While the market value of Bitcoin (BTC) has recently surged, its return to the $64,000 mark has not been enough to dispel lingering concerns, which could dampen optimism about its recovery.

While Bitcoin’s recent breach of $64,000 points to the potential for further upside, some analysts also warn of red flags that traders should be wary of.

Bitcoin is often seen as an important indicator of market trends. Over the past week, Bitcoin has increased by 2.4%, and in just the last 24 hours, it has increased by another 0.6%. While crossing the $64,000 mark is a positive sign, it could be premature with potential problems.

The price increase comes as Bitcoin has fallen 13% from its peak in March, suggesting the road to recovery could be challenging. While recent price increases are encouraging, they also demonstrate the fragility of the market’s recovery from previous crashes.

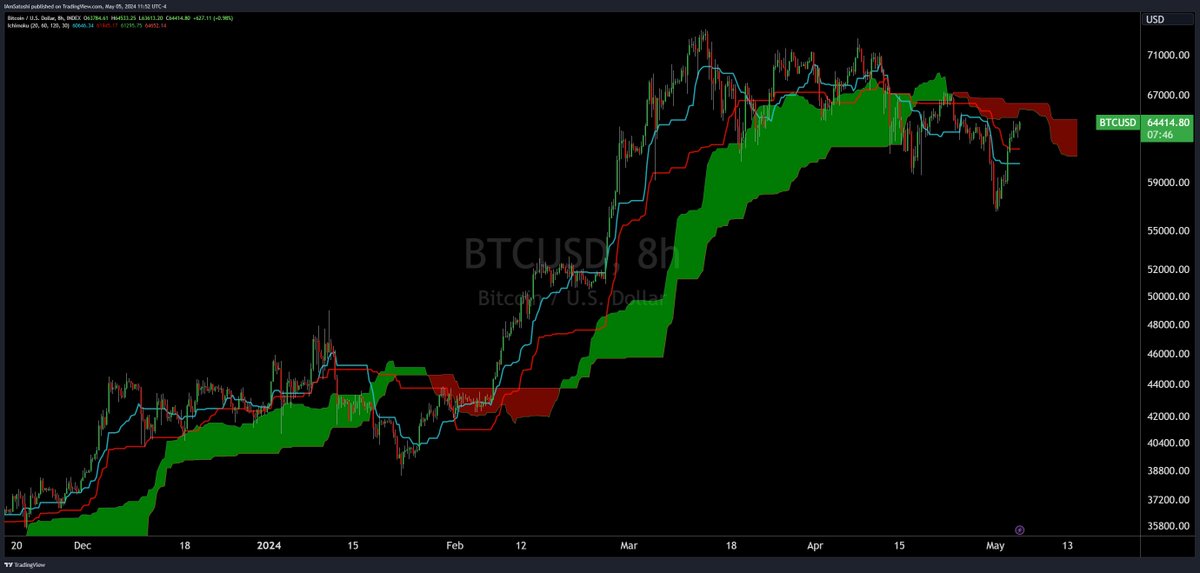

Ichimoku Cloud indicator

Source: TradingView

Josh Olszewicz, an experienced trader, pointed out that although Bitcoin surpassed the $64,000 mark, it is still dangerous. His analysis, using the Ichimoku Cloud, reveals a multifaceted view of market momentum and potential resistance and support levels.

Currently, the cloud still reflects red, showing that the downtrend is still dominant, with Bitcoin trading below, creating an important barrier.

According to the Ichimoku cloud, the downtrend will continue unless Bitcoin can stabilize and break through this cloud, moving from resistance to support.

Olszewicz advises that you pay attention to potential bullish confirmation via an inverse head and shoulders pattern, along with cloud momentum, which could represent a stronger reversal from the downtrend.

Related: Bitcoin Rebounds to $64,000 After Celebrating 1 Billion Transactions

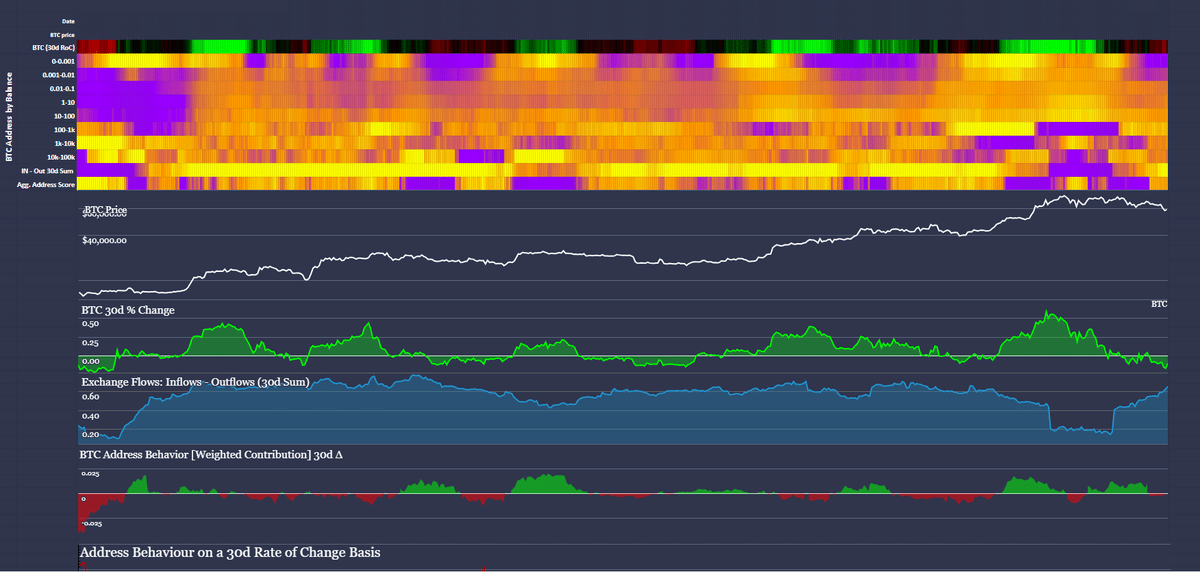

As for Bitcoin’s next direction, information from analytics company Santiment shows a more multidimensional view. While there are signs of distribution, the wallet’s overall performance points to robustness with no significant structural weaknesses.

This may indicate that despite visible immediate gains, market sentiment remains cautiously optimistic.

Bitcoin in the post-Halving period

Source: Santiment

Furthermore, according to crypto analyst Rekt Capital, Bitcoin is undergoing a transition from a price-based phase to a time-based phase post-halving. This often reflects historical patterns preceding significant price increases.

This phase, expected to last more than 150 days, could be a precursor to a more sustained period of growth, echoing previous cycles when prolonged consolidation led to strong upward movements.

Adding to the complexity, recent reports have shown positive signs, breaking out of a falling wedge pattern, suggesting buying momentum is increasing. This is supported by Glassnode data, which shows a bullish signal as Bitcoin’s reserve risk increases within historically favorable zones associated with price increases.