Bitcoin welcomes July with a surge, climbing back above the $63,000 mark. As the month unfolds, the cryptocurrency community eagerly watches Bitcoin. This period promises significant changes, though not necessarily the kind everyone is hoping for.

One of the most impactful events looming over Bitcoin’s near future is the imminent repayment from Mt. Gox. Once the largest Bitcoin exchange, Mt. Gox collapsed in 2014 following a massive hack. Now, a decade later, creditors are finally set to receive their long-awaited repayment of 140,000 BTC, valued at approximately $9 billion.

The Mt. Gox repayment plan casts a shadow over the market like a dark cloud. Starting in early July 2024, creditors will begin receiving their BTC. This distribution raises significant concerns about selling pressure.

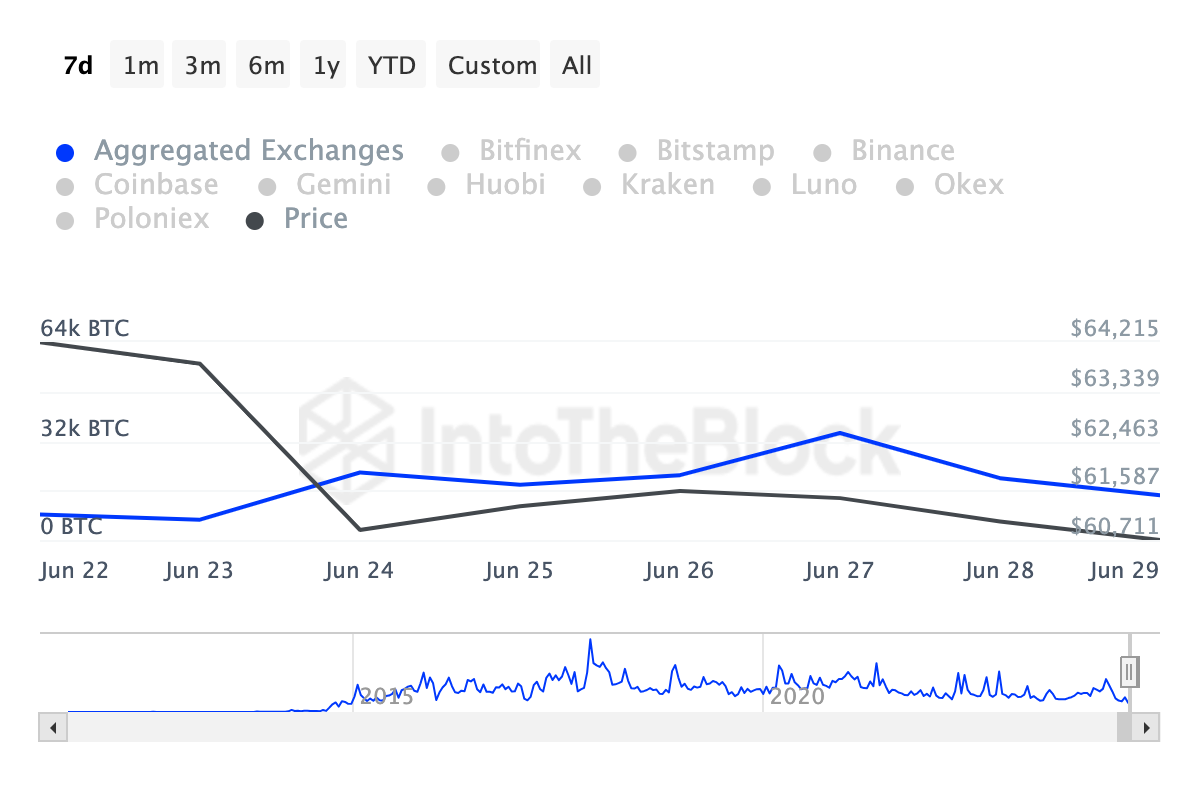

With Bitcoin’s price having soared 16,000% since the hack, many creditors are likely eager to sell their BTC for a profit. This sudden wave of selling could cause a significant drop in Bitcoin’s price. The sharp decline in the flow of BTC to exchanges indicates fewer Bitcoins are being moved for sale, which could be a bullish sign.

Technical indicators show stability and bearishness

The SMA line closely follows the actual reserve data of miners, indicating that despite occasional fluctuations, the overall trend remains relatively stable or slightly upward.

This suggests that, on average, mining companies have maintained or slightly increased their holdings, pointing to a potentially bullish sentiment among miners. Technical indicators reveal stability and a downward trend.

Bitcoin’s CMF value is positive (0.15), indicating that buying pressure has exceeded selling pressure over a certain period. This accumulation suggests that investors may be preparing for or optimistic about short-term stability or price growth in Bitcoin, despite the potential for a sell-off.

Interestingly, the overall trend in the OBV oscillator shows a slight decline towards the end of the chart, indicating that selling pressure might be increasing or buying power is weakening compared to previous sessions.

The accumulation/distribution line is trending upward, indicating that Bitcoin is being accumulated, which typically signals optimistic sentiment among traders.

Good news keep going keep doing great work.