Bitcoin fell to $95,800 in the past 24 hours before recovering to its current price. As Bitcoin nears $100,000, questions are being raised about the sustainability of the rally. While investors are excited, some signs suggest caution.

Technical Analysis

On the daily chart, Bitcoin is showing a strong upward trajectory after breaking out of a sideways phase around $65,000 just a few weeks ago. The Relative Strength Index (RSI) is currently at 78.6, signaling that Bitcoin is in overbought territory. Historically, RSI readings above 70 are often a sign of short-term corrections as investors start to take profits.

In addition, the Bollinger Band indicator shows that the price is approaching its upper limit, suggesting increased volatility. The 20-day moving average is currently lagging the spot price significantly, raising the possibility that the price could correct back to the mean, especially if profit-taking pressure is strong.

On-chain analysis

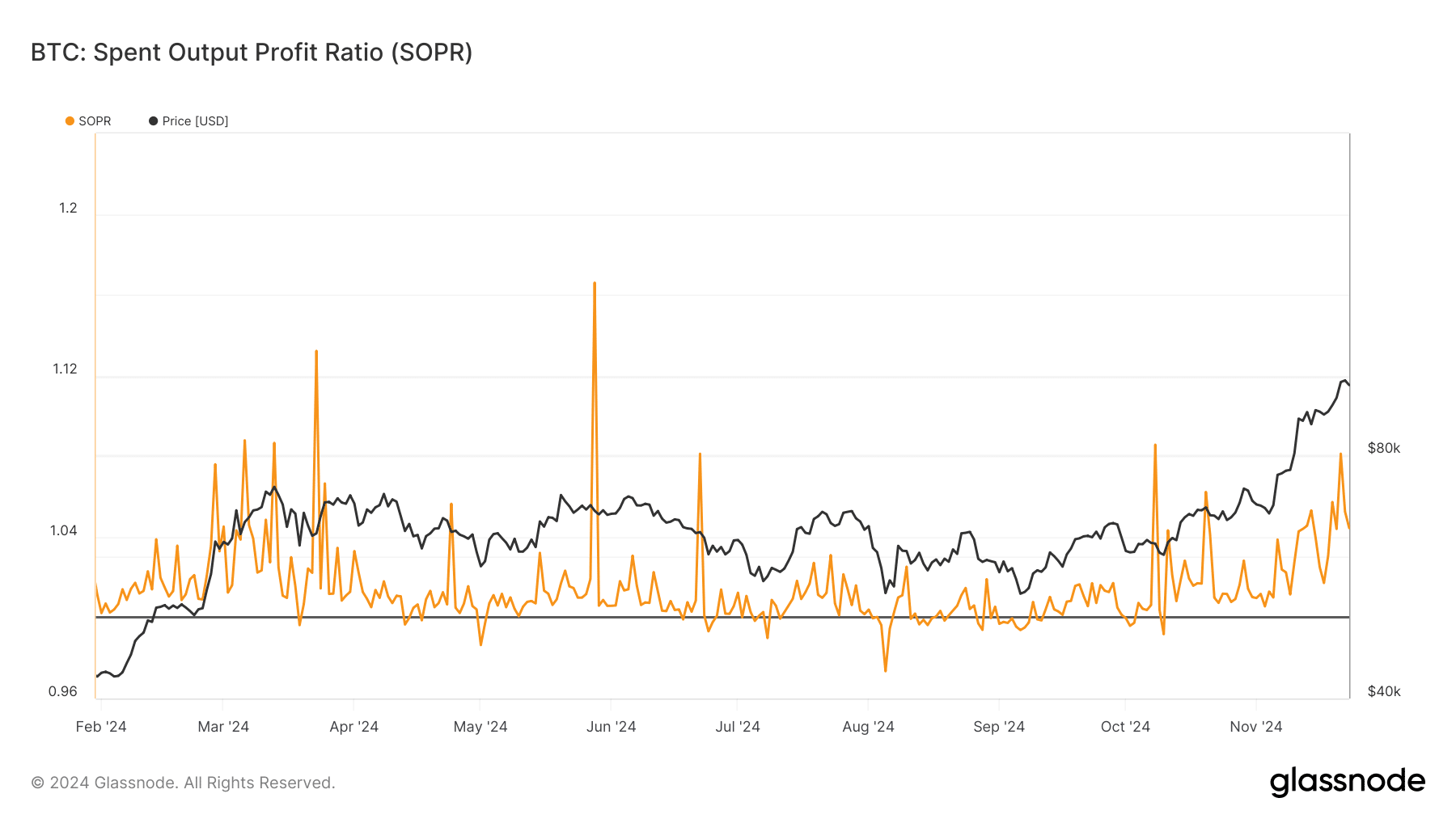

The Spend Output Profit Ratio (SOPR) chart – a measure of how profitable Bitcoin transfers on-chain are – has been steadily rising alongside the price. Over the past week, the SOPR reached 1.08, indicating a significant improvement in realized profits.

Traditionally, high SOPR levels like the current one coincide with local tops, as investors tend to increase profit-taking during bull markets. If the SOPR were to drop sharply, it would signal increased selling pressure, potentially triggering a significant correction. The spike in SOPR has now stalled, with the index falling to around 1.04.

Another worrying signal comes from the Bitcoin Funding Rate chart, which shows a sharp increase across many major exchanges. Funding rates turn positive when long positions dominate the market, but high levels reflect over-leverage. Currently, the funding rate is approaching levels seen at the peak of the 2021 bull market, suggesting that speculative enthusiasm may be reaching extreme levels.

If a correction occurs, over-leveraged positions are at risk of being liquidated en masse, which could exacerbate selling pressure and push prices further down.

Read more: XRP Poised to Surge to $1.96 Amid Positive Signals

While Bitcoin’s rally is historic, the convergence of factors such as an overbought RSI, high SOPR values, and a spike in funding rates are all warning signs that the market is overheating.

A healthy correction not only helps reduce speculative pressure but also creates an opportunity for the market to reset, paving the way for long-term sustainable growth instead of continuing to chase speculative fever.