The recent price fluctuations of Bitcoin [BTC] continue to frustrate traders as uncertainty looms over the “king of cryptocurrencies.” While other cryptocurrencies have experienced similar declines, BTC has been particularly affected by whale activity.

One prominent whale is at risk of liquidating 488.45 WBTC, valued at $28 million, on Compound [COMP], with a health ratio of 1.07 and a liquidation price of $50,429.

This whale has already faced liquidation three times during the 2022 crash, totaling 74,426 cWBTC worth $32.82 million. Should Bitcoin’s price drop below $50,429, further liquidations could push the price towards that level.

More Bitcoin liquidations on the horizon

The Bitcoin market as a whole faces the threat of additional liquidations. Notably, sell-side liquidations are projected to reach $1.07 billion around the $50,000 mark, with an additional $500 million expected if prices dip below $55,000.

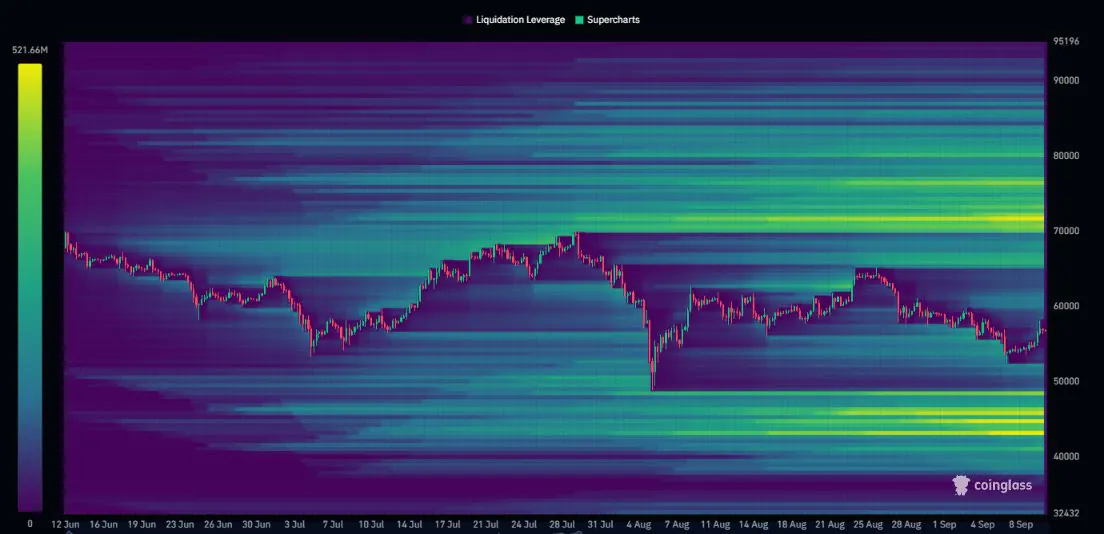

A three-month heatmap reveals significant liquidity on both sides of the market, with buy-side liquidations near $45,000 and sell-side liquidations around $72,000.

Traders are advised to avoid leveraged positions, as the market may experience sharp swings in both directions in an effort to capture liquidity. After failing to hold the $60,000 level, Bitcoin could continue its decline, potentially tapping into liquidity below $50,000 before reversing into a bullish trend.

What’s next for BTC?

On the 4-hour timeframe, Bitcoin has repeatedly failed to break above the 200-day Exponential Moving Average (EMA) in recent weeks.

This suggests that BTC may face additional downward pressure, as prices are often drawn to liquidity resting above or below key levels. Whether BTC trades above or below the moving average indicates market strength or weakness.

For buyers to initiate a recovery, they must regain these moving averages; however, sentiment suggests that further price drops are possible, with liquidity concentrated around the psychological $50,000 level.

