Bitcoin miners’ profits have plummeted to their lowest in years, while futures traders are showing an unusually pessimistic outlook. These predictions align with separate forecasts of an upcoming bull market driven by seasonal factors, with Bitcoin soon expected to transition from one of its worst months to one of the best in its history.

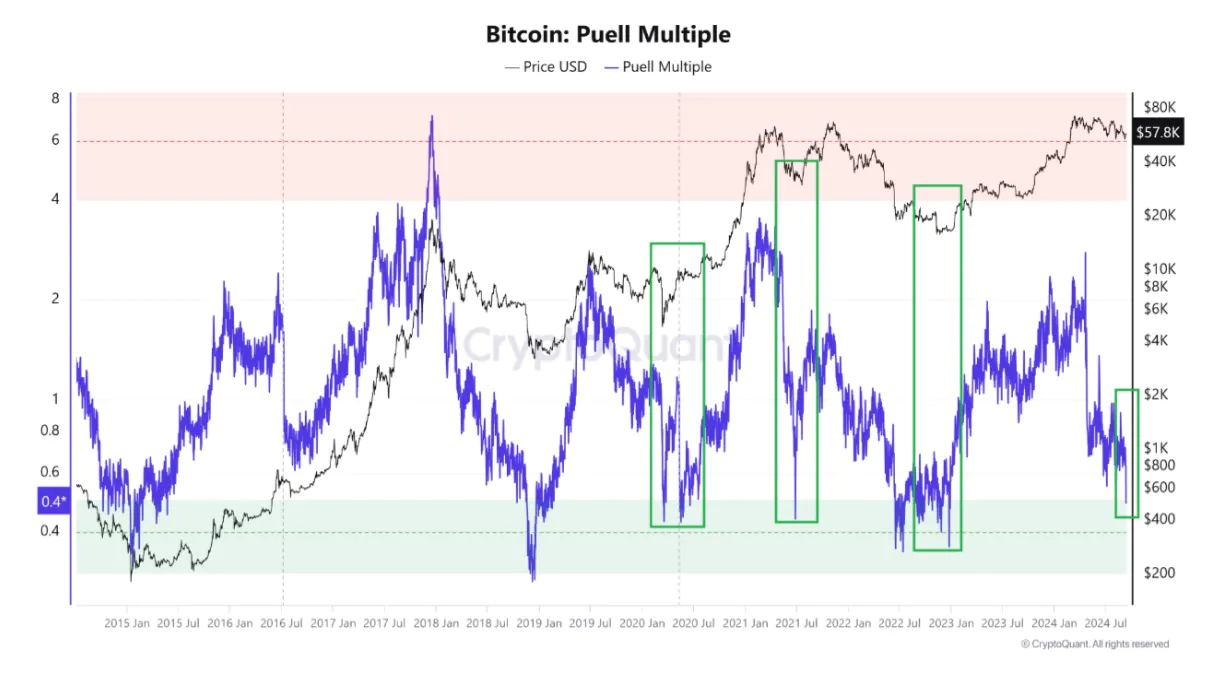

Bitcoin’s Bottom Signal According to Amr Taha from CryptoQuant, Bitcoin’s Puell Multiple has hit a low of 0.4 for the first time since late 2022, which marked the bottom of the most recent bear market following FTX’s collapse. The Puell Multiple compares the daily issuance of BTC in USD to its 365-day moving average. This metric is used to gauge miner profitability and is often relied upon to identify market tops and bottoms, as miners’ behavior can significantly influence price fluctuations.

“The Puell Multiple is approaching levels that have historically signaled a buying opportunity,” the analyst wrote. “Investors looking for long-term accumulation phases may view the current Puell Multiple, near 0.4, as a sign that Bitcoin is undervalued or at least nearing the market bottom.”

Bitcoin’s hash rate reached a new all-time high earlier this week, indicating that miners are now more competitive than ever in their efforts to mine a Bitcoin block. Meanwhile, the declining BTC price and the upcoming halving in April have significantly reduced the financial rewards tied to successfully mining a block.

Miners’ struggles aren’t the only concerning signal: another CryptoQuant analyst, Axel Adler Jr., noted on Thursday that the number of active addresses on the Bitcoin network has dropped to its lowest level since July 2021, shortly after China’s mining ban.

