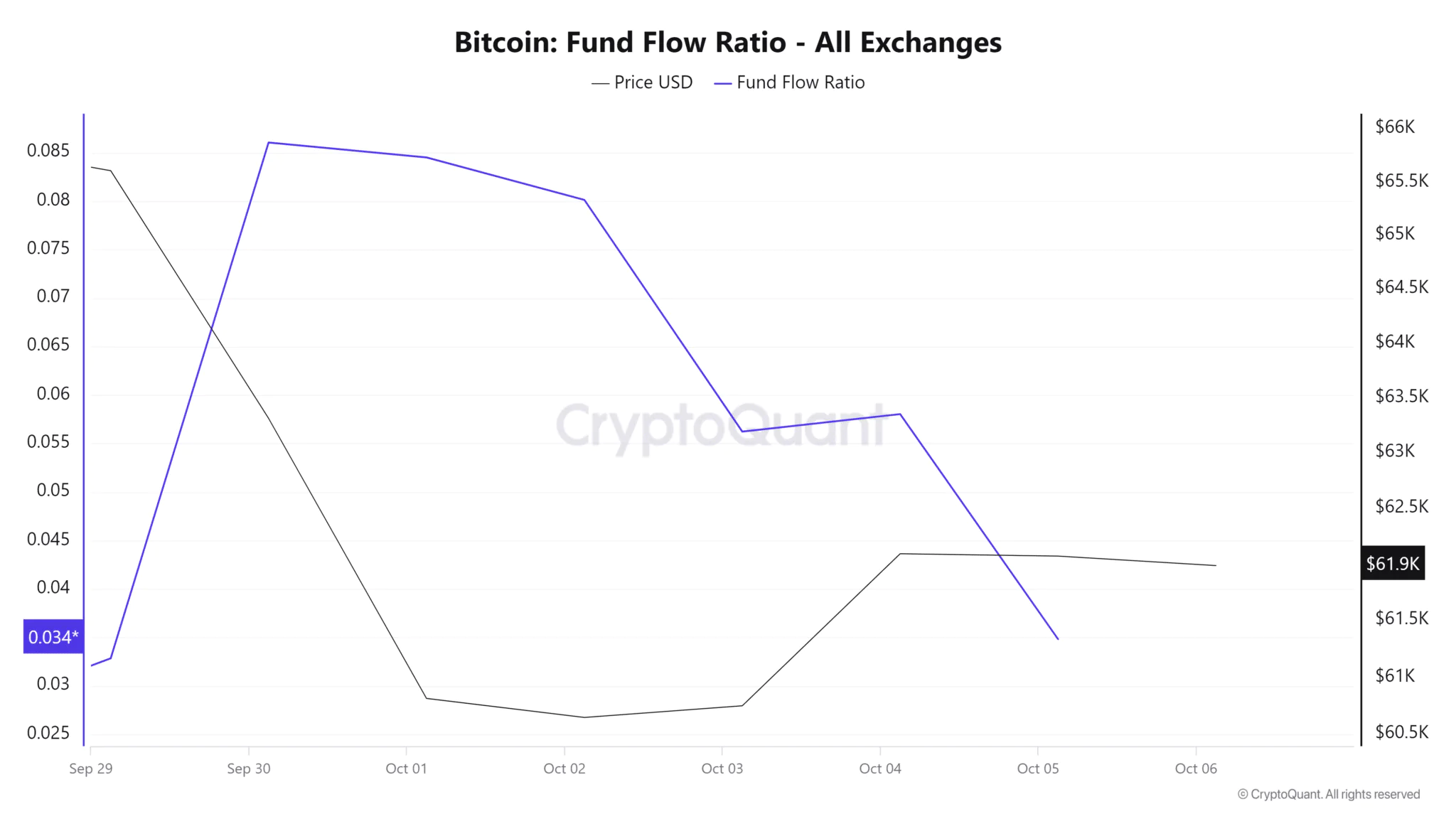

In addition, the fund flow rate has decreased over the past six days, despite the market downturn. This indicates that investors are transferring less BTC to exchanges to sell, instead storing the asset in personal wallets. This behavior shows the accumulation trend of investors, as they anticipate more profits in the future.

Finally, the funding rate of Bitcoin from exchanges has remained positive over the past week. This reflects that many investors are holding long-term long positions, expecting the price to continue to rise.

In summary, although Bitcoin has been trading sideways over the past few days, investor accumulation and sustained long positions suggest that the market is well positioned to take further profits.