Bitcoin surged to $68,000 after bottoming out at $65,500 two days earlier. The October rally was largely driven by supply shortages following the halving. As BTC is on track to complete its strongest month yet, conditions could be ripe for a supply shock if demand remains high.

The post-halving phase is crucial

Historically, the post-halving phase has often been a key catalyst for major rallies, especially from an economic perspective. As BTC supply tightens, miners are often hit hard, leading to a sharp sell-off.

As block rewards are reduced, many miners may struggle to sustain their operating costs, forcing some to exit the market. This shift leaves only the most efficient miners in the ecosystem, creating a bullish environment as BTC supply becomes increasingly scarce.

The chart shows that miner holdings of BTC have been steadily decreasing since the April halving. While this could increase selling pressure, the lack of BTC in the hands of miners – especially with the ever-lower block rewards – has not had a significant impact on the market. If demand remains, the selling pressure will be largely absorbed, opening the door for an ideal supply shortage.

October continued to be bullish for BTC, with the digital currency approaching $70,000. However, there has been no clear breakout, suggesting that the expected supply shock has yet to materialize.

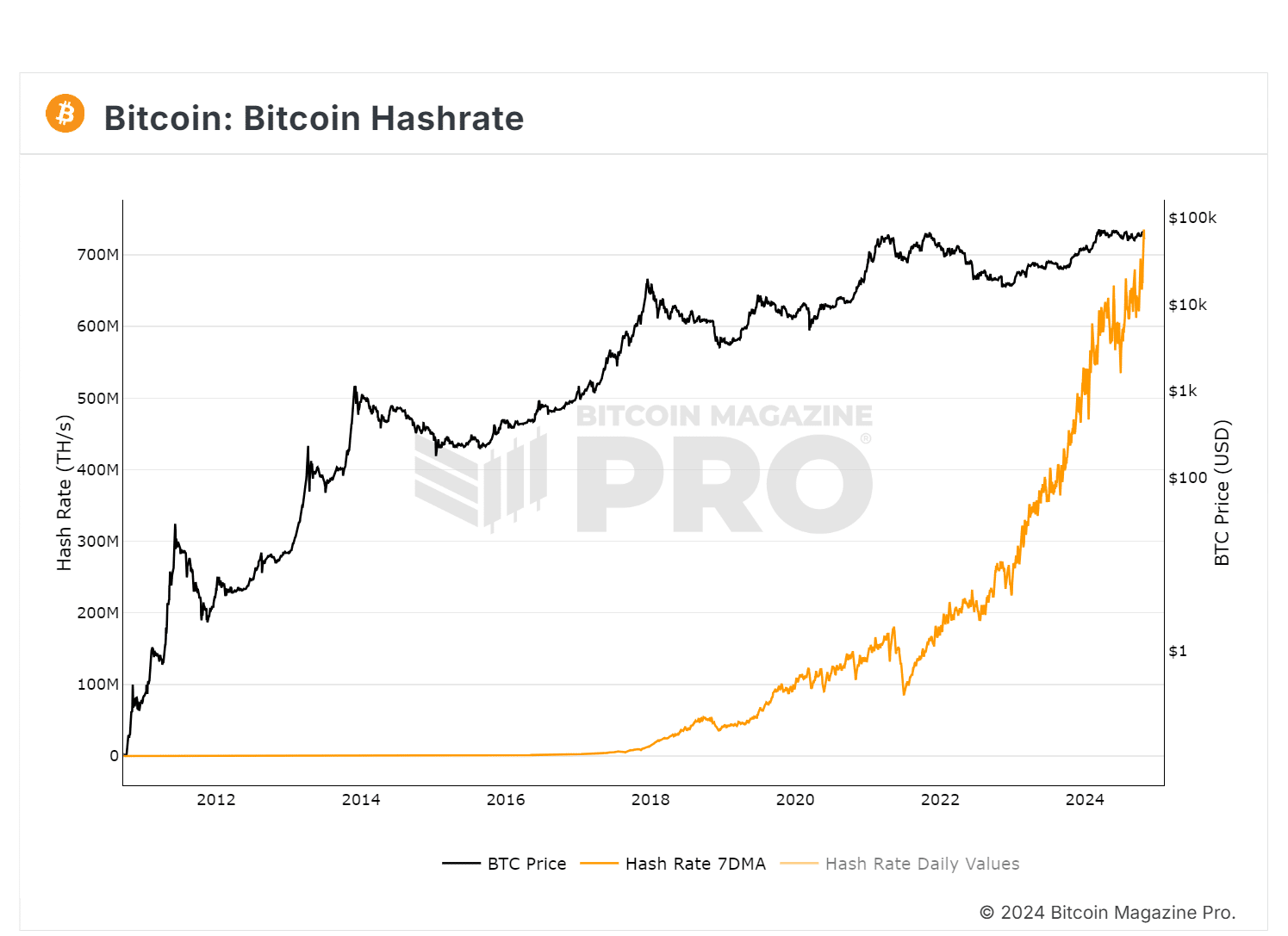

The current situation raises hopes of a strong parabolic rally as we head towards the end of Q4. Bitcoin’s mining difficulty is currently at an all-time high, requiring more computing power to validate transactions, forcing inefficient miners out of the market.

As a result, the hash rate has increased, reinforcing the security and stability of the network. This trend highlights the consolidation of the mining industry, where only miners with advanced technology and low costs can continue to survive.

Bitcoin will increase in price due to supply scarcity

In short, the possibility of a mass capitulation is still possible, and if this happens, the price of BTC will likely increase sharply as the available supply falls short of sustainable demand. Currently, BTC reserves on exchanges have increased significantly, indicating that the selling pressure is mainly coming from miners.

A supply shock is likely if demand remains high despite the current selling pressure; otherwise, the July cycle scenario could repeat itself. October saw a significant increase in inflows into ETFs, indicating growing interest from retail investors.

Read more: Tether Faces Increased Scrutiny from U.S, Crypto Market Plummets

Notably, BlackRock’s Bitcoin holdings have surpassed the 400,000 BTC mark, reaching 403,725 BTC, with a total value of $26.98 billion. In the past two weeks alone, BlackRock has purchased an additional 34,085 BTC, worth $2.3 billion. This reflects strong institutional demand, further reinforcing the possibility of a supply shock forming – a factor that could become a major driver of Bitcoin’s price increase in the coming period.