Bitcoin is currently trading around $95,000, with price movements remaining fairly stable over the past 24 hours as the correction subsides.

According to analysis by Mister Crypto, Bitcoin appears to be recreating a pattern that occurred in 2020, which resulted in a strong rally after surpassing $20,000.

This pattern shows that BTC typically experiences an initial rally, then drops to form a bottom, followed by a recovery that forms a symmetrical triangle pattern before making a big move. Currently, Bitcoin appears to be in the middle of this cycle. After the recent rally, the price has dropped and formed a bottom, which matches the previous cycle perfectly. If the pattern continues, this could be a signal that Bitcoin will soon conquer the $100,000 mark.

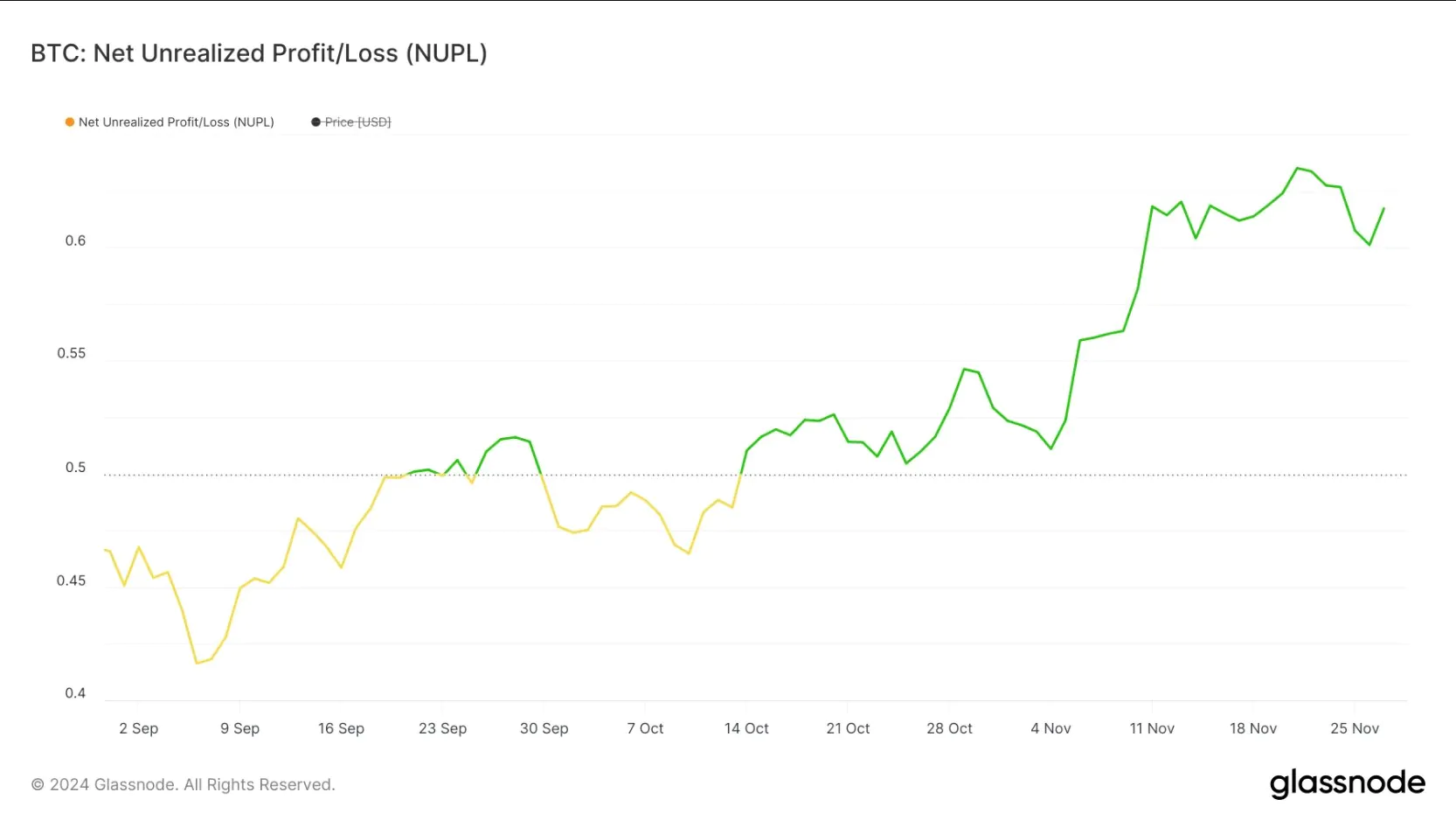

BTC NUPL, or Unrealized Profit/Loss Index, is at 0.61 and has been in the “Confidence” zone since October 14. NUPL measures the ratio of unrealized profits to losses, providing insight into market sentiment.

The 0.61 level indicates rising bullish confidence as the majority of investors remain in the red, reflecting optimism about continued price gains.

However, despite reaching the “Confidence” zone, BTC’s NUPL is still below the 0.7 threshold — a level that typically marks a transition into a high-risk zone. Historically, when NUPL crosses the “Confidence” zone, prices typically experience a major correction due to increased profit-taking pressure.

Read more: BitWise Seeks to Launch Multi-Asset ETF for 10 Cryptocurrencies

At its current position, BTC still has room to grow before facing major risks. This strengthens the possibility of the uptrend continuing, towards the historical target of $100,000.