Bitcoin has surged strongly right after the New Year holiday, leading to a simultaneous breakout of Altcoins in the market. This price increase was accompanied by a sharp increase in open interest in the Futures market, reaching nearly $60 billion in just two days. This reflects a sharp increase in trading demand, indicating that investors have returned to the market after the holiday.

The monthly funding rate reached 1.3% – the highest in more than two weeks, although it is still in the neutral range. The indicators of the Bitcoin Futures market have improved significantly, even as the open interest has decreased. This shows that Bitcoin short sellers are cautious, not daring to open more short orders below $95,000, bringing positive expectations to the market.

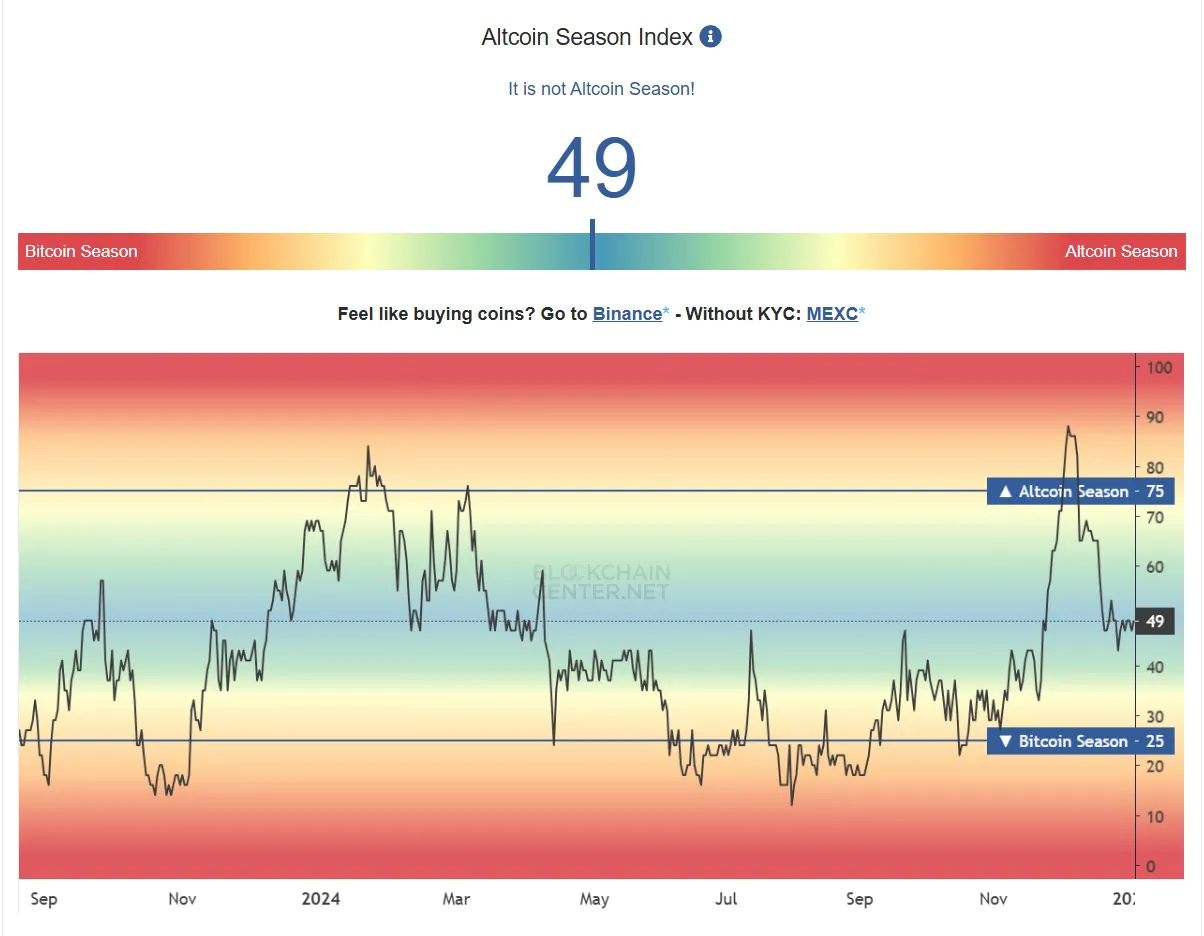

The Altcoin Season Index has increased to 49, signaling a recovery trend of Altcoins. When this index reaches 75, it will confirm that the market has entered the “Altcoin Season”. Previously, the index peaked at 88 on December 4 but then fell sharply to a low of 43 on December 26 due to a market correction. Currently, there are clear signs of recovery, predicting that Altcoins will make strong progress in January.

Read more: Could XRP Surge to $11?

Similarly, at the end of 2023, Bitcoin made its mark with a new record for transaction volume and hash rate on New Year’s Eve. The network’s computing power peaked at 808 exahashes per second (EH/s), breaking previous limits.

Entering 2025, Bitcoin’s hash rate continues to grow strongly, opening up expectations for a breakthrough year. Data from hashrateindex.com shows that the seven-day moving average (SMA), the most accurate measure of network performance, reached a record high of 808 EH/s on December 31, 2024.