As the price rebounded, trading volume surged by 53.38% over the same period, reaching $33.57 billion. Additionally, BTC’s market capitalization rose by 4.24%, bringing it to $1.13 trillion.

Prior to this uptick, BTC had been on a sharp downward trajectory, losing 6.54% over the past 30 days. Despite the recent gains, its price remains relatively low compared to the recent high of $65,103, and it’s still down 22.8% from its all-time high (ATH).

What market sentiment says

Current market conditions suggest a glimmer of hope for BTC, with some analysts expressing optimism. For instance, Santiment’s analysis predicts further price growth, citing Bitcoin’s market value as a key indicator.

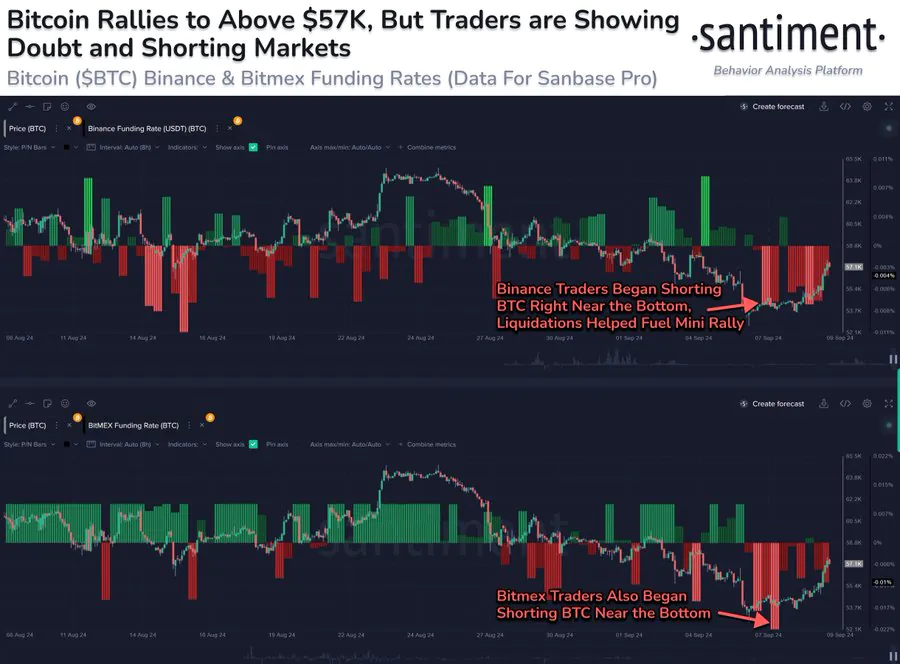

Market Sentiment Santiment observed that BTC’s value has risen over the last 24 hours, despite being heavily shorted on major exchanges like Binance and Bitmex over the previous four days. In this environment, many traders are betting on a price decline. Short selling typically occurs when traders borrow BTC to sell it, intending to repurchase it at a lower price later.

The strong short selling since Saturday suggests that many traders anticipate a price increase. This market sentiment is often driven by FUD (Fear, Uncertainty, and Doubt), as investors lack confidence in the price direction and expect a decline.

However, if the price rises instead of falling as short sellers predict, it creates upward pressure. These investors are forced to repurchase the assets they borrowed to cover their positions, especially as the risk of greater losses looms. This scenario was evident during the price surge over the last 24 hours.

As a result, the recent price increase has led to the liquidation of many short positions, highlighting the market’s volatility. This forced buying increases demand, pushing the price higher, ultimately creating a short squeeze situation.

