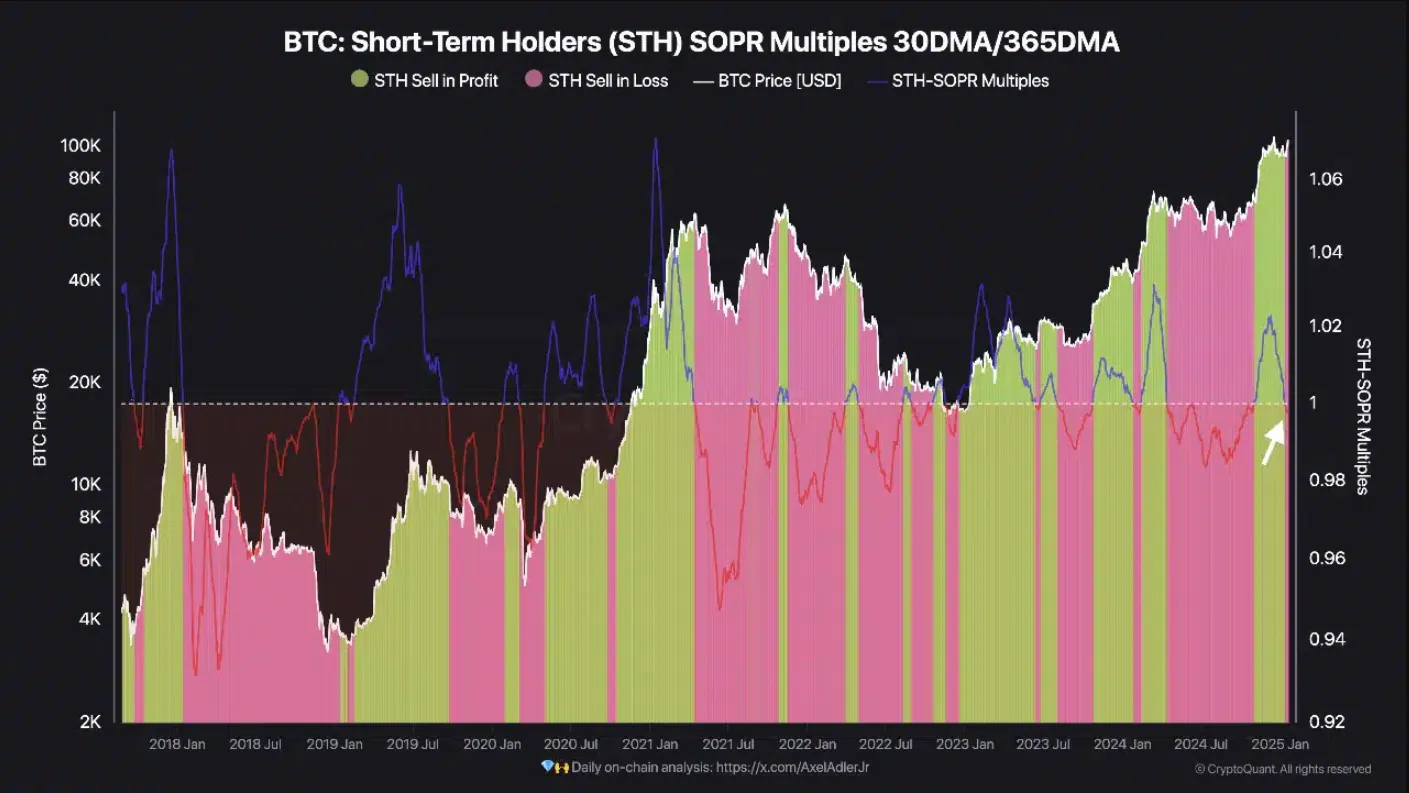

Bitcoin has rebounded strongly, reaching a peak of $107,000 in the past 24 hours. Bitcoin’s price correction a day ago forced many short-term investors to accept selling losses, as the Short-Term Holders’ Spending Output Profit Ratio (STH SOPR) turned negative.

This index compares the SOPR data of STHs over the last 30 days with the 365-day average, thereby highlighting the change in the profit trend of this group of investors. Historically, negative readings have marked important turning points in the market, providing attractive opportunities for long-term investment or warning of increased risks in the short term.

The STH SOPR is a measure of the level of selling by short-term investors, reflecting whether they are trading at a profit or a loss. When comparing the 30-day data with the 365-day average, the index provides a clear view of the profit trend of the STH group. Currently, the data shows that the STH SOPR multiple has dropped to negative levels, meaning that the group is selling at a loss.

Traditionally, such bearish periods not only represent increased pressure in the market but also open up attractive accumulation opportunities for long-term investors. The recent market chart recorded a drop in the index below the 1.0 threshold, signaling a decline in confidence among short-term investors.

Historically, negative STH SOPR multiples are often associated with important turning points in the Bitcoin market. For example, during the COVID-19 pandemic crash in March 2020, the STH SOPR dropped deeply into negative levels, indicating that short-term investors were panic selling to cut losses.

However, this period later turned out to be one of the most attractive investment opportunities, as Bitcoin rose from $4,000 to over $60,000 in just one year.

Read more: Trader Loses Millionaire Status Due to Memecoin FOMO

Similarly, in mid-2018, when Bitcoin plunged from its peak of $20,000, the STH SOPR index remained negative, reflecting short-term investor capitulation. However, this was also an accumulation period, paving the way for Bitcoin to reach a new peak in 2020.

These examples show that negative STH SOPR periods not only reflect market stress but also potentially hold long-term accumulation opportunities for strategic investors.