Bitcoin peaked at $106,500 last night, before correcting back down to $99,000. The drop reflected profit-taking by investors as Donald Trump prepares to take office as President of the United States.

Binance’s whale activity spiked, with the whale ratio increasing by 1.02%. This is an indicator that tracks large inflows into the market, used to gauge significant moves by investors with large Bitcoin holdings.

Traditionally, a sharp increase in whale activity is often seen as a precursor to large buys or sells. This often precedes sharp price swings in the market.

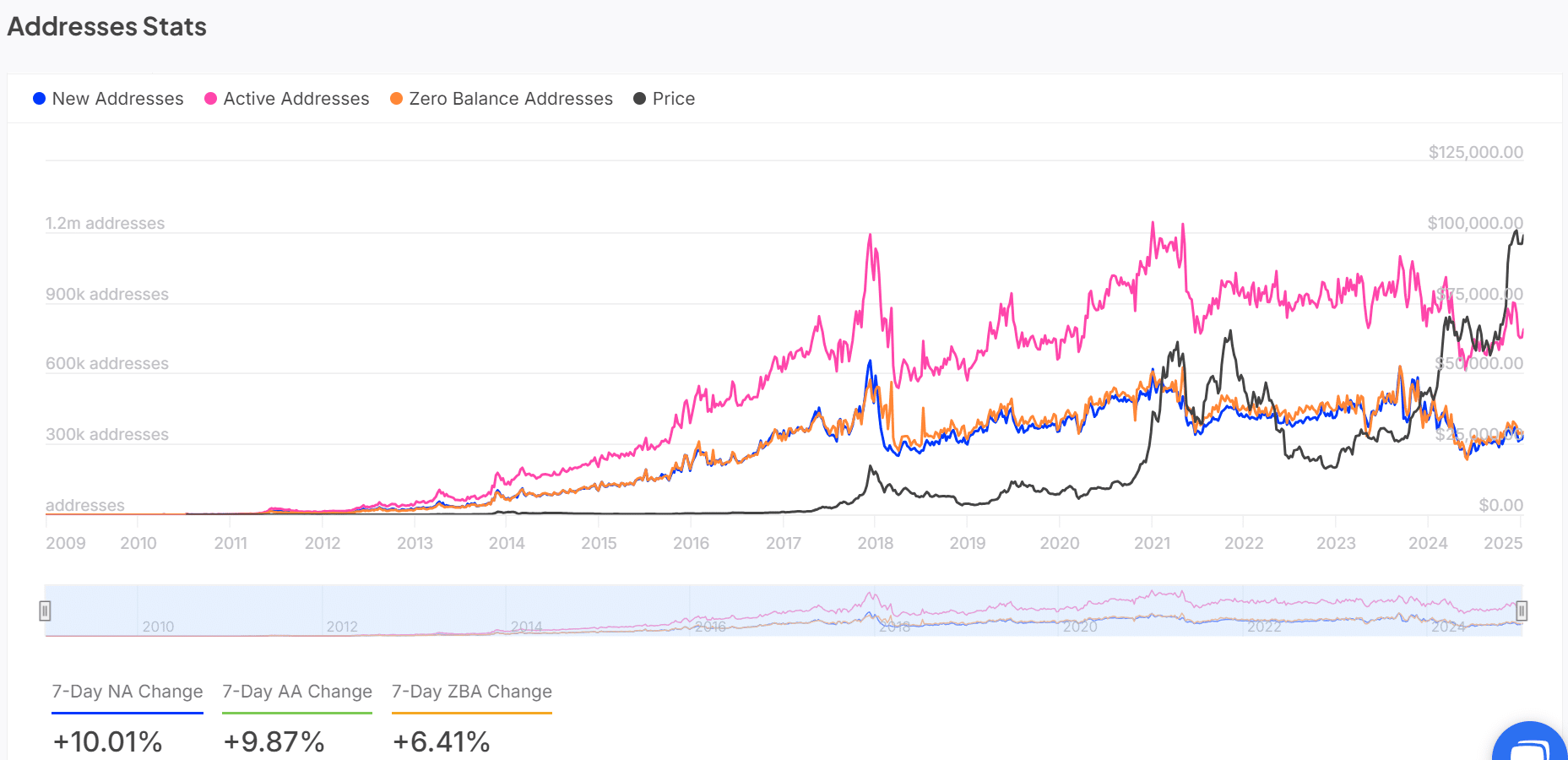

Notably, the number of Bitcoin active addresses has increased by 9.87% over the past 7 days, reflecting growing interest in the crypto asset. This growth is an important indicator of market heat, showing that there is a strong increase in trading demand from both individual and institutional investors.

In addition, the increase in the number of active addresses is often considered an important measure of market confidence. If this trend continues, it could provide the necessary push to support Bitcoin to reach higher prices.

