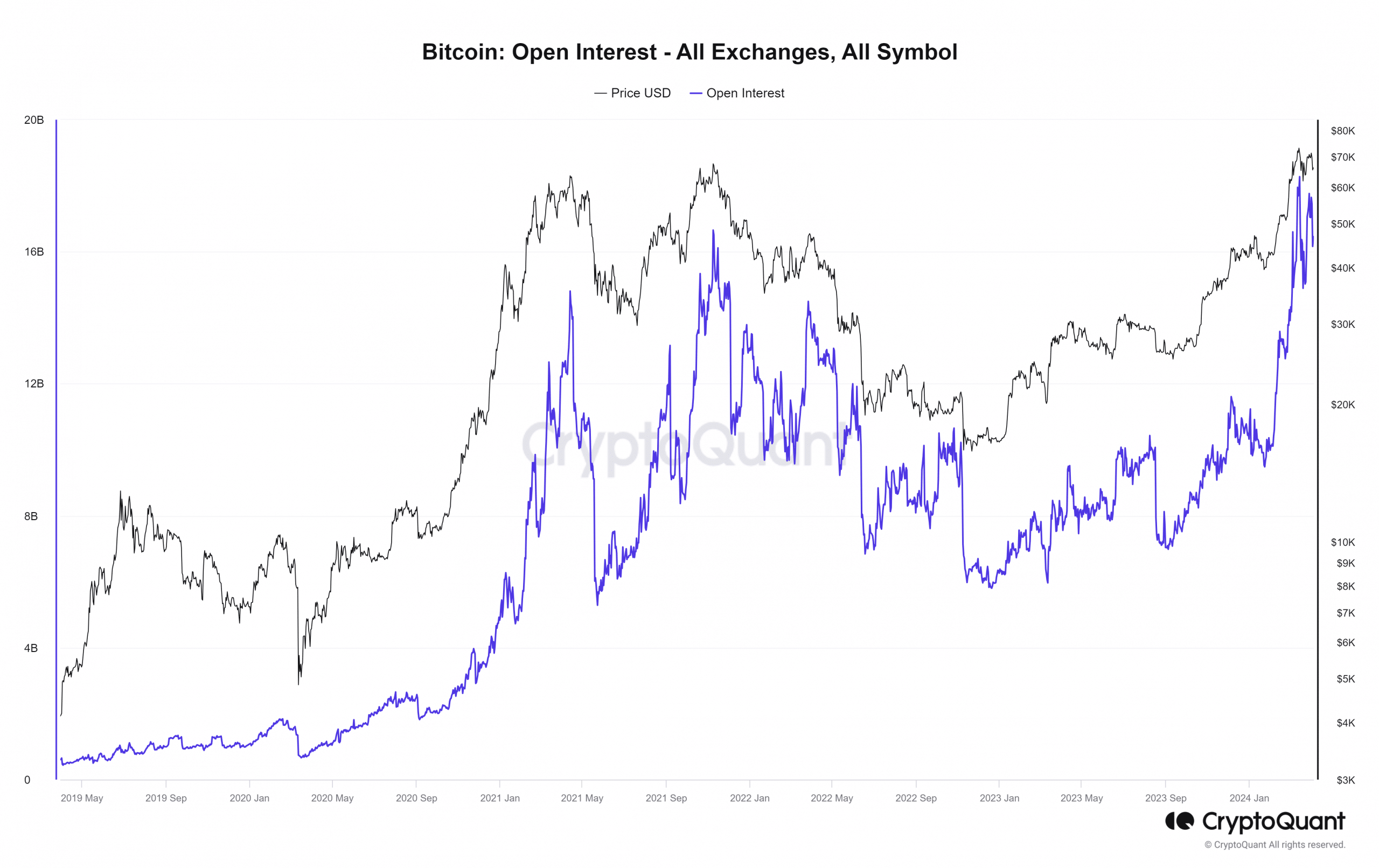

The price of Bitcoin (BTC) has dropped 6.8% in the last two days, despite rising from $64.5k to $66.5k. An article on CryptoQuant has attracted attention by pointing out that every time Open Interest (OI) surpasses $13 billion, the Bitcoin market usually experiences significant corrections.

Bitcoin open interest once again exceeds the $13 billion mark

Open interest reached $17.7 billion on March 28, and then we have seen losses over the past few days. With many retail participants removed from the futures market, the question is will BTC recover or continue to decline over the next two months?

According to the article on CryptoQuant, every time BTC’s OI surpasses $13 billion, the market usually experiences a major correction. This occurs when OI reaches its highest level during periods of strong or exciting market growth.

Source: CryptoQuant

OI peaks in 2021 were $14.8 billion in April 2023 and $16.6 billion in November 2021. In both of these cases, BTC dropped by about 50% over the following 70 days.

