Bitcoin has surpassed $70,000 for the first time in more than seven months. The rally in Bitcoin has been fueled by a number of factors, most notably the Fed’s interest rate cut. Forecasts show that the Fed is likely to cut interest rates by another 25 basis points on November 7, bringing interest rates to around 4.5% – 4.75%, in order to stabilize economic growth.

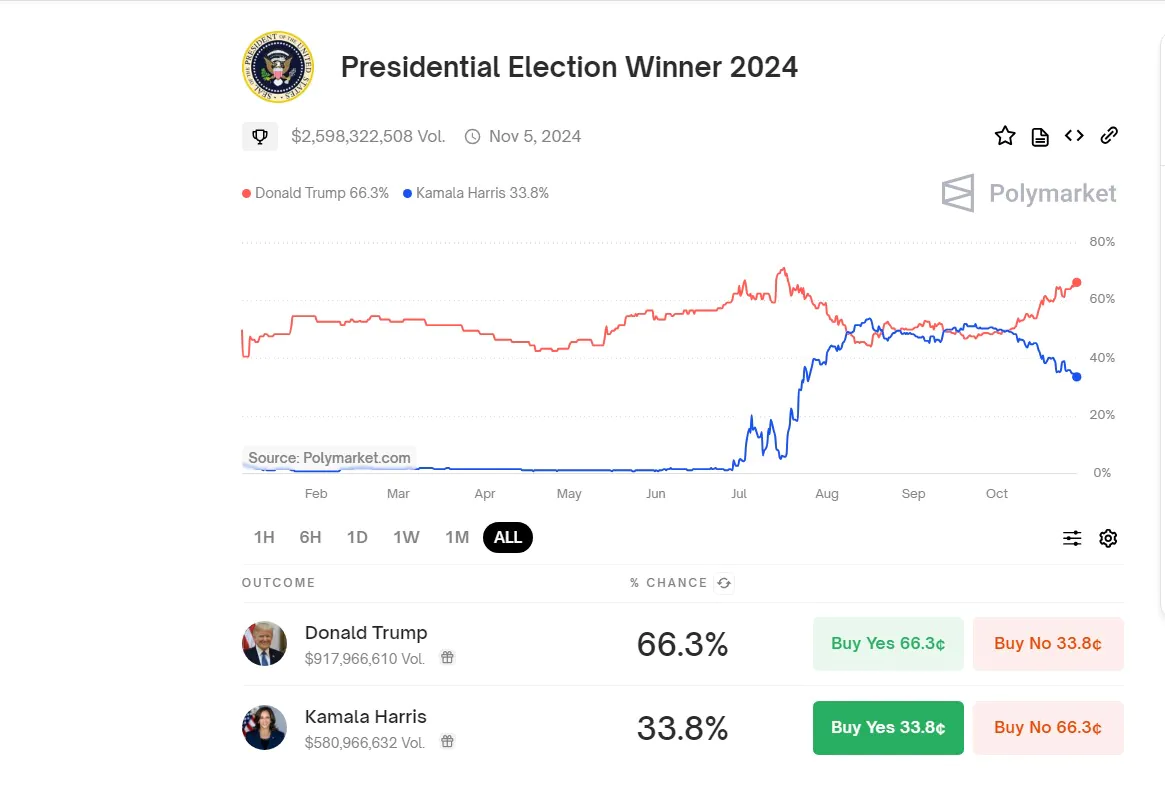

The bullish sentiment has also been fueled by US presidential election polls, with Kamala Harris and Donald Trump in a tight race in battleground states. On the Polymarket platform, former President Donald Trump is currently the frontrunner in the race.

Benjamin Cowen, founder of Into The Cryptoverse, said that this week will determine Bitcoin’s trend throughout the fourth quarter. Bitcoin is currently at a crossroads between cycles and monetary policy. Historically, BTC has performed strongly in the fourth quarter of halving years.

In addition to unfavorable macroeconomic factors, the halving cycle could drive a sharp increase in Bitcoin prices in Q4 2024. The analyst also noted that Bitcoin’s market dominance is approaching the important 60% mark, a threshold that indicates Bitcoin’s growing influence, potentially leading to a market-wide correction.

Read more: Trader Turns $1,800 Investment into $873,000 in 48 Hours

Currently, Bitcoin’s Fear and Greed Index is at 72, indicating a high level of greed as many investors expect prices to continue rising, reinforcing bullish sentiment. However, this also raises concerns about the possibility of the market overheating, especially if external factors such as regulatory changes or economic data are present, which could upset sentiment and trigger a sell-off.