Bitcoin’s price has marked a significant decline, leaving the entire cryptocurrency market in the red, breaking below $69,000.

Over the past few years, the market has seen a boom in crypto assets, along with Bitcoin’s ups and downs following its bullish periods. Bitcoin price fluctuations are almost inevitable, when capital inflows and outflows are large, creating unpredictable fluctuations.

Bull cycles are often accompanied by a significant increase in capital flows into the market, driving up asset prices. In contrast, bearish periods often occur after asset prices have increased due to economic and industry factors. Assets can hit record highs and fall to lows not seen in months. These fluctuations have been recorded in Bitcoin’s historical price data.

A clear example is in 2021, when Bitcoin reached a record high price above $64,000. Meanwhile, the 2022 bear market has pushed Bitcoin prices below $19,000. Here are some signs that point to the end of the bull run.

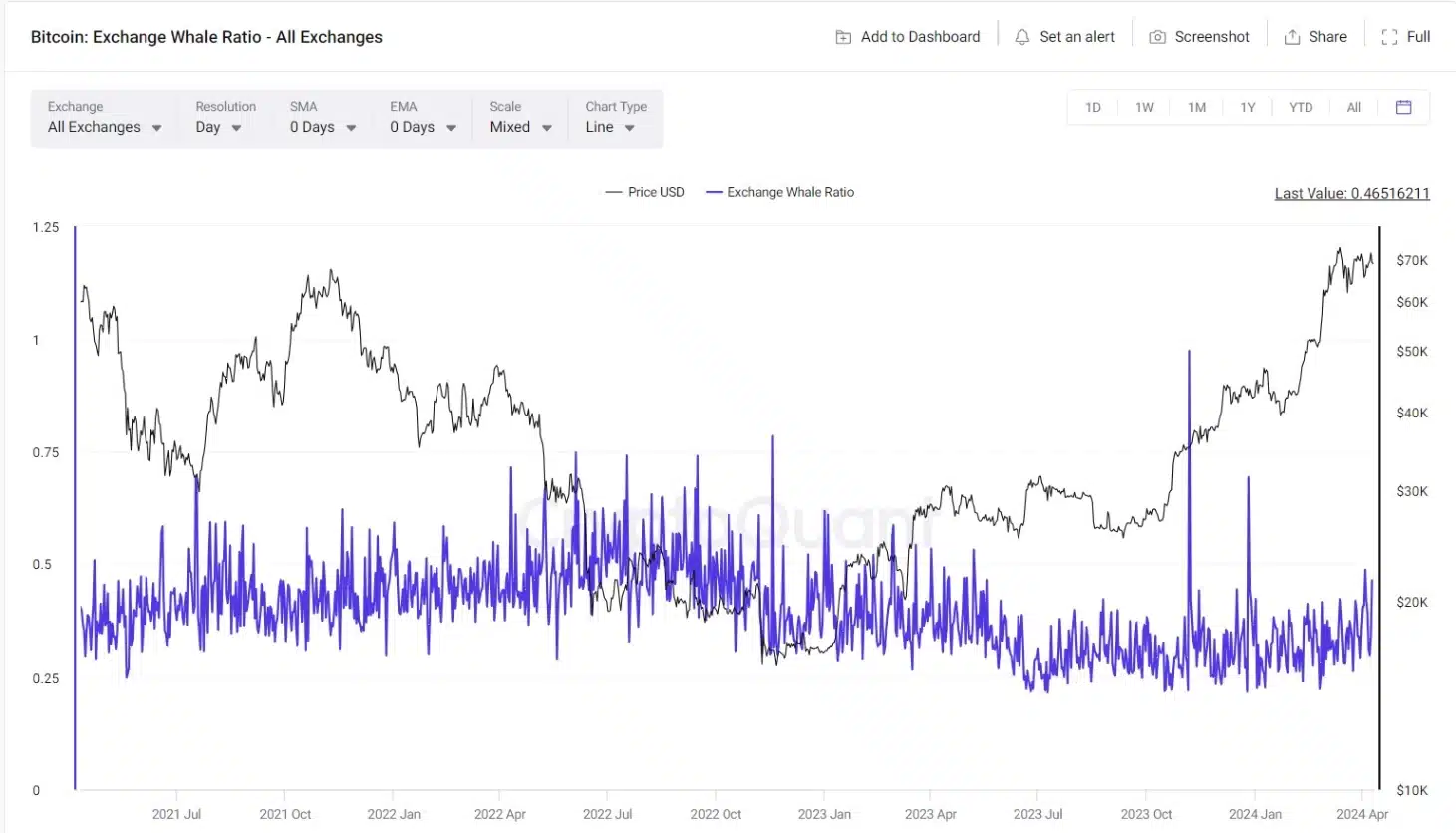

Whale activity

The activities of large investors, or “Bitcoin whales”, have a greater influence than other factors on the market. This is a direct result of their holding of large amounts of Bitcoin, often over 1000 BTC. If activity on the blockchain shows these individuals are selling assets, it is a sign of Bitcoin’s decline, reflecting a change in market sentiment. Similarly, the transfer of large amounts of Bitcoin to exchanges can also be seen as a sign of large investors preparing to sell, signaling a decline in Bitcoin.

Relative Strength Index (RSI)

Indicators such as Bitcoin’s relative strength index (RSI) can also provide important information to investors about the direction of market movement. RSI measures the buying and selling pressure of an asset, and when an asset becomes overbought, this can signal a possible price drop, leading to a decline in Bitcoin.

Low trading volume

Low trading volumes are often a clear sign that market sentiment around crypto assets is declining, which often leads to a decline in Bitcoin. When market activity increases, it is often accompanied by bullish price action; Conversely, when activity declines, this signals concerns about a price decline.

Strict regulations

Strict regulations from government agencies around the world create uncertainty for investors. Much of this harsh regulation often stems from market crashes and bearish events. For example, the collapse of Terra’s stablecoin and FTX exchange in 2022 wiped billions of dollars off the market. These events led to the collapse of Bitcoin and increased stricter regulatory measures in many jurisdictions.

Related: Deutsche Bank Releases Survey Results on Bitcoin

Market hype and fanfare around cryptocurrencies like Memecoin, while not directly related to Bitcoin, is often a sign of heightened market activity and rising RSI. Initially, this seemed positive as it was accompanied by a period of cash inflows and price increases; however, this is often followed by a correction in the market, leading to a decline in Bitcoin.

خوبایت