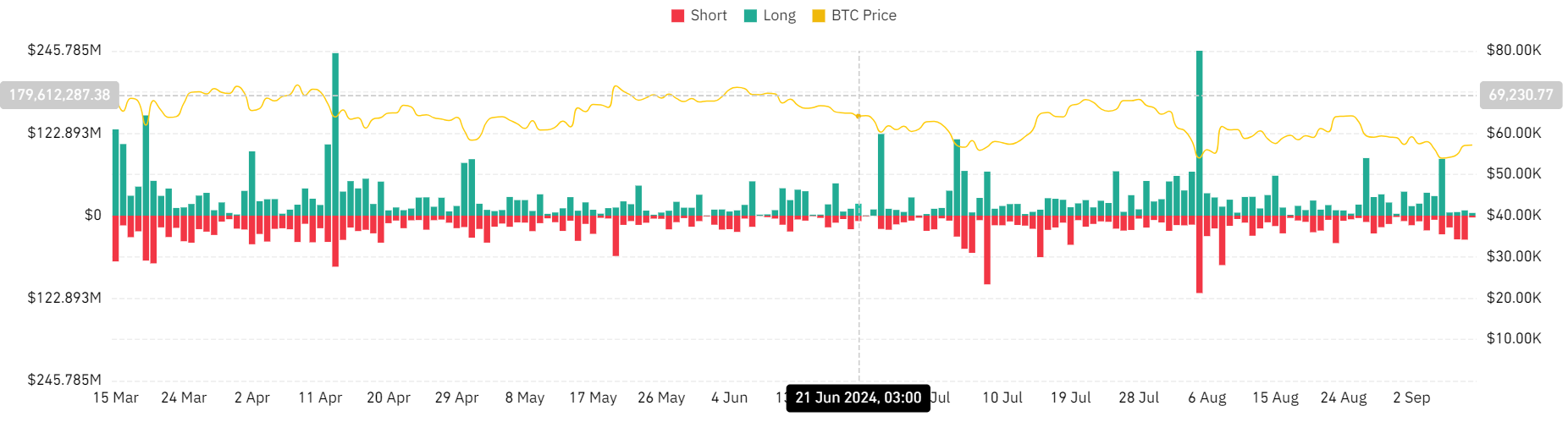

Bitcoin Price Chart

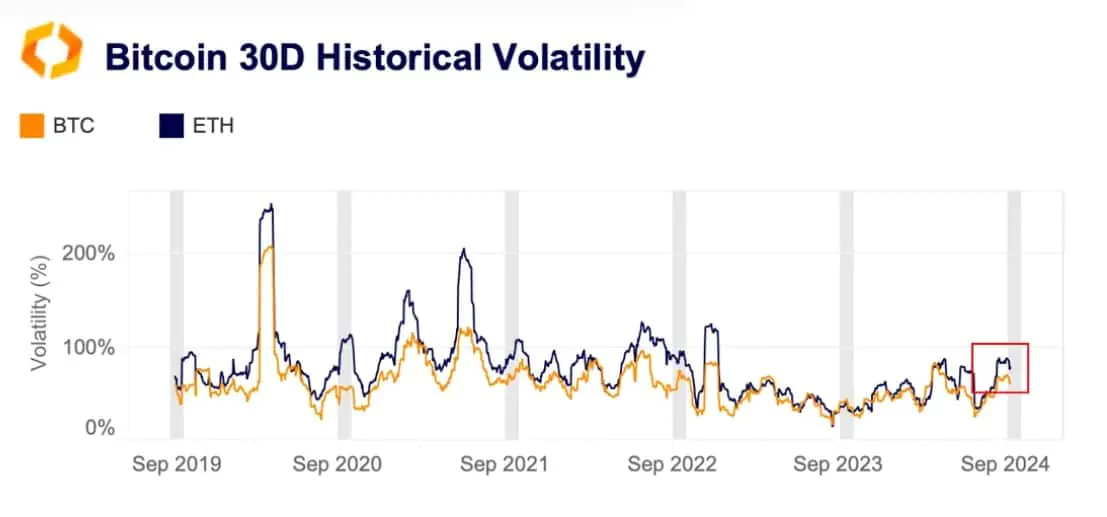

As noted by Santiment, the Bitcoin market is experiencing heightened uncertainty, leading to increased volatility. Historically, September has been a volatile month, and this year is no exception, with Bitcoin’s 30-day volatility surging by 70%.

