This price fluctuation has sparked discussions among cryptocurrency analysts regarding Bitcoin’s potential direction in the coming weeks. One such analyst, Mags, recently shared his insights on X, where he discussed Bitcoin’s current price action.

Is a breakthrough past $70,000 imminent? Mags emphasized that Bitcoin’s current sideways movement shouldn’t necessarily be interpreted as bearish. He noted that before each major move, Bitcoin typically undergoes a consolidation phase within a specific range. Historically, these consolidation periods last anywhere from 8 to 30 weeks. As of now, Bitcoin has entered the 25th week of its current consolidation phase. Although it’s challenging to predict the exact duration of this period, Mags highlighted that Bitcoin remains in a bullish market.

If this trend continues, Mags believes that the eventual breakout could be quite significant.

As Bitcoin approaches the critical resistance level of $70,000, other analysts are also weighing in on the possibility of a breakthrough.

Captain Faibik, another well-known cryptocurrency analyst on X, pointed out that although Bitcoin’s buyers seem to have control of the situation, the real challenge still lies ahead.

He speculated that Bitcoin might retest the $70,000 resistance level this week but questioned whether the buyers have the strength to push through this crucial barrier. Key Fundamentals: What Do They Indicate for Bitcoin’s Future? To gauge the potential for sustainable price growth, we should consider the fundamental factors underpinning Bitcoin. According to data from Coinglass, Bitcoin’s open interest has dipped slightly by 1% in the past day, bringing its current valuation to $34.39 billion.

Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not yet been settled. A decline in open interest might indicate a decrease in market activity or a shift in trader sentiment.

However, despite this decrease, Bitcoin’s open interest volume—a measure of the total value of these contracts—increased by 1.84% during the same period, reaching $39.06 billion. This rise suggests that while the number of contracts has declined, the value of the remaining contracts has grown, possibly indicating a growing confidence among traders in Bitcoin’s short-term outlook.

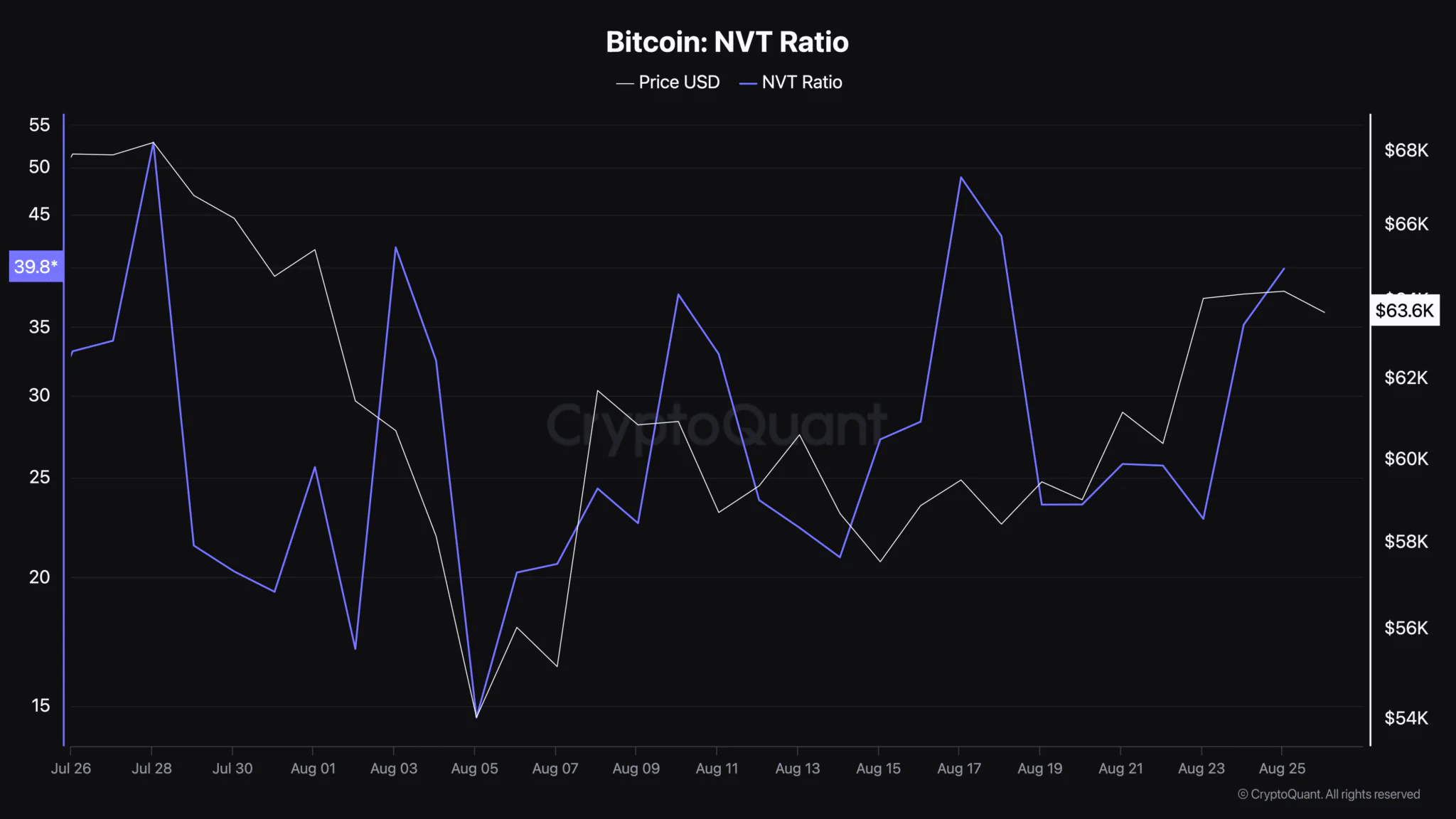

Another crucial metric to consider is Bitcoin’s Network Value to Transactions (NVT) ratio, which has been climbing and currently stands at 39.8, according to data from CryptoQuant.

The NVT ratio is a valuation indicator that compares Bitcoin’s market capitalization to its network transaction volume. A higher NVT ratio can suggest that Bitcoin is overvalued relative to its transaction volume, potentially signaling a need for caution. However, it could also indicate that the market is expecting future growth in transaction volume, which would justify the current valuation. In Bitcoin’s case, the rising NVT ratio might imply that investors are anticipating continued price increases, supported by the broader market trend.