Bitcoin Shows Strong Demand

The market has changed dramatically, creating favorable conditions for bullish investors to push prices higher. Over the past six days, Bitcoin has shown strong demand, a sign that buyers have regained control after cooling off in the first 10 days of October. In other words, BTC appears to be rebuilding the same bullish momentum seen in September.

There are several reasons why Bitcoin could reach $70,000 in the coming days or weeks.

Over the past 24 hours, Bitcoin has seen significant volatility, including selling pressure that pushed prices close to $68,000. However, buying demand then returned strongly, pushing the price up and avoiding a deeper decline.

Despite the correction, Bitcoin quickly recovered despite the leveraged sell-off. The sharp move on Tuesday showed a “shakeout” of leveraged positions, as Bitcoin’s Open Interest hit an all-time high.

Furthermore, the estimated leverage ratio also spiked to a new high. High leverage ratios coupled with open interest often create conditions for liquidations, especially when excessive optimism sets in. Once the price corrects, market sentiment is often severely affected. However, this did not happen on Tuesday.

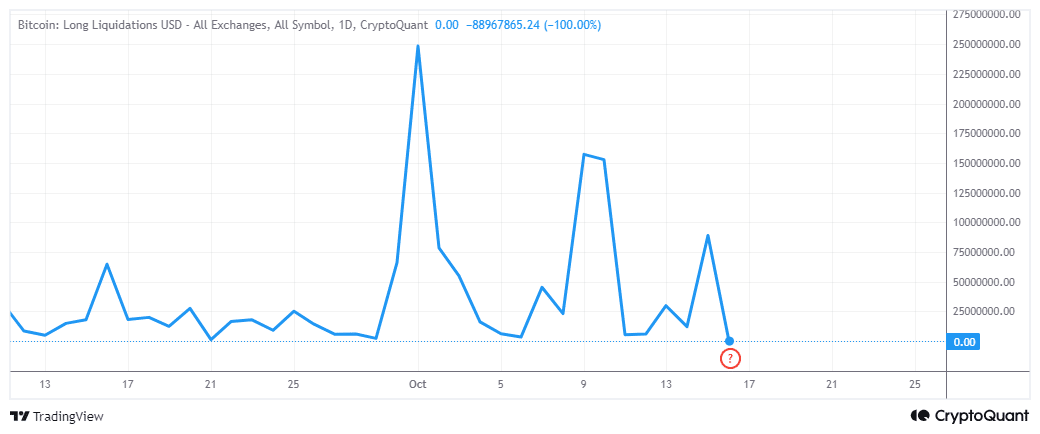

Long Liquidations Peak

Long liquidations peaked at $88.9 million on September 15. However, demand quickly returned, pushing the price past $67,000. This result further reinforces the growing optimism that Bitcoin will continue to increase in value.

Notably, the recent recovery in demand has also been marked by strong accumulation of Bitcoin ETFs. According to recent reports, ETFs have purchased over $500 million worth of Bitcoin in the past 24 hours.

Similarly, on October 14, ETFs also accumulated over $500 million worth of Bitcoin. These data suggest that demand from financial institutions is also leaning towards optimism.

This further explains why Bitcoin is resisting the bearish trend and reinforces expectations that the upcoming rally will take Bitcoin above $70,000. In addition, another important factor such as the upcoming US election could push Bitcoin prices even higher, depending on the outcome.