On-chain data reveals that OTC platforms favored by Bitcoin miners have experienced a sharp increase in balances, a trend historically viewed as bearish.

Recently, Bitcoin miners have transferred significant amounts to OTC exchanges. As highlighted by an analyst in a CryptoQuant Quicktake post, miners have been funneling funds into decentralized OTC exchanges over the past three months.

OTC desks are platforms that facilitate direct trading between individuals or institutions. These transactions are more discreet than those on centralized exchanges, making it challenging to trace who is trading on these platforms. However, the analytics firm CryptoQuant has leveraged on-chain data to identify several addresses likely associated with the OTC platforms preferred by miners.

These addresses are typically where miners transfer their funds. Given that miners usually move assets out of their reserves to sell, it makes sense that the addresses they send to are, in some way, connected to sales transactions.

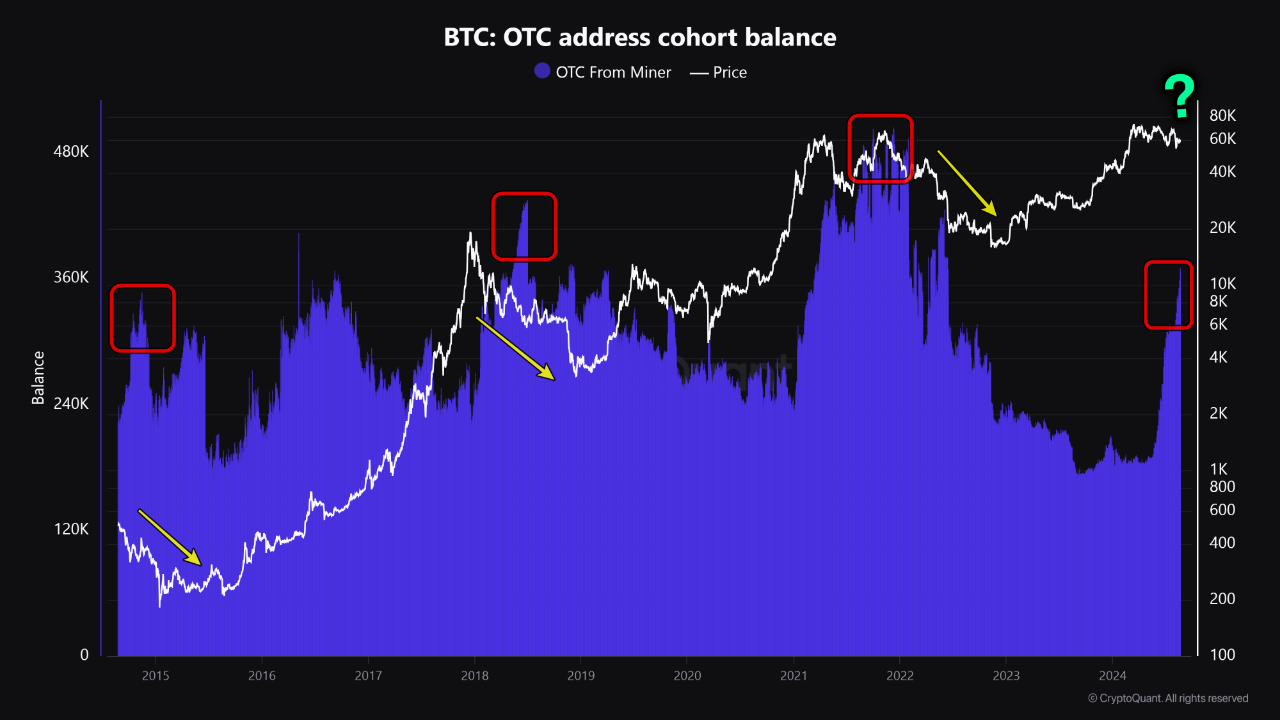

Below is a chart that illustrates the balance trends of these potential OTC platforms used by miners over the past decade. As shown in the chart, the balances on miners’ OTC desks were relatively low at the beginning of the year, even after the cryptocurrency reached its all-time high (ATH).

However, during the consolidation phase following this ATH, miners conducted significant transfers to these addresses. As noted by the analyst, the Bitcoin OTC balance on miners’ desks surged by more than 70% over the past three months, rising from 215,000 BTC in June to 368,000 BTC in August—a jump of 153,000 BTC.

This level of balance has not been observed since June 2022. Given these large deposits, it seems miners have been eager to move their funds recently. In the chart, the analyst highlighted what occurred during previous periods when miners’ OTC balances followed a similar trajectory. Historically, such a pattern has often preceded a decline in BTC prices.

As for why miners are transferring such large amounts to these platforms, the answer may lie in an event that took place in April this year: the fourth Halving. The Halving is a recurring event that occurs approximately every four years, permanently cutting the Bitcoin block reward in half. Since miners earn a significant portion of their income from block rewards, it’s evident that these events can have a substantial impact on their financial stability.

Initially, miners delayed transferring their funds to these platforms after the Halving, likely because the market sentiment remained optimistic. However, as the consolidation phase dragged on, miners may have found it increasingly difficult to withstand the financial pressure, leading them to decide to sell. Given the historical precedent of this pattern, it’s plausible that Bitcoin could experience a similar bearish impact this time around.