The Federal Reserve’s delayed actions have drawn criticism, with market analyst Patric noting on X (formerly Twitter) that they cut rates too late in 2020, raised them too late in 2022, and again delayed rate cuts in 2024.

The FED cut interest rates too late in 2020.

The FED raised interest rates too late in 2022.

The FED cut interest rates too late in 2024.

I see a pattern.

— Patric H. | CryptelligenceX (@CryptelligenceX) August 5, 2024

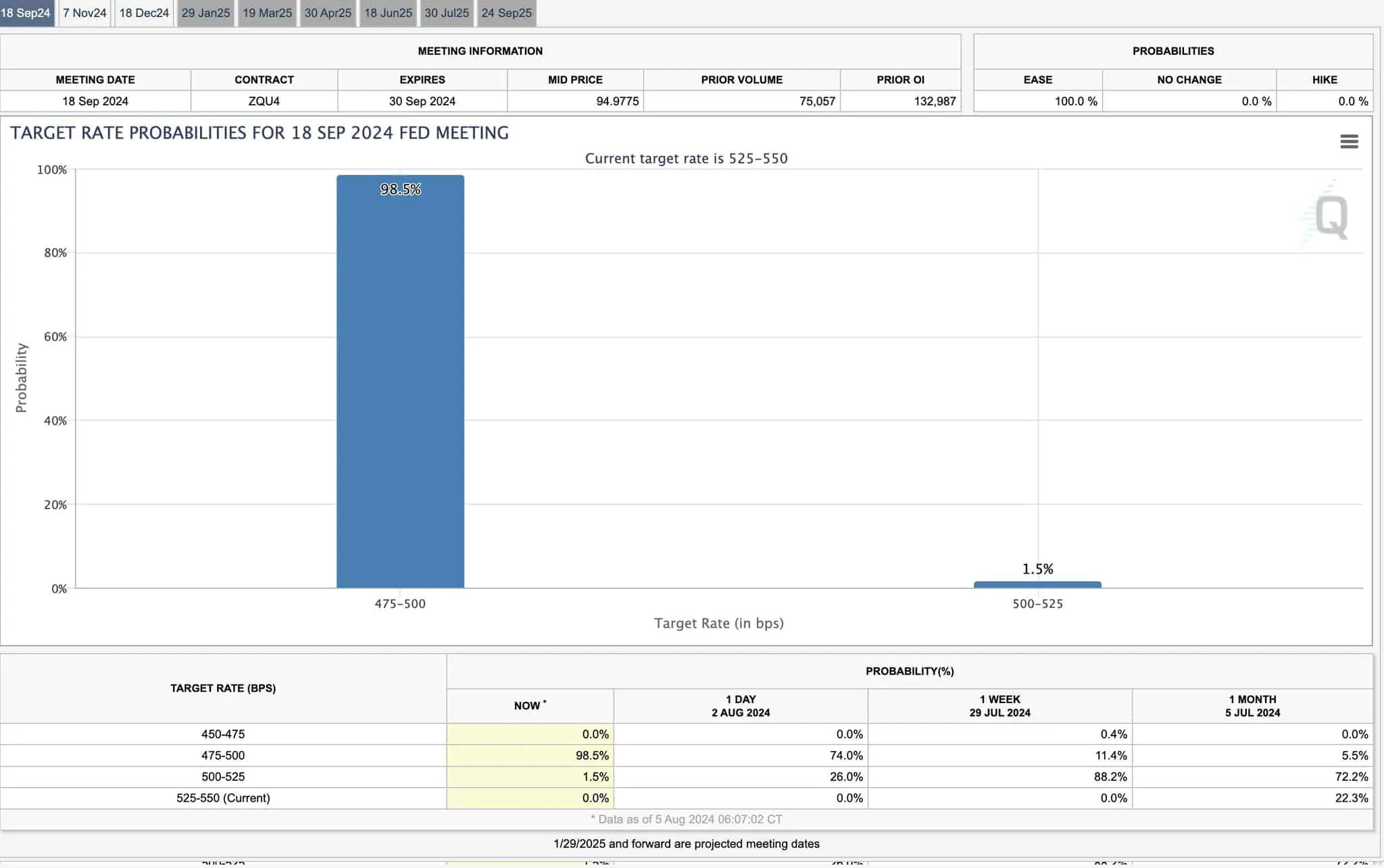

These continuous delays have significantly impacted the financial markets. Currently, it is anticipated that the Fed will reduce interest rates monthly from September through December, according to the target probabilities.

While this poses challenges for the general public, it benefits cryptocurrencies. The Fed has postponed these actions because lowering interest rates during high inflation can be detrimental to the economy. Now, with growing concerns of an economic recession, inflation is no longer the sole worry.

Rate cuts and the potential for additional money printing serve as short-term solutions for the economy. However, this situation harms ordinary people who rely on cash because it leads to inflation, diminishing the value of their money. This issue was also evident in 2020.

This pattern of delayed interest rate decisions can create buying opportunities for certain assets. People need to understand how these changes affect their savings and consider investing in assets that can protect their wealth from inflation.

Bitcoin (BTC): The Collapse from COVID-19 vs. Recession Downturn

Before a significant bull market, we often see a substantial crash or a prolonged consolidation phase. Bitcoin’s price action in 2020 resembles the pattern we’re observing in 2024.

After emerging from the downtrend in 2020, BTC soared to new all-time highs following the COVID-19 crash.

This raises the question: Will history repeat itself with Bitcoin? Currently, Bitcoin remains in a significant consolidation phase, and a major breakout has yet to occur, but it seems inevitable.

Solana: Rejected at the $110 Support Level

The SOL chart appears promising. It has tested the crucial support and resistance level of $110 and then bounced back within the range.

This volatility has reached a critical demand level and eliminated many lower price points. While there’s no immediate need to buy during the uptrend, Solana becomes an attractive option to consider if the price dips.

Is it the Right time now to buy BTC with the current predictability?