Bitcoin price has not fluctuated significantly over the past few days, demonstrating neutral market sentiment. However, although the BTC price did not change much, the Crypto Fear and Greed Index tells a different story.

The holder becomes greedy

The Fear and Greed Index is currently at 57, showing that the majority of the market is willing to buy BTC and is mostly optimistic. This could indicate that BTC price is likely to increase sharply in the future and could reach $65,000.

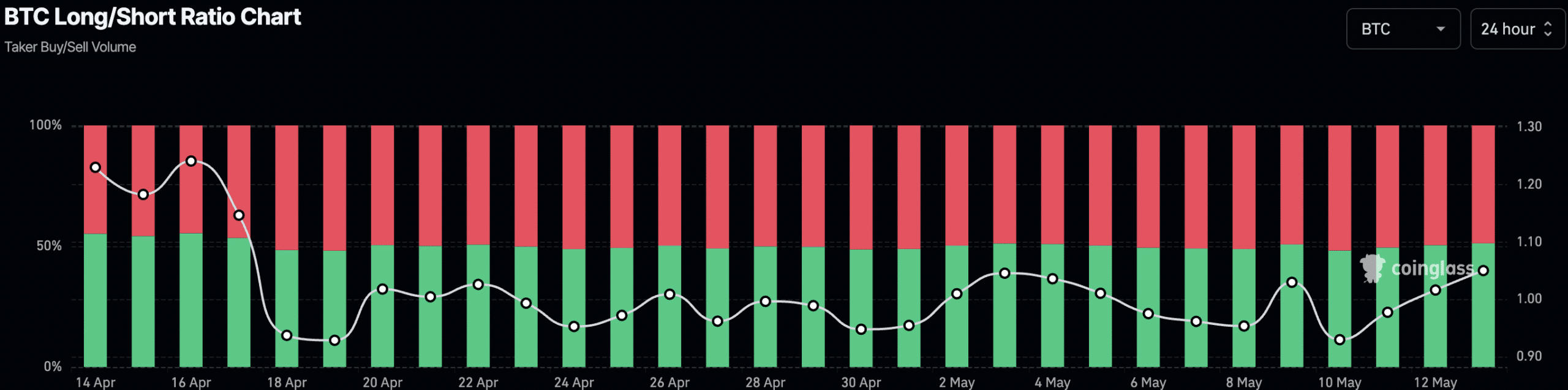

According to data from Coinglass, the proportion of long positions in favor of BTC has also increased significantly from 48% to 51.23% over the past few days. At the time of writing, BTC is trading at $62,581.09 and its price has increased by 2.21% in the past 24 hours.

