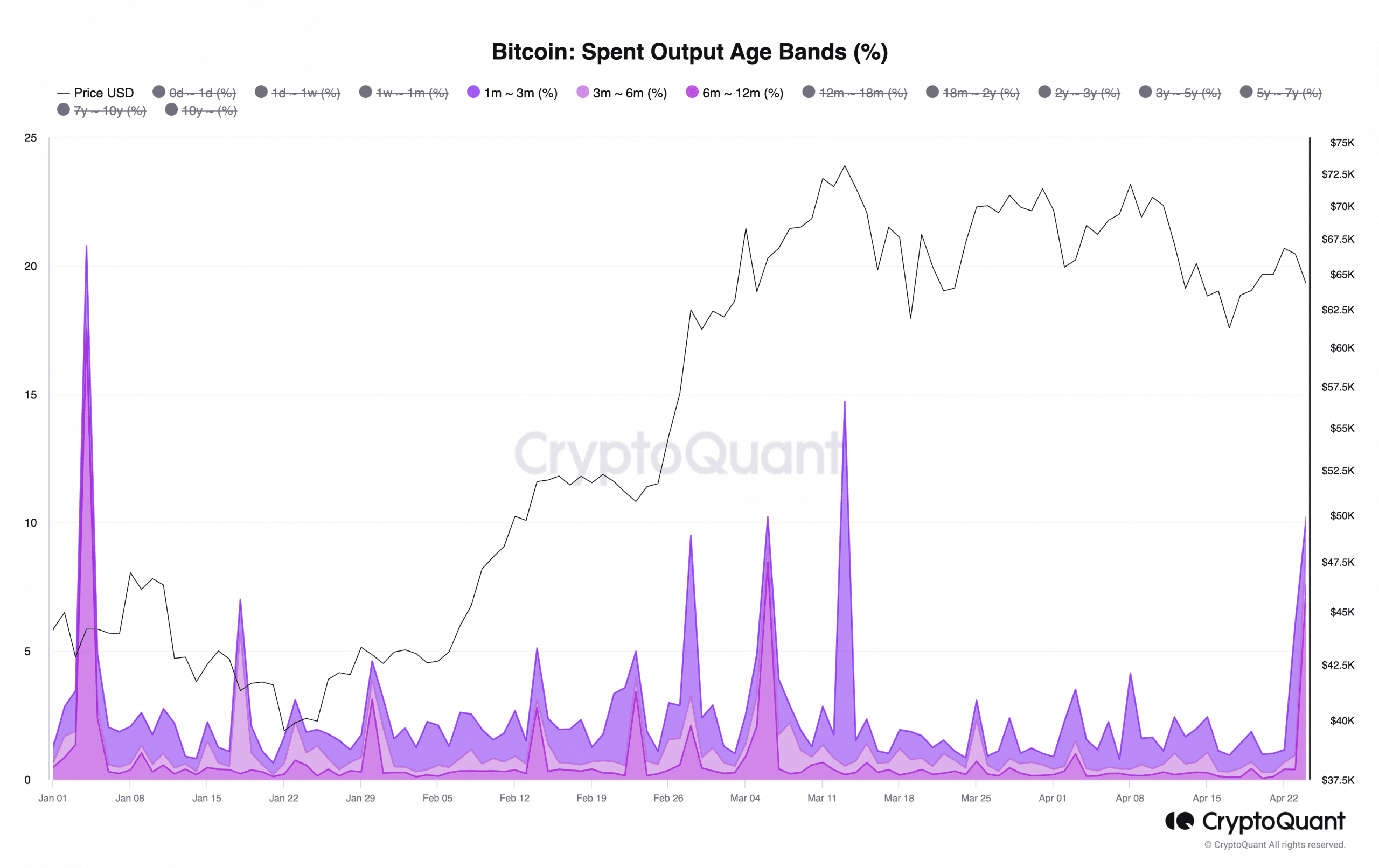

Bitcoin is hovering around the $64,000 mark with little volatility in the past 24 hours. According to data from CryptoQuant, the spending output of Bitcoin for investors holding their funds from one to twelve months has seen a sudden increase, suggesting the possibility of price fluctuations. The spending outcomes of BTC for investors in different age groups provide detailed insights into the spending behavior of hodlers.

For instance, tracking whether coins held by short-term hodlers are being moved indicates increasing profit-taking activity. When the spending output of short-term BTC hodlers increases, it often hints at market volatility.

Source: CryptoQuant

In a recent report, CryptoQuant analyst Mignolet stated: “The movement of this entity can be considered data to confirm volatility rather than price increases or decreases. It seems that volatility may soon emerge.” However, evaluating the key volatility indicators of the coin on daily charts indicates minimal risk of any significant short-term price fluctuations.