History Suggests a Return to Equilibrium

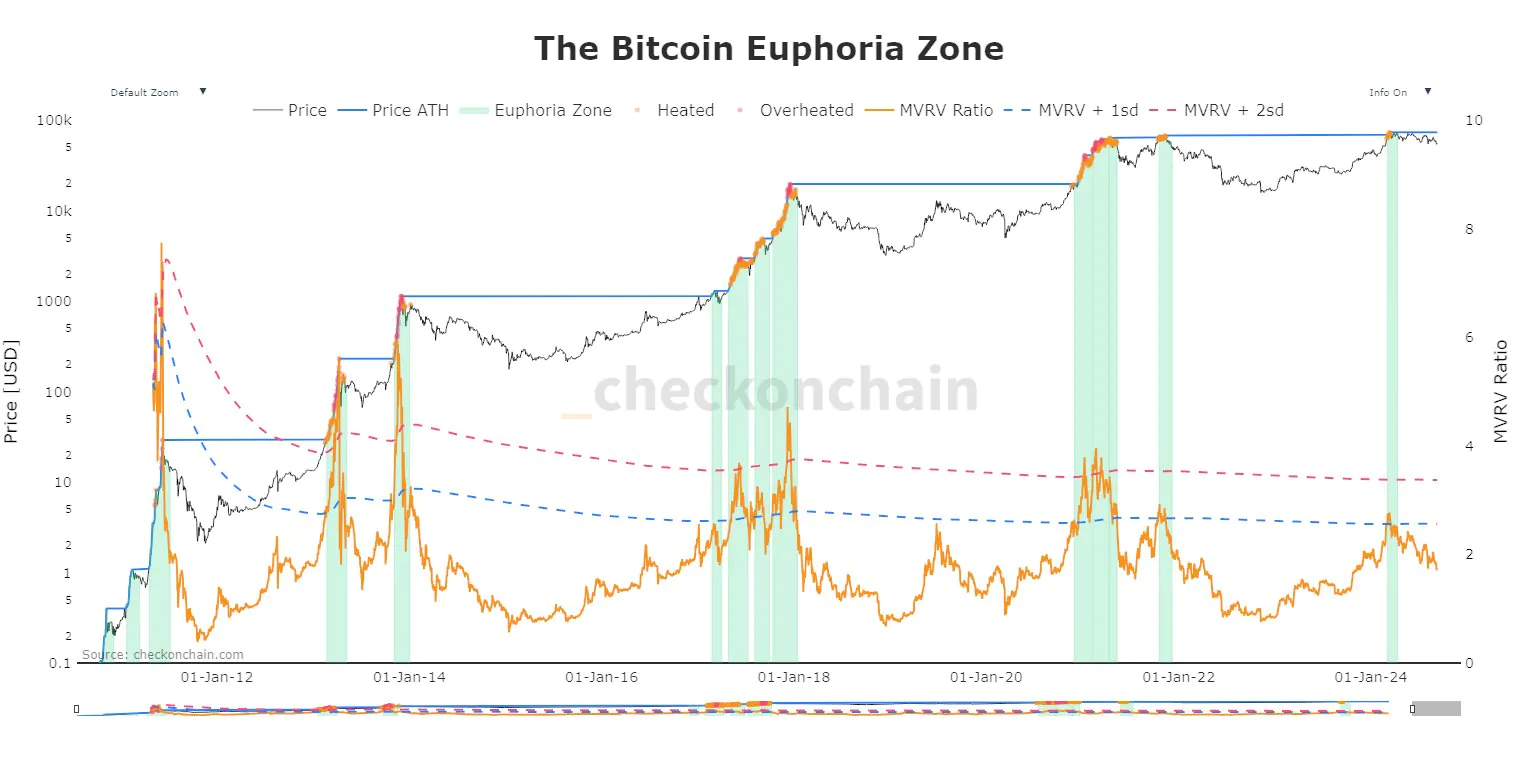

Historically, Bitcoin tends to revert to its equilibrium zone, offering the potential for future price increases. The “Euphoria Zone” indicator shows that the all-time high (ATH) of a previous cycle often becomes the low point for the next bull run.

Other metrics, such as the Market Value to Realized Value (MVRV) ratio, indicate that BTC is moving toward its equilibrium level—a key area where prices typically rebound.

Although Bitcoin has not yet reached this level, analysts predict that BTC could dip below $50,000, gather liquidity, and then rally to new highs, possibly by late Q4 2024 or early Q1 2025.

The ongoing price volatility and liquidation events signal further potential turbulence in the near future. As liquidity builds below critical levels, BTC may experience additional declines before making a significant recovery. However, if Bitcoin follows its historical pattern, a rebound is likely, setting the stage for a higher rally as liquidity increases.