Source: coinglass

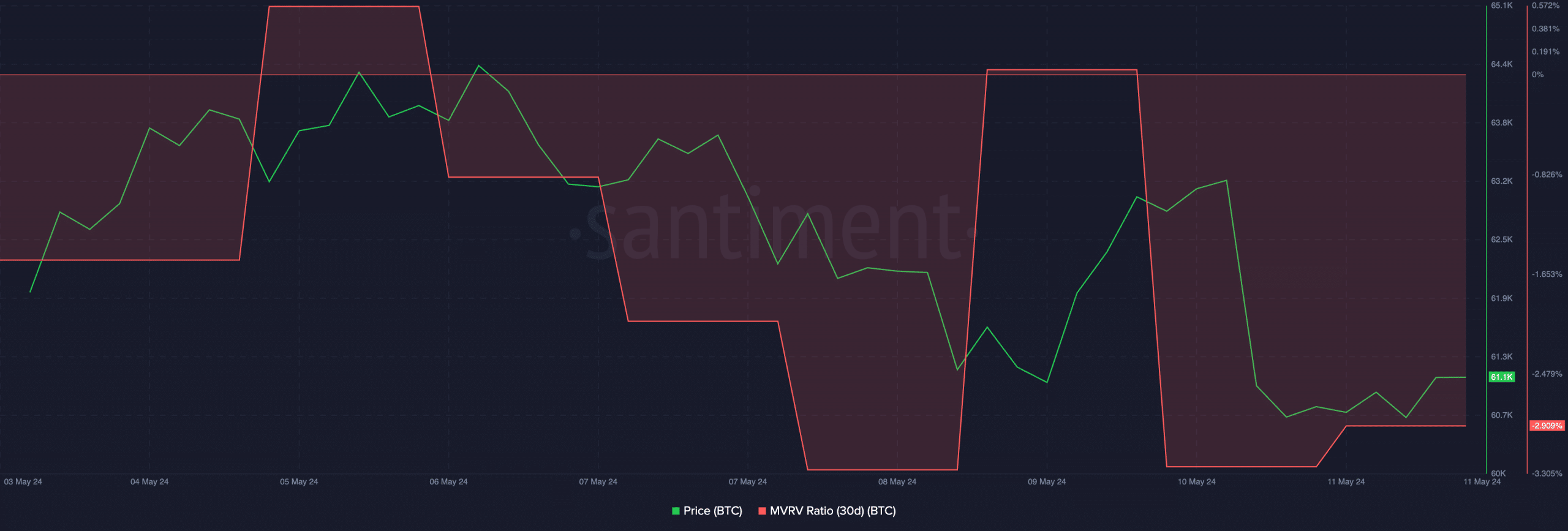

Despite the recent price increase, BTC’s MVRV ratio has dropped significantly, implying that most holders are still out of profit and there is not much selling pressure.

Source: Santiment

It is not only BTC that is affected by growing greed in the market. Since BTC is highly correlated with other altcoins, they are also expected to grow.

Related: Bitcoin Bounces Back to $61,000 Alongside Active Whale Activity

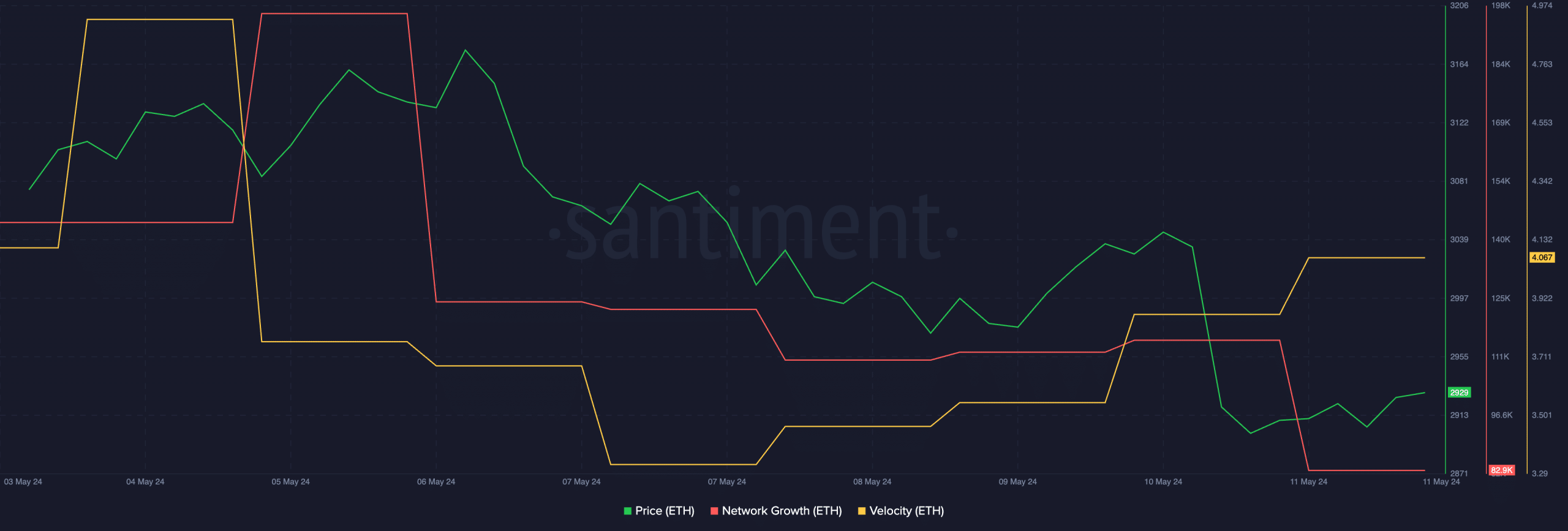

For example, Ethereum has also seen a 1.27% increase over the past 24 hours. Examining data from Santiment shows that ETH transaction speeds have increased significantly, implying that transaction activity on the Ethereum network is increasing. This could signal a positive change for ETH holders going forward.

Source: Santiment

Even though ETH price is increasing, ETH network growth rate is decreasing. This shows that the number of new addresses interested in ETH is decreasing. A decline in network growth could impact ETH’s ability to increase in price in the future.

Source: Santiment

Other altcoins like SOL could also benefit from the ambitious market. At the time of writing, SOL is trading at $145.66 and has increased 0.44% over the past 24 hours. Along with that, the volume of discussion about SOL on social networks also increased, showing growing interest in this token.