Bitcoin faces several conflicting trends, including derivative metrics that indicate low buyer interest and macroeconomic indicators suggesting that traders are increasingly moving away from cash positions. Interestingly, these stock market rallies coincide with a significant drop in U.S. Treasury yields, signaling strong demand for these traditionally safe instruments.

Essentially, traders are now willing to accept lower returns on fixed-income assets, which may reflect growing confidence in the Federal Reserve’s strategy to curb inflation without triggering a recession. The Fed is widely expected to cut interest rates on September 18th, following a period of maintaining rates above 4% since December 2022.

Investors are focusing on stocks and bonds ahead of economic uncertainty

Investors are increasingly turning their attention to stocks and bonds amidst economic uncertainty. Strong demand for government bonds, often regarded as the safest asset class, doesn’t necessarily indicate confidence in the U.S. dollar’s purchasing power. Should investors begin to view the U.S. government’s financial position as unsustainable due to rising debt, their initial response may be to seek refuge in even safer assets. In such a scenario, Bitcoin investors might face moderate short-term concerns, although the long-term outlook remains generally optimistic.

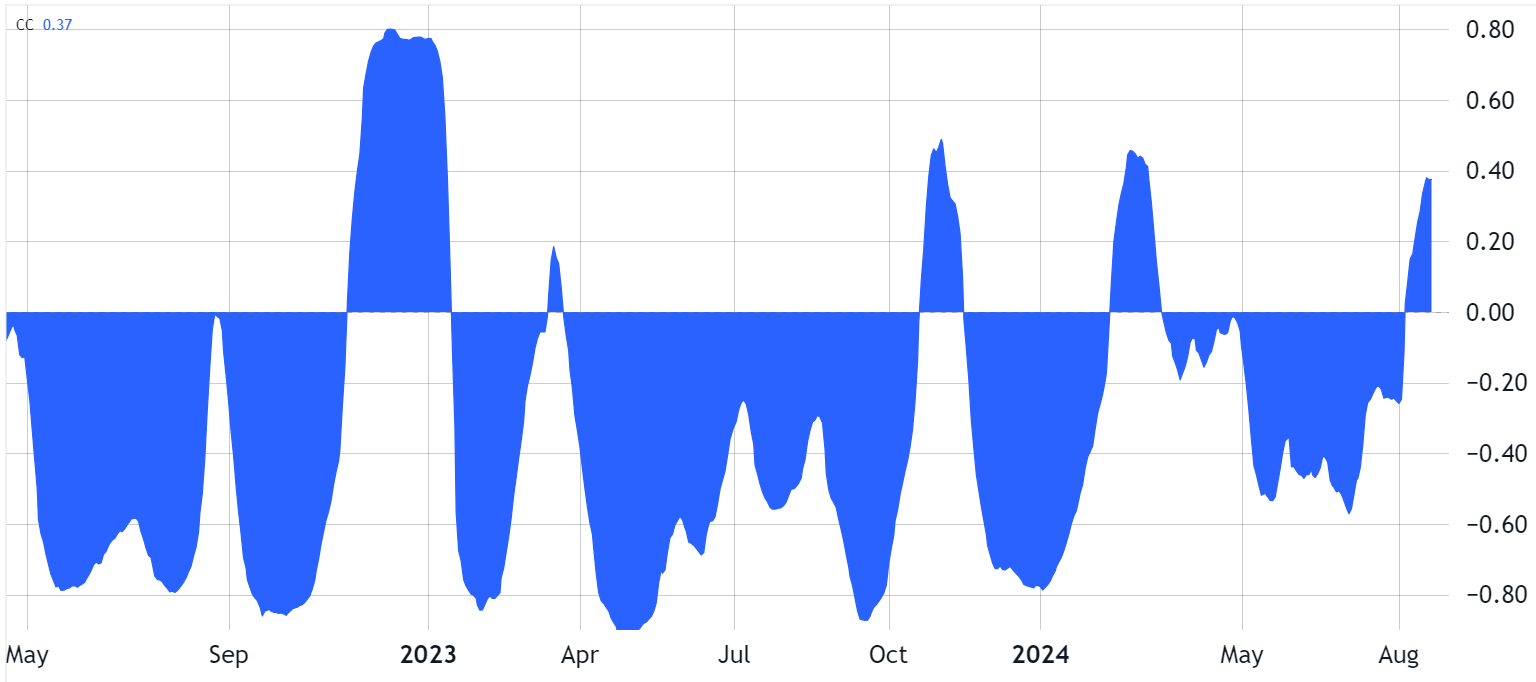

The U.S. Dollar Index (DXY) has recently fallen to its lowest level since December 2023, losing ground against other major global currencies. Some analysts suggest that DXY has an inverse correlation with Bitcoin prices, partly because Bitcoin’s appeal lies in its independent payment processing capability and fully transparent economic model.

Historical data reveals that the inverse relationship between DXY and Bitcoin has been evident in the past, but this correlation has weakened in recent months, fluctuating between -40% and +40%. This recent volatility diminishes the statistical strength of the inverse correlation argument. However, the lack of a clear correlation does not entirely rule out the possibility of Bitcoin reclaiming the $72,000 level.