Although open interest recently reached $18.2 billion, this does not automatically lead to a 50% drop over the next two months. During the 2020 bull run, open interest surpassed previous highs impressively, implying that capital inflows into the market have increased significantly.

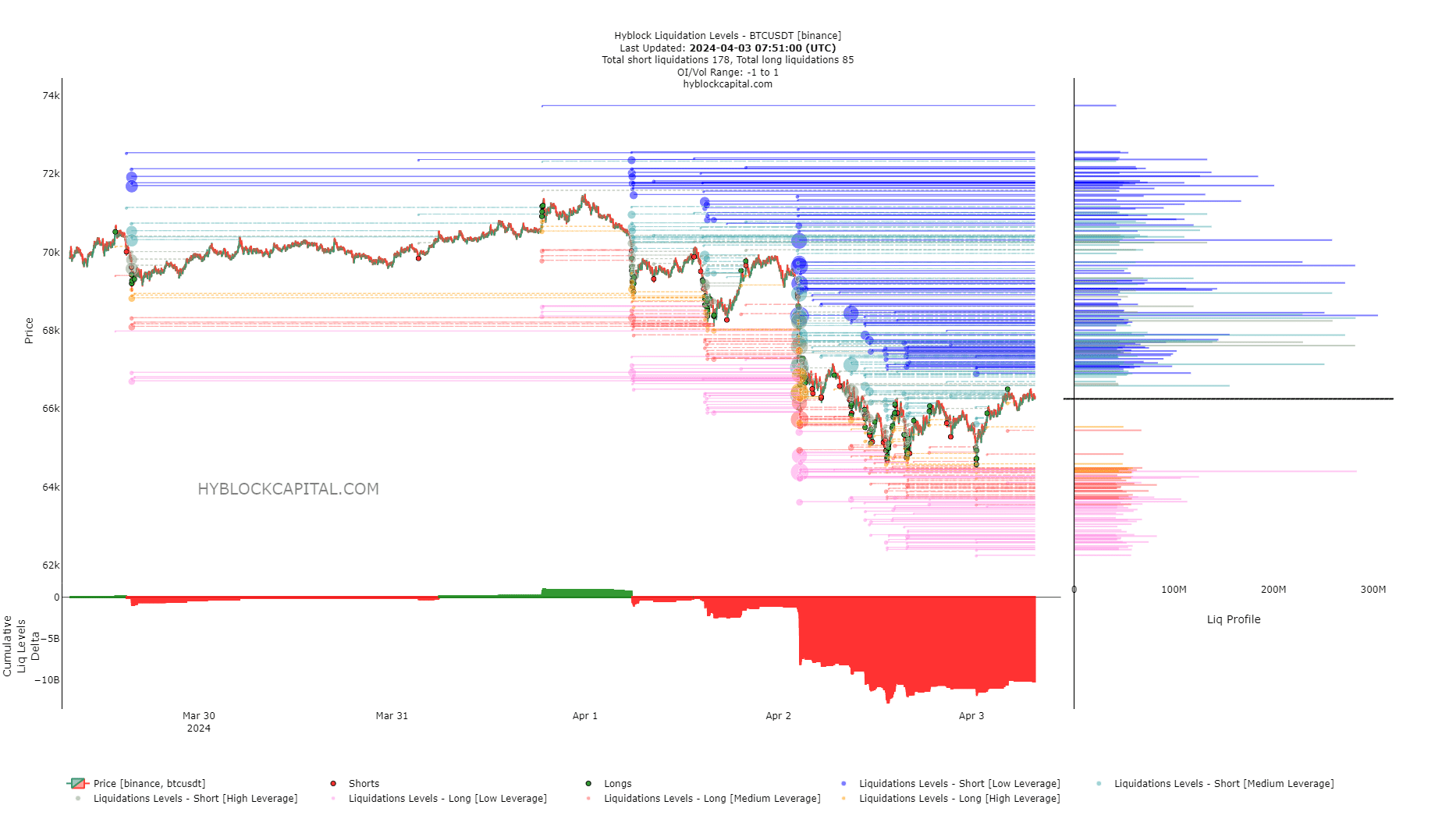

The liquidation charts show a short-term bullish reversal

Source: Hyblock

The liquidation charts now show that the short-term price uptrend is reversing. The cause of the large fluctuations in OI is that prices are attracted by liquidity. When the market is supported by demand from the spot market, significant fluctuations over a short period of time are unlikely to occur due to spot market orders.

As the market approaches a local peak and prices are pushed higher by interest rates in the futures market, but spot demand is much less, the likelihood of liquidation increases significantly. This is something investors need to pay attention to.

