Bitcoin has surged to $97,000, marking three consecutive days of impressive price gains in early January.

Glassnode has identified several key price levels that will determine Bitcoin’s trajectory in the coming weeks.

These levels are determined by analyzing the Cost Basis Distribution (CBD) metric – a measure of the total Bitcoin supply held by addresses, along with the average cost basis within specific price ranges.

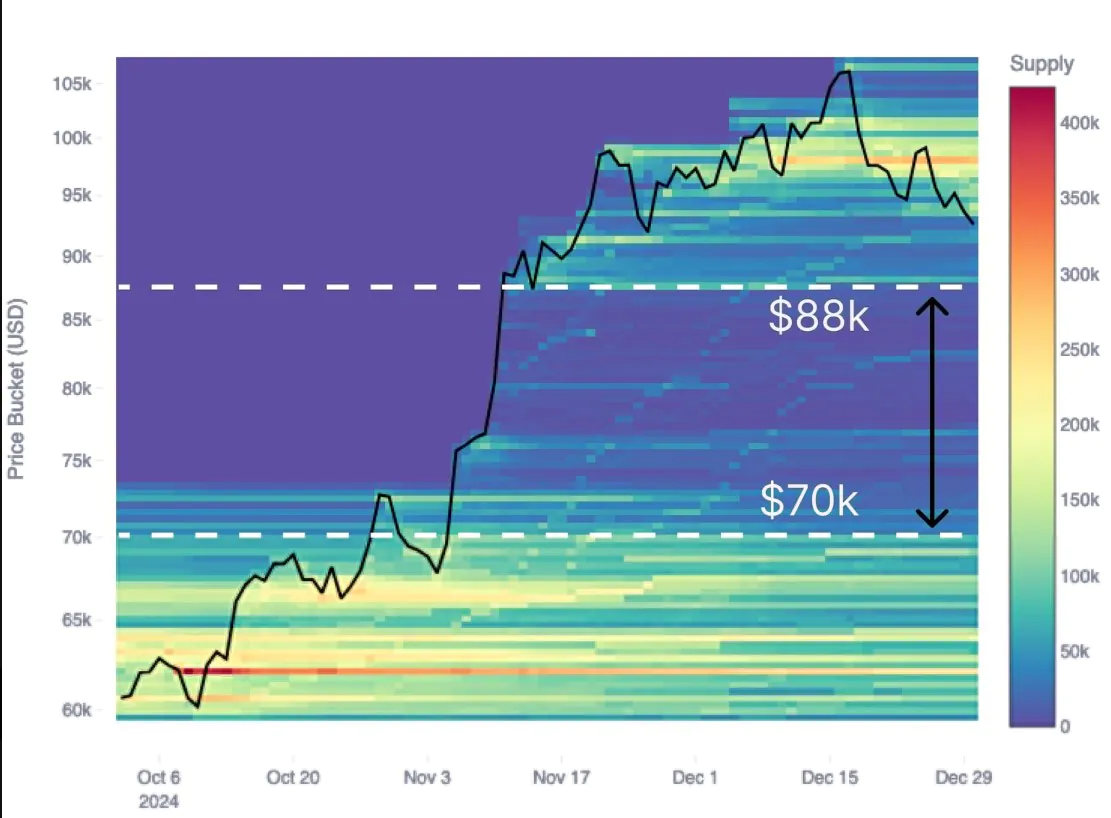

Accordingly, BTC has a densely concentrated supply between $88,100 and $103,000. This suggests that many investors are choosing to sell Bitcoin in this price range to take profits.

Below this densely concentrated supply area is a significantly less dense area, with a gap between $70,000 and $88,100. This area has much less supply than the $88,100 to $103,000 area.

According to analysis from Glassnode, if Bitcoin enters a prolonged correction phase, the current price area could become a significant bottom. During the correction phase, BTC is likely to drop to new weekly or monthly lows, similar to what happened after Bitcoin reached a record high after the US presidential election.

A bright spot of this “air-gapped” price area is its ability to stimulate excitement from crypto investors and new buyers who want to take advantage of the opportunity to accumulate BTC at low prices. If Bitcoin drops to $70,000, this could spur massive buying activity from those who believe in the prospect of a strong price increase again, especially when BTC surpasses $100,000 in the future.

Read more: Will 2025 Be a Boom Year for Bitcoin DeFi?

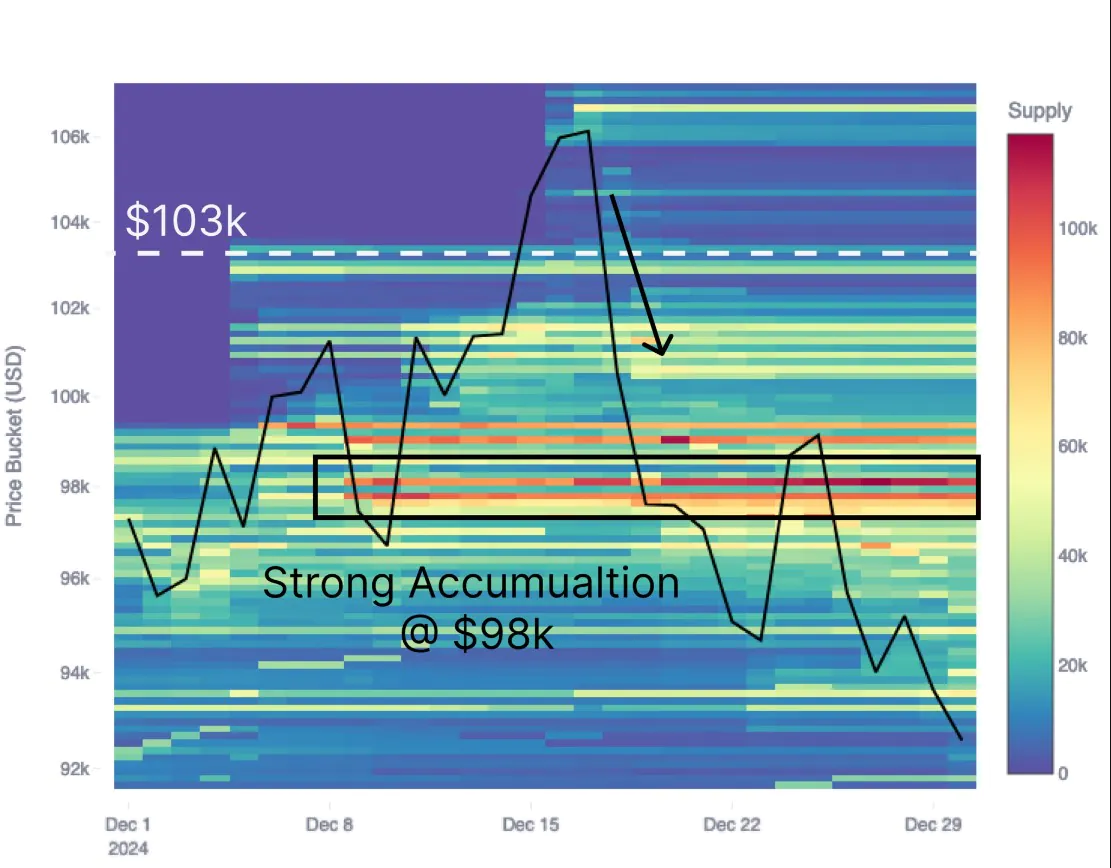

Glassnode also pointed out that the $98,000 price level is an important level where investors who buy Bitcoin have remained steadfast despite market volatility. Therefore, this price level is considered a key support area for short-term price movements.