Bitcoin hit $99,000 last night, moving closer than ever to the historic $100,000 mark.

All holders are in profit

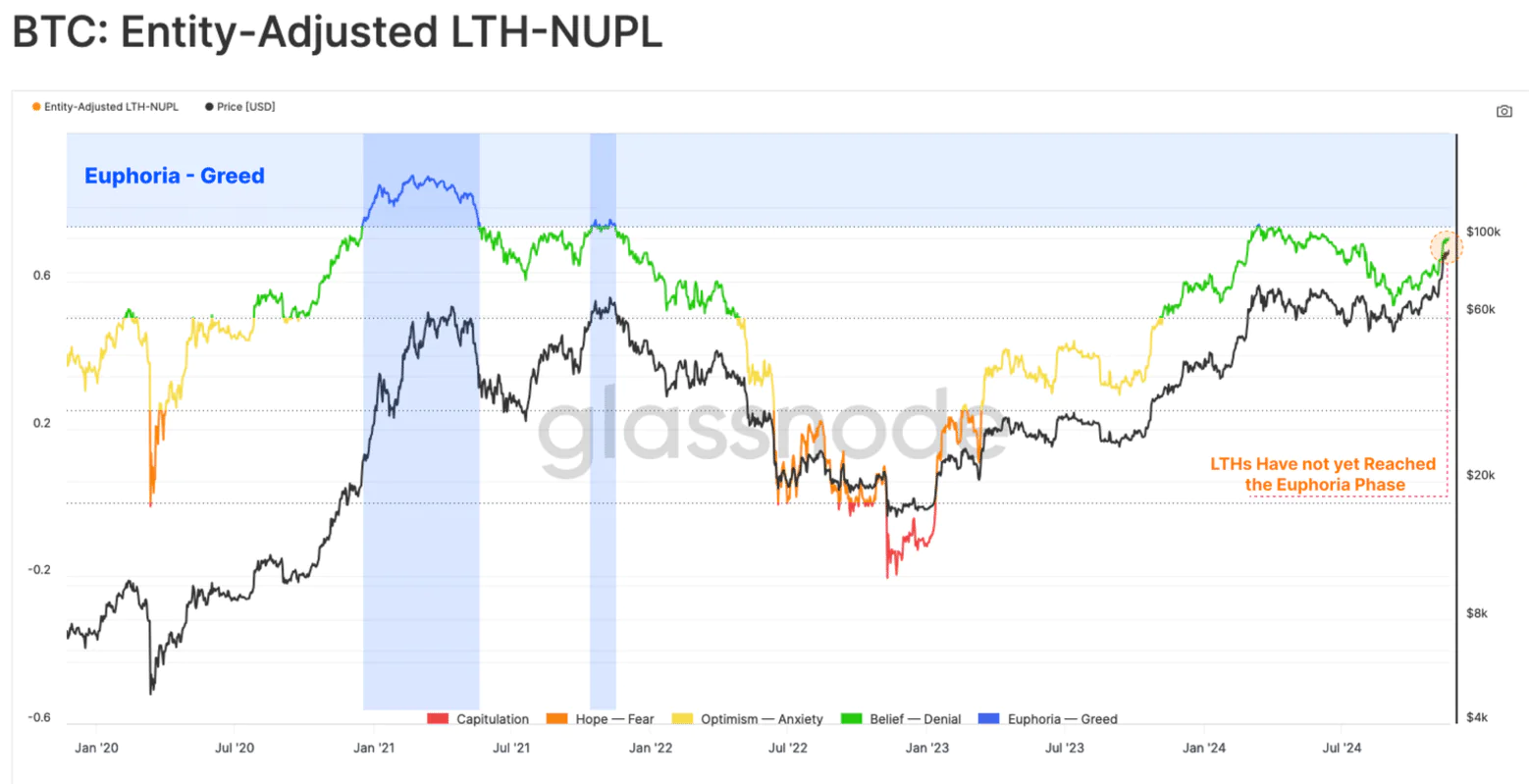

According to Glassnode’s weekly report, all long-term Bitcoin holders are currently in profit. However, their Unrealized Profit/Loss (NUPL) is at 0.75, indicating that they have not yet entered a euphoric or greedy phase.

Long-term holders tend to sell at peaks and buy at lows. This pattern appears to be repeating itself as their Bitcoin holdings have dropped by more than 200,000 BTC since the price crossed $75,000 two weeks ago. Currently, this group still holds 14 million BTC, and a quick profit-taking could slow down Bitcoin’s growth momentum.

However, two important factors have kept Bitcoin from succumbing to selling pressure: higher valuations and strong demand from large institutions.

Institutional demand through Bitcoin ETFs has significantly absorbed Bitcoin sales from long-term holders. Over the past week, the average inflow into these ETFs has ranged from $1 to $2 billion.

According to Glassnode, from October 8 to November 13, Bitcoin ETFs absorbed up to 93% of Bitcoin sales from long-term holders, playing an important role in stabilizing prices.

However, over the past week, this group’s selling activity has increased sharply, creating selling pressure that far exceeds demand from ETFs. If supply exceeds demand in the coming period, the market may face significant fluctuations.

Short-term Holders’ Profit Ratio

Data from CryptoQuant shows that the Spend Output Profit Ratio (SOPR) of short-term holders has risen to a one-week high of 1.03. This means that the amount of Bitcoin sold by this group is valued at 3% higher than the purchase price. However, this figure has not reached the maximum profit level, indicating that short-term traders tend to continue holding or wait for the price to increase further before taking profits.

Read more: Gary Gensler Announces Resignation Date as SEC Chairman

In the context of the current market sentiment showing extreme greed, the group of short-term investors, who are usually sensitive to price fluctuations, are likely to choose to continue holding or even accumulate more Bitcoin in the coming time.

The selling activity of long-term holders has also directly affected the Bitcoin futures market. On Binance, the ratio of short positions has increased to 61%, the highest level in more than a week. This reflects the belief of many traders that the $100,000 level is a strong resistance level. However, if Bitcoin breaks above this level, short liquidation could trigger a wave of forced buying, pushing the price even higher and extending the current rally.