Bitcoin speculators experienced a turbulent week. Analyzing the daily price chart, the cryptocurrency not only dropped by approximately 7% after surpassing the $70,000 mark earlier this week, but cracks also began to appear. Overall, optimistic traders still believe the uptrend continues, considering the strong expansion from July 14 to July 21. However, since then, prices have fluctuated and primarily declined, indicating a potential bearish presence.

Will Bitcoin holders face more suffering?

Amidst this price instability, an analyst expressed caution about the future, even predicting that Bitcoin might continue to fall in upcoming trading sessions. Posting on X, the analyst shared trading data, revealing that bears are currently in control. Specifically, the analyst noted an increase in weekly liquidation volume clusters, coinciding with the recent price drop in the latest trading day. With this signal, the analyst believes that sellers might keep pushing the cryptocurrency lower, at least for the next week.

Over the last 24 hours, the price of BTC has dropped by 3.2%. Judging by the weekly clusters of liquidation volumes, the decline may continue for a week or more. https://t.co/7Rw1btrzKr pic.twitter.com/05rLyTbreO

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) August 1, 2024

While this was unfolding, the net buyer volume on major perpetual exchanges remained negative. The net buyer volume, which on-chain analysts use to gauge market sentiment, fluctuates depending on market valuations.

When the net buyer volume drops to negative levels, it indicates that most traders are holding short positions. According to the analyst, prices can only rebound when this metric turns positive, allowing buyers to take control of the market.

Examining the daily Bitcoin chart, there is support for buyers around the $63,000 level. However, the higher range between $60,000—a round number—and $63,000 is crucial. If the bulls can maintain this level and prevent sellers from pushing prices lower, the likelihood of a Bitcoin recovery increases significantly. Any movement above $70,000 would be pivotal and align with the bullish trend established in the third week of July.

Institutional Accumulation: Spot ETF Issuers Hold Nearly 300,000 BTC

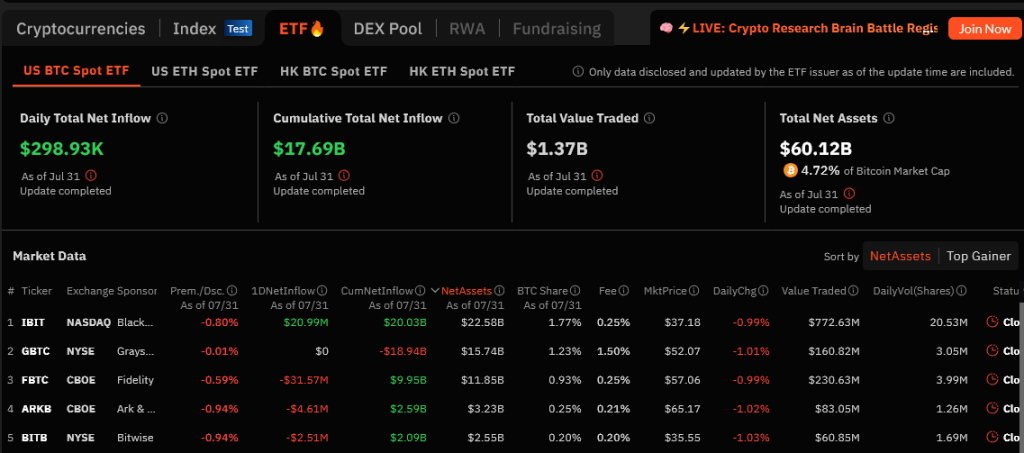

Despite the current weakness, institutions are still eager to gain exposure to Bitcoin. Since the approval of spot Bitcoin ETFs in the United States, data from Ecoinometrics shows that leading issuers like Fidelity and BlackRock have accumulated nearly 300,000 BTC.

On August 1, data from Soso Value revealed that all spot Bitcoin ETFs hold over $60 billion worth of BTC. On July 31 alone, BlackRock purchased nearly $21 million worth of BTC.

Despite this, there were significant outflows from other issuers, primarily Fidelity. The fact that institutions are doubling down and accumulating this cryptocurrency is highly optimistic for Bitcoin, especially in the long term.