With the positive developments in institutional adoption and user engagement, Bitcoin’s price has surpassed the psychologically significant milestone of $60,000. This price movement, set against the backdrop of increasing adoption and growing institutional interest, weaves a compelling narrative in the current Bitcoin news.

In a surprising turn of events, Norway’s sovereign wealth fund has significantly increased its indirect Bitcoin holdings, marking a pivotal moment in the cryptocurrency’s adoption. This Bitcoin news highlights the growing trend of institutional interest in digital assets, with governments worldwide holding substantial Bitcoin reserves.

Norway’s sovereign wealth fund expands indirect Bitcoin holdings

In the latest Bitcoin update, K33Research reports a significant development: Norway’s sovereign wealth fund (NBIM) has substantially increased its indirect Bitcoin holdings.

The fund now holds an amount equivalent to 2,446 BTC through strategic investments in technology companies with cryptocurrency exposure. This Bitcoin-related portfolio, valued at an impressive $143 million, has seen substantial growth of 938 BTC since the end of 2023. In a bold move making waves in Bitcoin news, Norway’s sovereign wealth fund has strategically reallocated its investments.

The fund has reduced its stakes in Meta and other major tech giants, shifting capital into promising Web3 stocks instead. The primary beneficiaries of this shift include industry leaders such as MicroStrategy, Coinbase, Block, and Marathon Digital.

Global Governments Holding Bitcoin: A Growing Wave of Adoption

The Bitcoin news from Norway is just the tip of the iceberg regarding government involvement in cryptocurrency. A comprehensive report from Coingecko highlights a broader trend: governments worldwide now hold approximately 2.2% of the total Bitcoin supply.

This figure, amounting to 471,000 BTC, underscores the growing institutional interest in cryptocurrency. Leading this Bitcoin news trend is the United States, with holdings exceeding 212,000 BTC. This significant government stake in Bitcoin not only legitimizes the cryptocurrency but also signals a potential shift in how nations view digital assets as part of their investment strategies.

