Bitcoin surged to $76,800 over the past 24 hours, continuing to break its all-time high record after the US Federal Reserve (FED) decided to cut interest rates. The US central bank approved a 0.25 basis point interest rate cut, a decision supported by all 12 members of the FED board. Previously, in September, the FED cut interest rates by 50 basis points, this was the first cut since the strong rally in 2022.

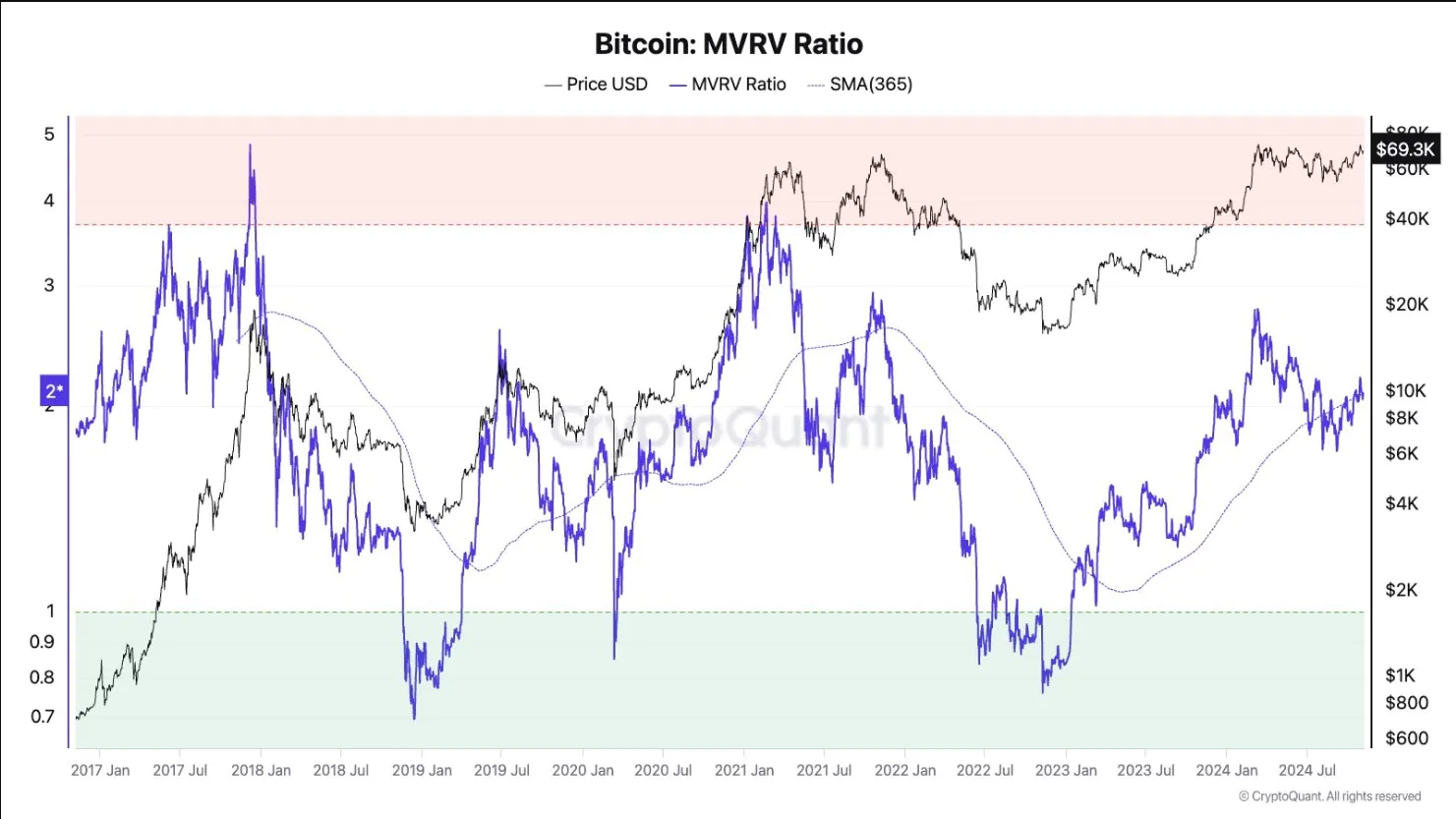

Despite the strong price increase, leading cryptocurrency research platform CryptoQuant believes that Bitcoin still has growth potential. CryptoQuant highlights the MVRV index and the ratio of the current price to the cost of buying by investors as positive factors.

MVRV is an index that measures the market value of a coin compared to its actual value, to assess whether the asset is overvalued or not. Currently, Bitcoin’s MVRV is around 2.26, indicating that the Bitcoin market is not overheated and is far from its peak. An asset is considered overvalued when its MVRV exceeds 3.7.

CryptoQuant also believes that Bitcoin’s price is still close to the buying price of traders, which should help alleviate potential selling pressure. Analysts expect Bitcoin’s price to reach six figures during this bull run, driven by institutional investment, favorable macroeconomic factors, and political influences.

Read more: Solana Ecosystem Meme Coins Hit $12 Billion After 30% Surge

In a message to investors, Bitwise Chief Investment Officer Matt Hougan set a price target of $200,000 per Bitcoin by 2025.