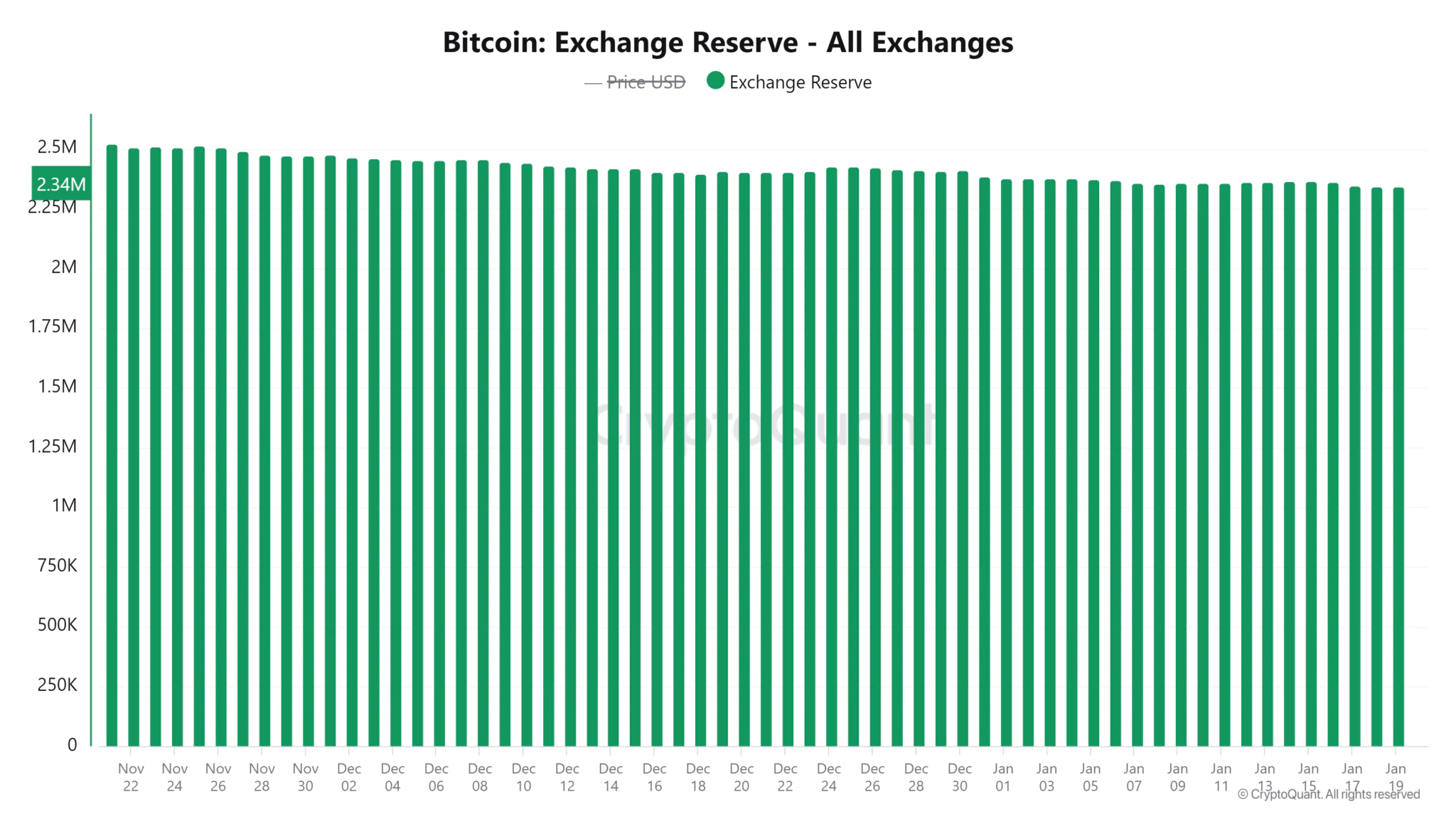

Over the past 96 hours, more than 20,000 BTC, worth over $2 billion, have been withdrawn from exchanges. Currently, the Bitcoin reserves on exchanges are only 2.344 million BTC, reflecting a continuous decline. This trend shows that investors are moving their assets to personal wallets – a clear signal of long-term optimism.

Notably, the decrease in reserves on exchanges is often associated with a decrease in selling pressure. This could be a further factor supporting the possibility of Bitcoin continuing to increase in price in the near future.

The current buyer buy/sell ratio is 1.01, with a 0.99% increase in buyer dominance. This metric shows that investors are actively buying Bitcoin at higher prices, confirming that demand is increasing.

Read more: Donald Trump to Elevate Crypto as a National Priority

This bullish sentiment adds to the narrative of growing interest in Bitcoin, adding momentum to a short-term rally.

With increased whale activity, a sharp increase in active addresses, falling exchange reserves, and a positive buyer buy/sell ratio, Bitcoin seems poised for a spectacular breakout.