Yesterday, Bitcoin surged back to nearly $89,000 as investor sentiment improved following the recovery of the S&P 500 index.

Previously, on March 2, Bitcoin had regained the $95,000 level but quickly dropped back to $82,000, reflecting a significant increase in market volatility.

Amid such unpredictable market movements, the number of Bitcoin accumulation addresses remains low unless external factors drive speculative demand. When this speculation fades, these addresses tend to shift toward selling.

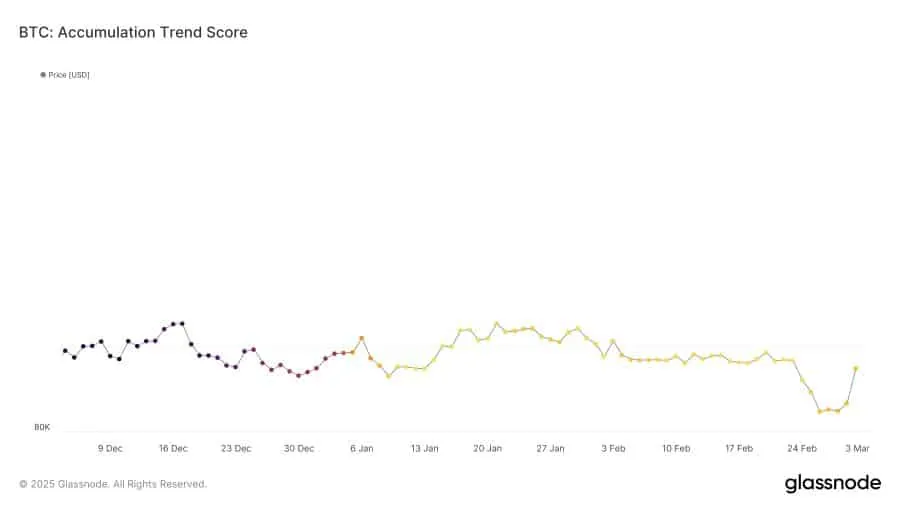

Data from Glassnode indicates that Bitcoin is still stuck in a distribution phase. Its accumulation trend score has remained below 0.5 for 58 consecutive days, marking an extended period of distribution. In fact, Bitcoin is now approaching the average one-year distribution duration, aligning with previous market cycles.

Over the past year, the average distribution phase has lasted 65 days, while the accumulation cycle has averaged 57 days. Overall, Bitcoin has spent 170 days in relative accumulation (trend score > 0.5) and 196 days in relative distribution (trend score < 0.5). On average, the market has alternated between accumulation and distribution phases in cycles lasting between 57 and 65 days.

Currently, with a flashing score of 0.9, data suggests that large investors are still in distribution mode, with no confirmed transition to accumulation yet. This trend is further reinforced by changes in whale inflows.

Specifically, the amount of BTC flowing into exchanges has surged to 12,900 BTC from a previous negative 75,800 BTC. This indicates that major investors are depositing more Bitcoin onto exchanges rather than withdrawing, signaling a strong selling intent. As large wallets continue to sell, the market may take longer to transition back into sustainable accumulation.

Bitcoin remains in a distribution phase, with significant selling pressure still weighing on the market. This is evident in the negative cumulative volume delta, indicating that selling is outpacing buying.

Over the past 24 hours, this selling pressure has had a noticeable impact on Bitcoin’s price action. Until the market shifts toward accumulation, Bitcoin is likely to continue declining. However, based on current market sentiment and macroeconomic factors, there are signs that selling pressure is gradually easing.

If macroeconomic uncertainties subside, demand for Bitcoin could return, helping the market recover. A shift in investor sentiment could push Bitcoin back to higher price levels in the near future.