Similarly, the recent surge in the S&P 500, which might seem counterintuitive, actually reflects a broader investor skepticism towards holding cash positions. This sentiment is inherently positive for Bitcoin’s outlook. The world’s largest and most profitable companies, offering potential dividends or stock buybacks, are positioned as effective hedges, especially when considering the substantial cash reserves held by tech giants.

Bitcoin derivative metrics indicate resilience and potential for price growth

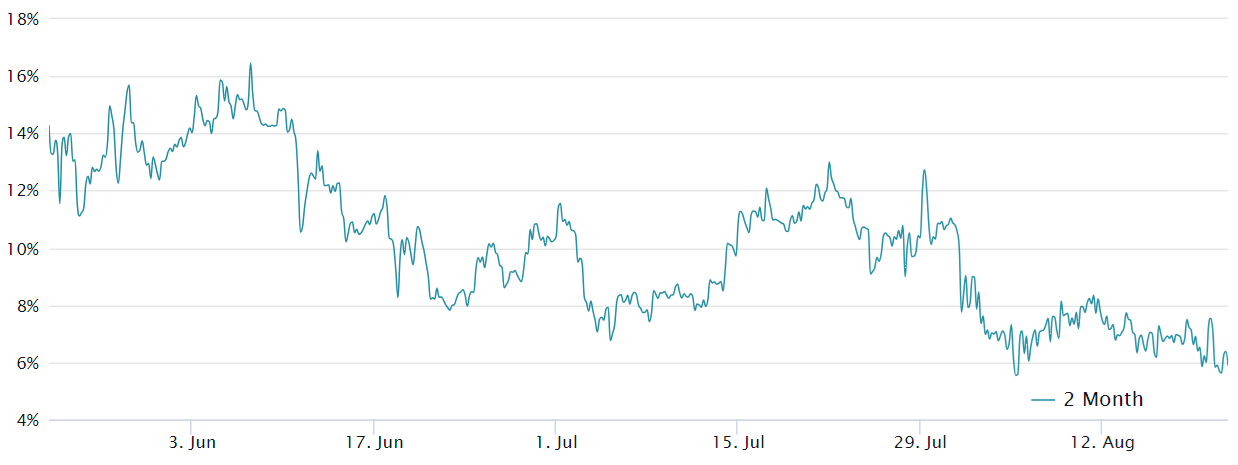

To understand how professional Bitcoin investors are positioning themselves, it’s essential to analyze the BTC futures market. Under normal market conditions, monthly contracts typically trade at an annual premium of 5% to 10% over the spot market, compensating for the longer settlement period associated with futures contracts.

Recently, the Bitcoin futures premium has dropped to 6%, its lowest level since October 2023. Although still within a neutral range, it hovers near the bearish territory. This marks a stark contrast to late July when the premium exceeded 10% as Bitcoin’s price soared above $68,000.

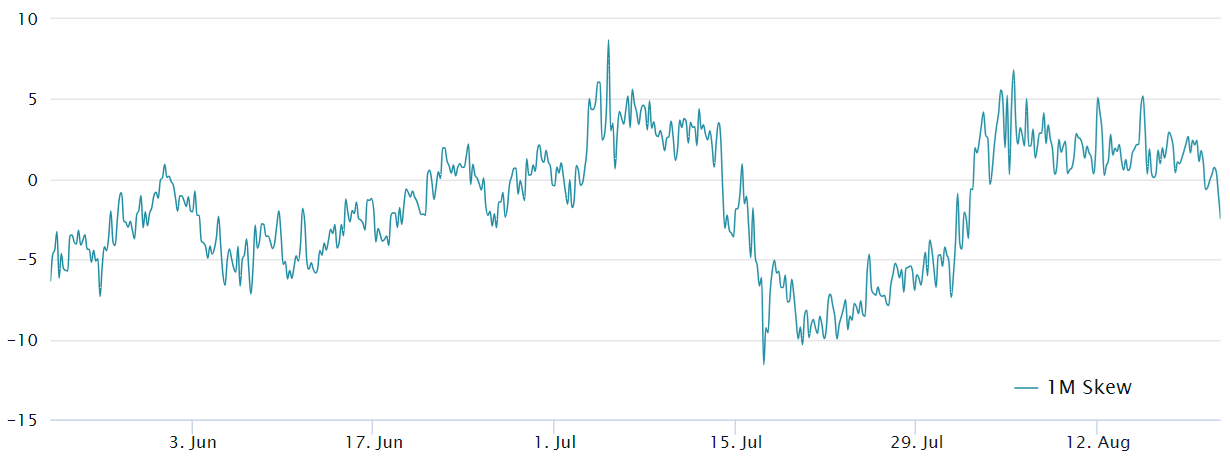

To determine whether this movement is isolated to the futures market, it’s also important to examine BTC options data. In a neutral market, the imbalance between call (buy) and put (sell) option prices should not exceed 7% in either direction. If traders become increasingly pessimistic, the demand for put options will rise, pushing the options skew indicator above +7%.

In contrast to the futures market, there is currently balanced demand for both call and put options, as indicated by the delta skew. This balance has persisted over the past few weeks, suggesting that professional traders aren’t particularly concerned about Bitcoin regaining the $62,000 level. It’s more likely that traders are holding back from increasing their exposure to cryptocurrencies ahead of the Fed’s decision in September.

Nem sei como vim parar aqui mas achei ótimo esse post não sei quem você é mas com certeza você está indo para um blogueiro famoso se ainda não o é.