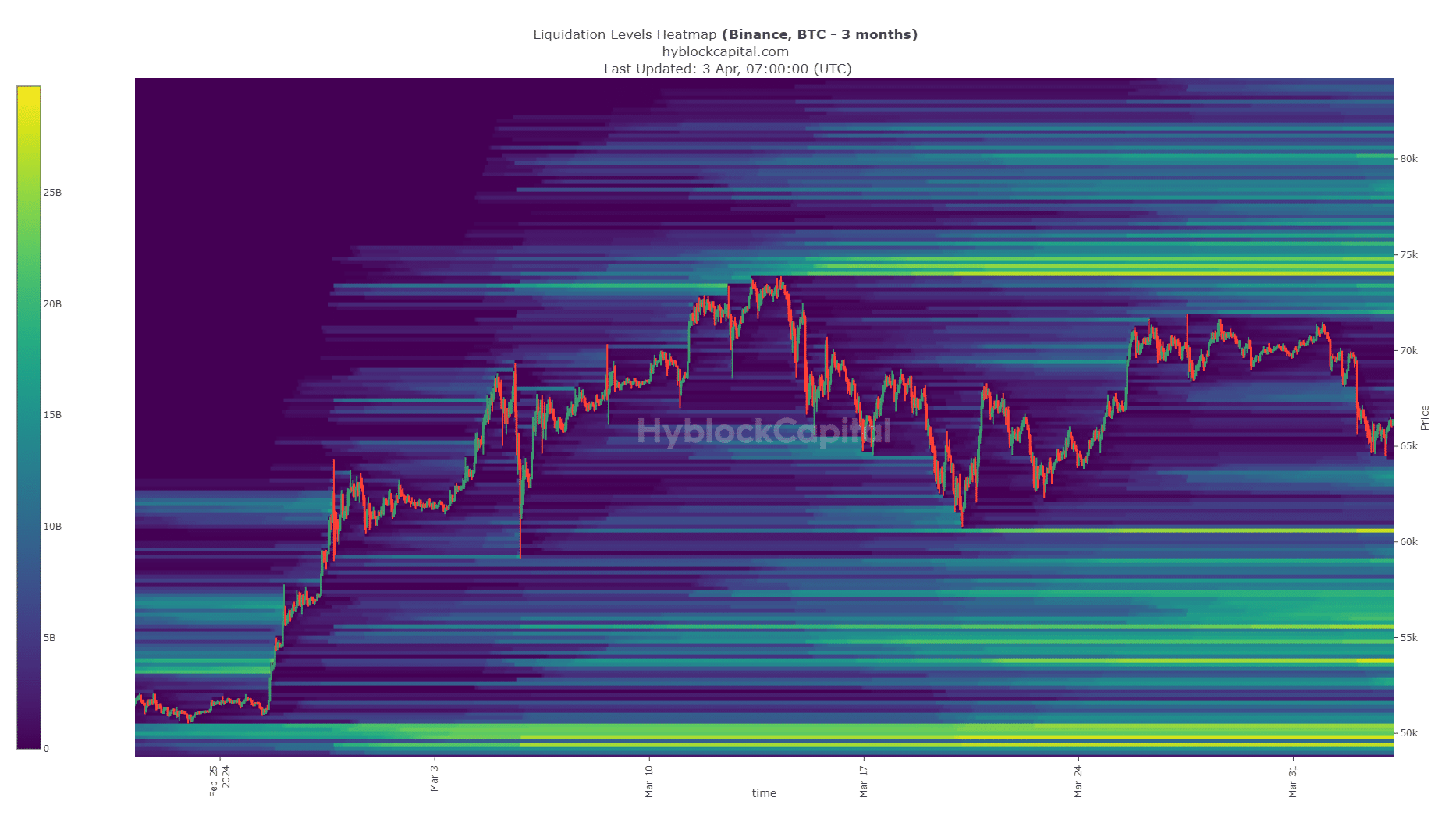

Source: Hyblock

Currently, the delta cumulative liquid level is very negative. The number of short liquidations is more than the number of long liquidations with a good profit margin. Therefore, the price may be lured higher to wipe out the bears $68.2k, $69.6k, and $70.3k are the levels that BTC could rise to in the coming days. There is a large amount of short liquidation at these levels that could be wiped out.

Related: Surge of Bitcoin Exiting Coinbase Exchange Unexpectedly

Bitcoin’s long-term outlook is focused on two main areas. The $60.6k area is considered to the south, while the $74k-$74.6k area to the north should prove important.

With the Bitcoin halving event less than three weeks away, we can expect more volatility before the bull run really begins.

Thanks

Ykk

Le bitcoin évolue sans cesse.C’est bon.

Is it about advert always?

Crop for mining