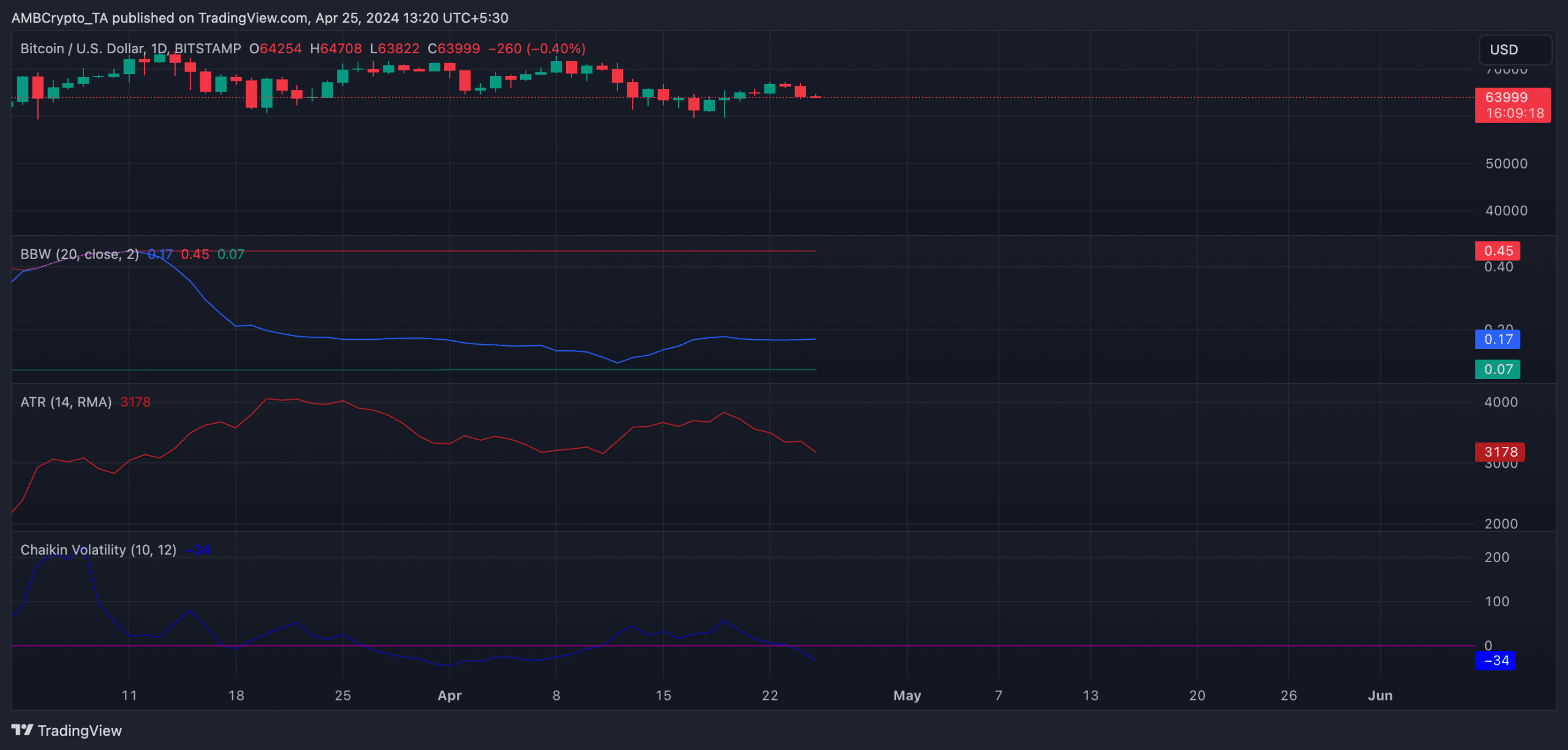

Data from Bitcoin’s Average True Range (ATR) indicator shows a steady decline since April 19. This indicator measures the average price volatility over a specific period. When it decreases, it indicates a reduction in market volatility.

Source: BTC/USDT on TradingView

Confirming the market’s reduced volatility, Bitcoin’s Chaikin Volatility indicator has been observed to decrease at the time of writing. Since April 19, the value of this indicator has decreased by 162%. This indicator measures the price volatility of an asset by comparing the current range between the highest and lowest prices with the previous range over a specific period. When it decreases in this way, it indicates that the asset’s market is becoming less volatile as the range between its highest and lowest prices is narrowing.

Related: Bitcoin Dips to $64,500, Yet Scarcity Remains High

Furthermore, Bitcoin’s Bollinger Bands Width (BBW) indicator shows low volatility levels in its market. When an asset experiences flat BBW, it indicates that its price is experiencing low volatility and its movement is relatively stable and confined within a narrow range.

I love you

I am sure I love it thank you so much 🙏

Yes I’m saying that

I love you

I am sure I’m going to love it and thank you