Bitcoin Adoption Metrics Paint a Promising Picture

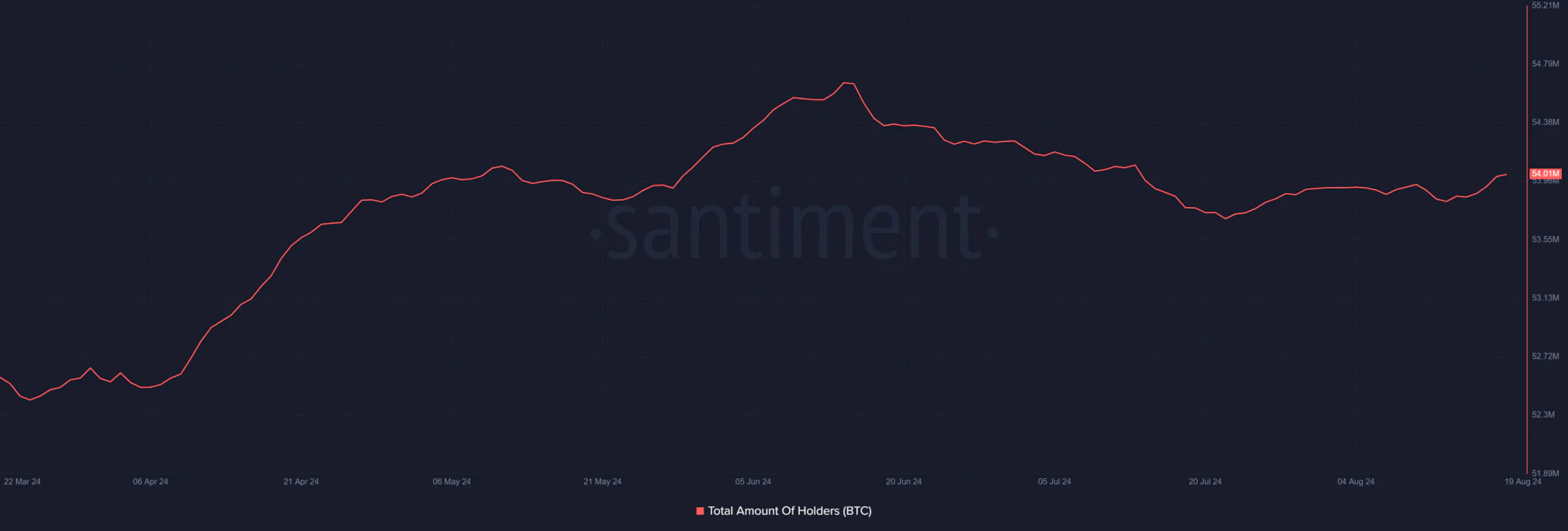

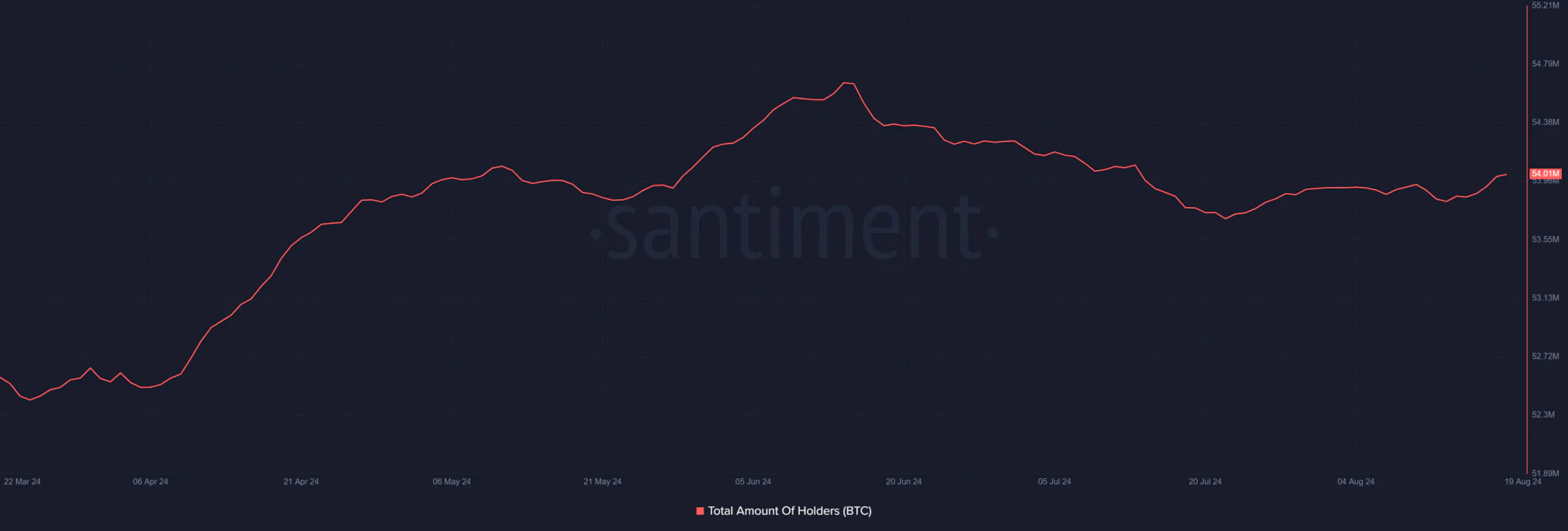

Delving deeper into Bitcoin news analysis, recent data from Santiment reveals an encouraging trend in user adoption. The number of non-zero Bitcoin addresses has risen notably, from around 53 million to 54 million in recent days. This increase, despite some market volatility, clearly indicates that more individuals and institutions are joining the Bitcoin ecosystem. The rise in non-zero addresses is particularly noteworthy, as it highlights the expanding base of Bitcoin holders.

While recent Bitcoin news has reported a slight decline in daily active addresses, the overall outlook remains robust. The number of daily active Bitcoin addresses continues to exceed the critical threshold of 500,000. Previously fluctuating between 600,000 and 700,000, this figure has now reached over 592,000.