Preparing for October

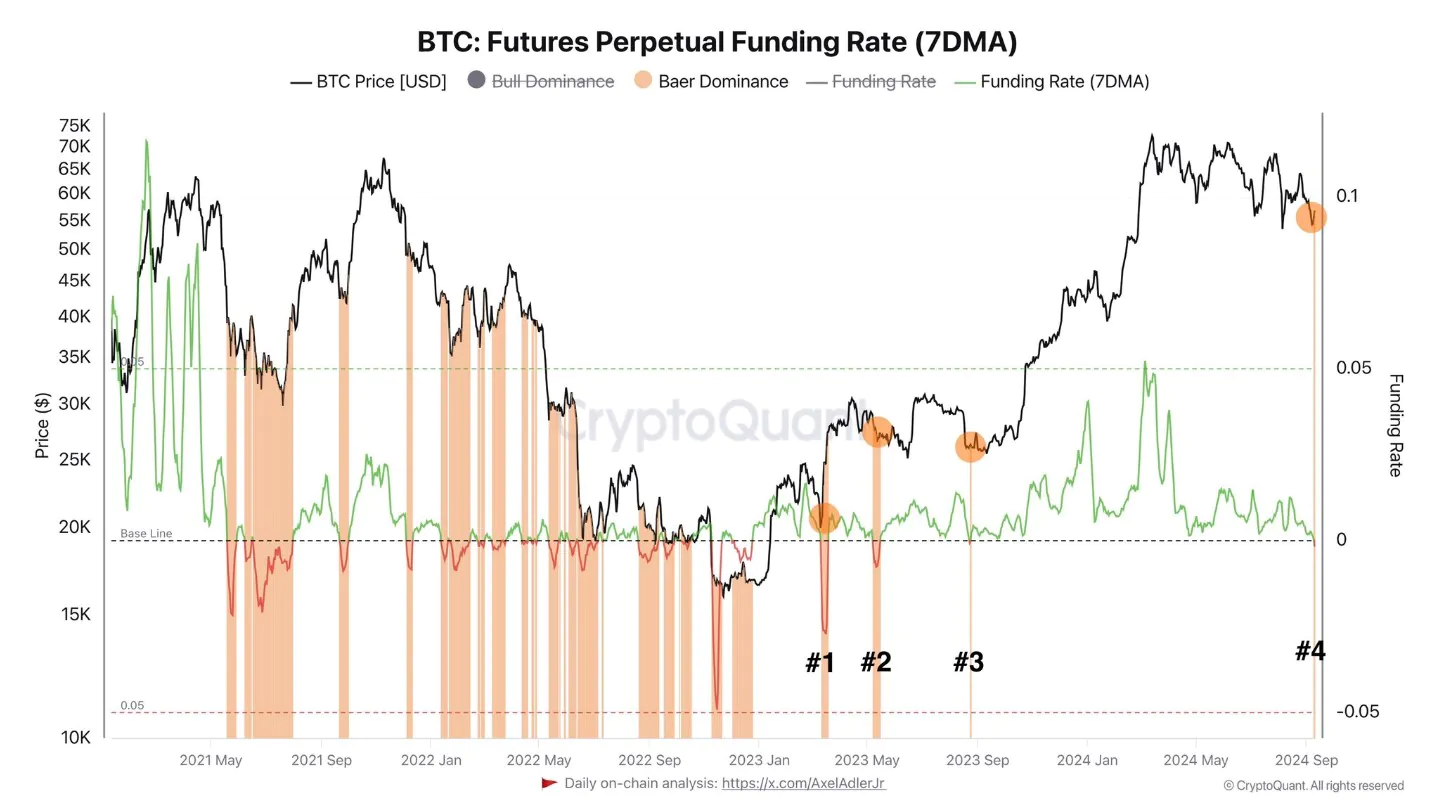

Bitcoin’s average perpetual futures funding rate turned negative on Wednesday for the first time since September 2023. According to Adler, in a bull market, this is often a bullish signal.

“I think the market will make a decision in the coming weeks,” he said. “I don’t expect a major drop unless a black swan event occurs. After that, we should move higher and test the $70K level.”

Bitwise released a memo on Tuesday, noting that while Bitcoin typically underperforms in September, the following two months are usually some of its strongest. For example, in October, BTC has historically risen by an average of 29.5%.

Central banks are also cutting interest rates right now, which generally benefits all financial assets. On Thursday, the ECB lowered its deposit rate by 12 basis points.