Amid a broader market downturn, 97,602 traders were liquidated in the past 24 hours, with a total liquidation value of $274.73 million. The leading cryptocurrency, Bitcoin (BTC), continued its decline, losing 1% of its value, while trading volume also plummeted by 20% in the same period.

Buy Signal Emerges

Notably, a key on-chain indicator has flashed a buy signal, opening up opportunities for contrarian traders. However, caution is warranted as downside risks remain.

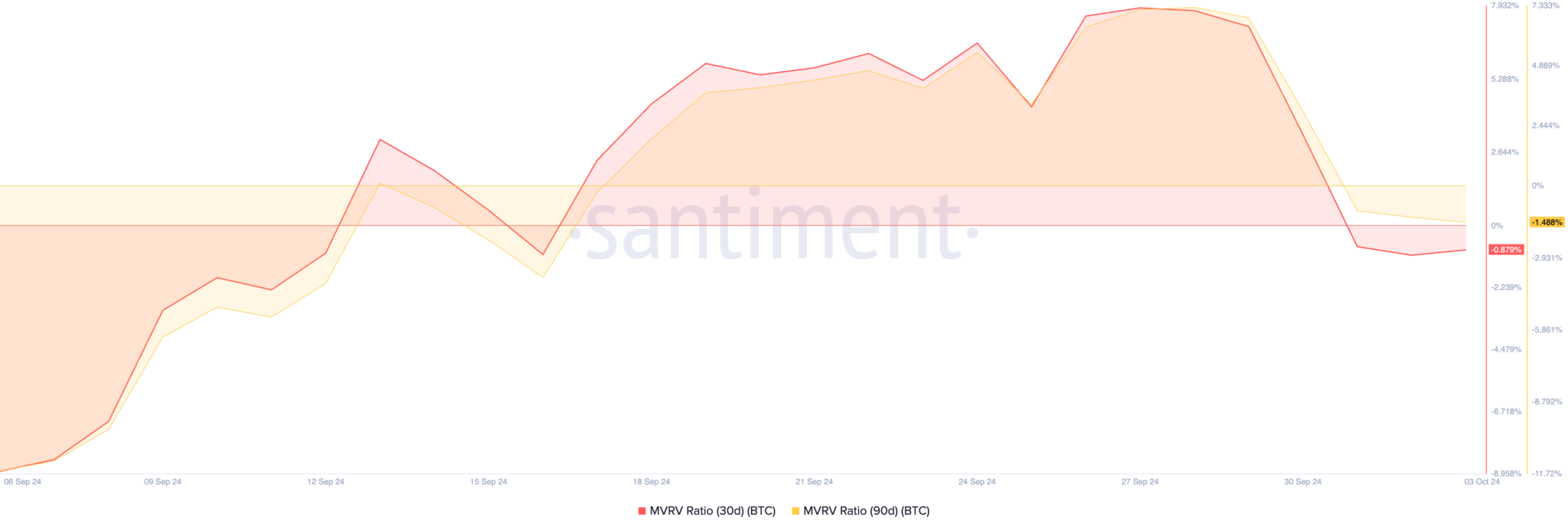

Buy Signal from Bitcoin Market Value to Realized Value (MVRV), a metric that measures the average returns of all holders, is the main on-chain factor to watch. At the moment, Bitcoin’s 30-day and 90-day MVRV ratios are -0.89 and -1.48, respectively.

In general, when MVRV is negative, it indicates that the current market price is lower than the average price at which the majority of investors bought. This means that if all investors sell their assets at the current price, they will face losses.

However, this indicator also provides some support. Historically, a negative MVRV ratio is often seen as a buy signal, indicating that the market is oversold and may open up a buying opportunity. When MVRV is negative, it reflects that the asset is trading below its historical average purchase price and is likely to recover soon.

Whales Accumulate Bitcoin

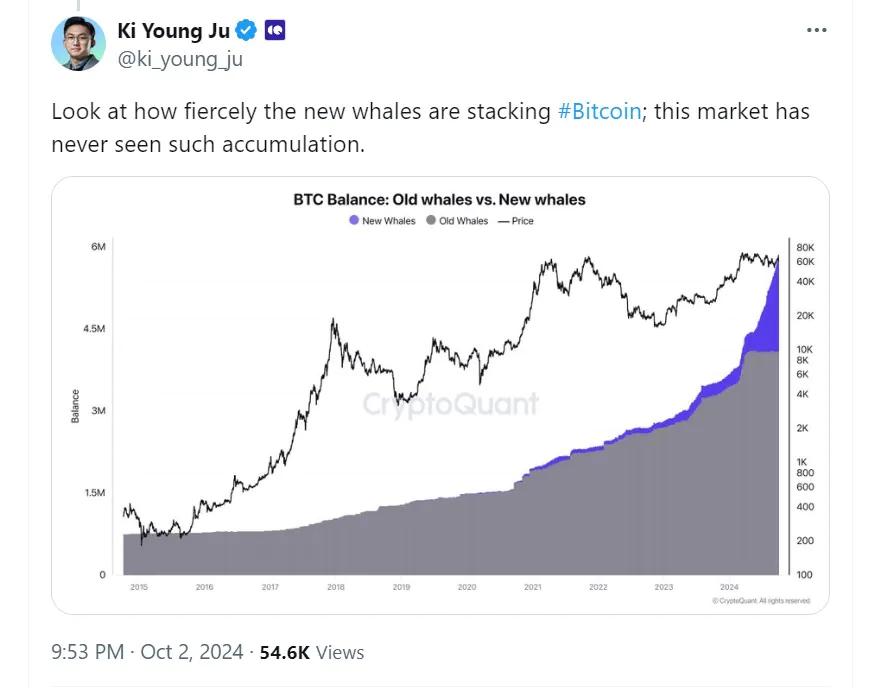

Some traders have noticed this buy signal and have begun to increase their accumulation of Bitcoin. In particular, the activity of new “whales” (large investors) has spiked recently, marking an unprecedented level of participation.

“Look at how new whales are accumulating Bitcoin aggressively; this market has never seen such accumulation,” Ki Young Ju, founder of CryptoQuant, shared in a post on X.

While the buy signal may encourage some traders to increase their Bitcoin holdings, it is also important to remember that the downside risk is not completely gone. Buying pressure is decreasing, which is reflected in Bitcoin’s relative strength index (RSI), which is currently at 44.88.

RSI is a key indicator that helps determine whether a market is overbought or oversold. At 44.88, this shows that selling activity is dominating the buying pressure from Bitcoin holders.