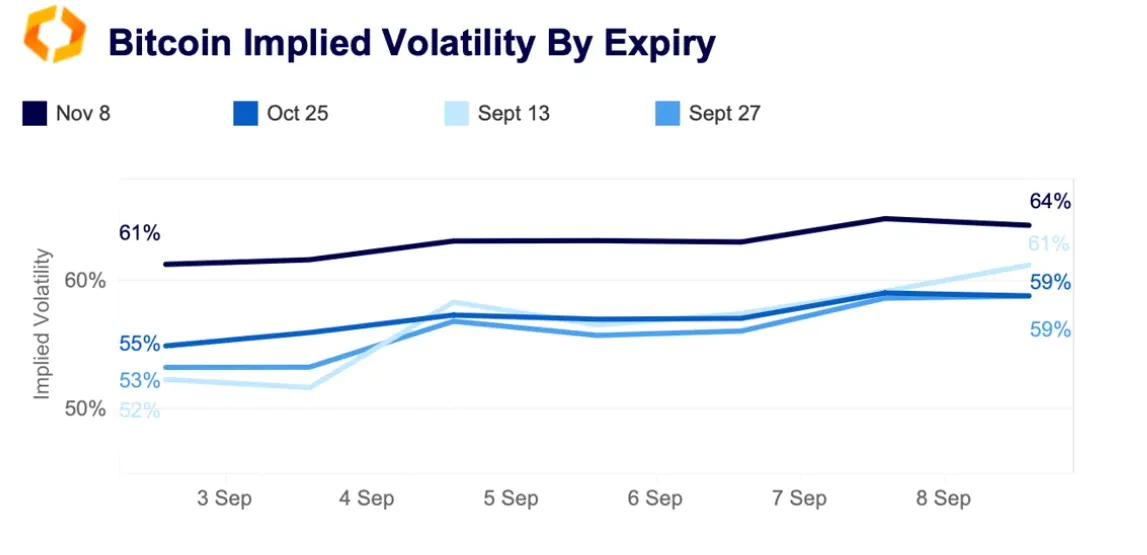

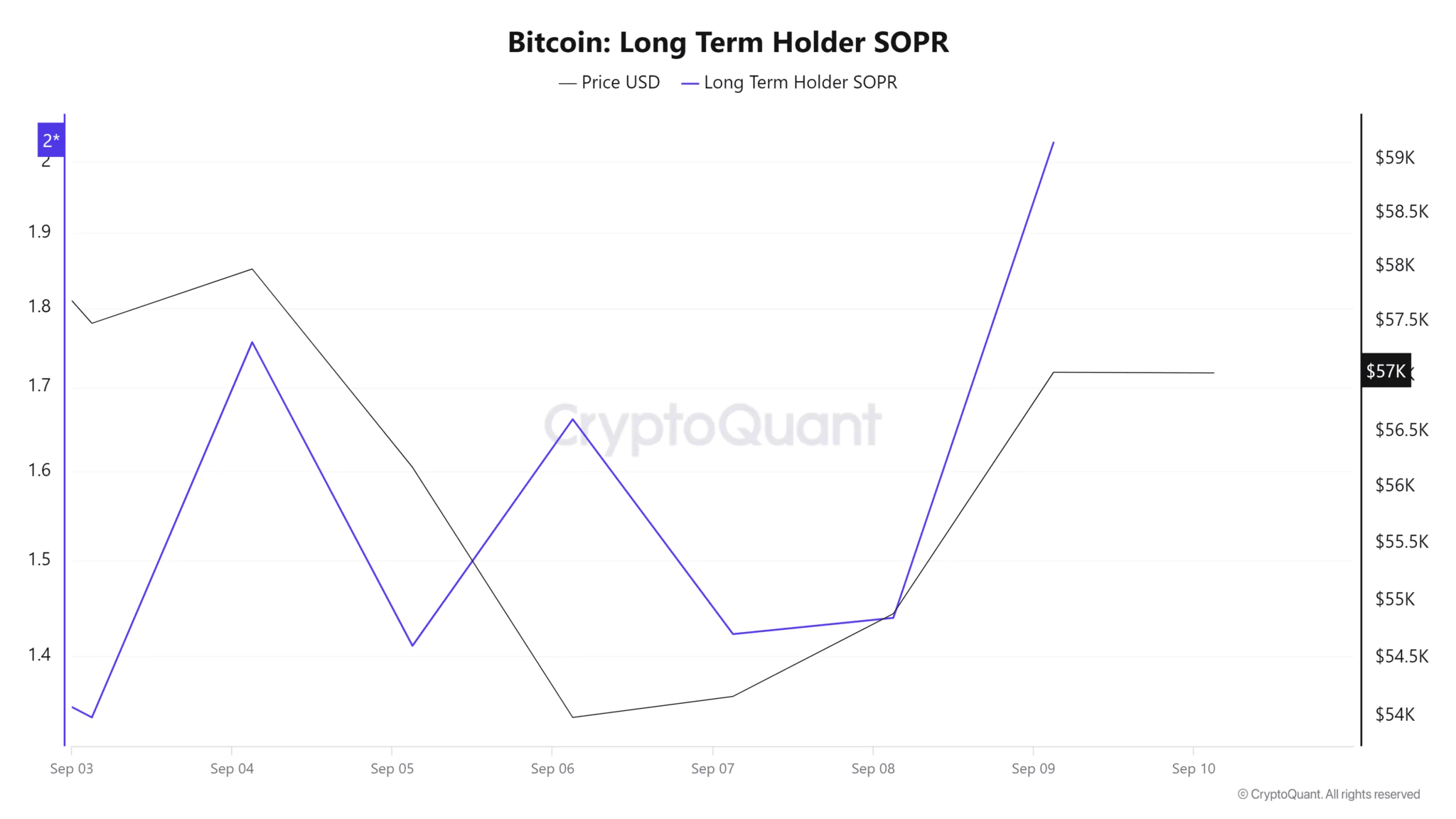

Indicators like Implied Volatility have risen since September, after a decline in August. Notably, short-term options have skyrocketed by 60%, jumping from 52%. Additionally, the upcoming U.S. presidential election is contributing to the market’s current instability. This FUD (Fear, Uncertainty, and Doubt) is further exacerbated by a sudden spike in the Long-Term Holder SOPR (Spent Output Profit Ratio), which rose from 1.4 to 2.0.

While the price is currently rising, there is a possibility of a pullback as investors may sell to lock in their realized profits. Consequently, the demand for short positions suggests that many investors expect a price drop. However, the increased demand for short positions could paradoxically fuel more buying, potentially driving the price higher.

If FUD pushes the price upward, BTC could challenge the resistance level of $59,363 and strengthen its position to surpass the $60,000 mark.