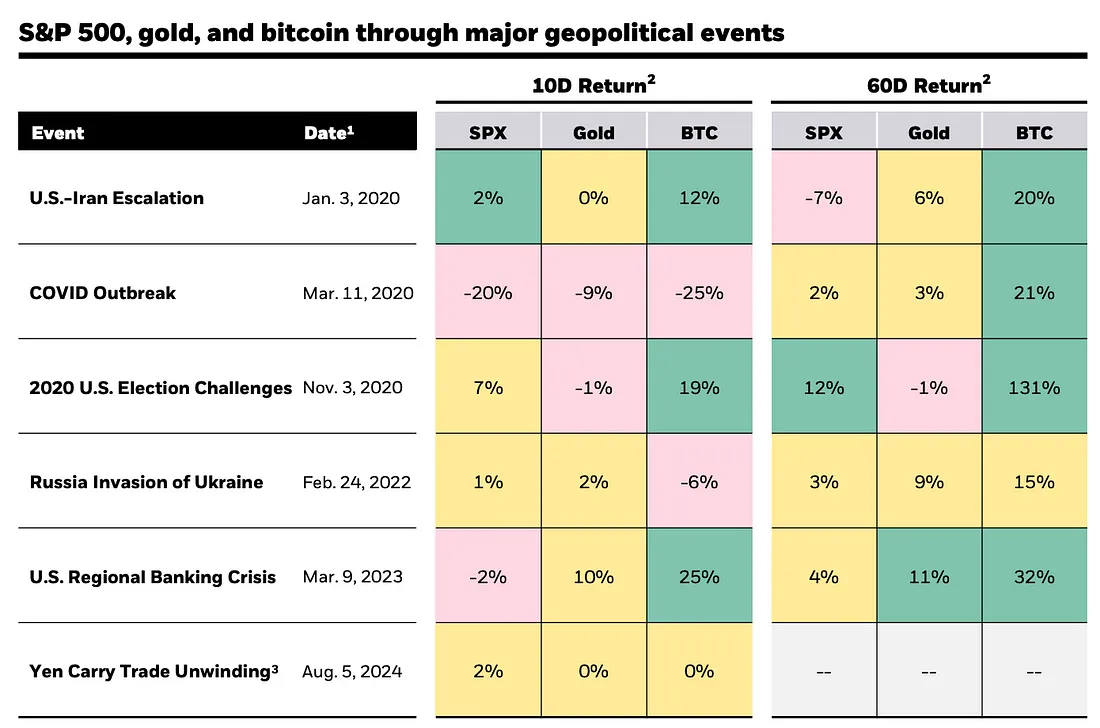

Given this weakness in Bitcoin, many might assume that traders would be bearish. However, Bitcoin derivatives suggest otherwise. Some analysts believe that political and social unrest could negatively impact Bitcoin’s short-term price. History shows that Bitcoin has typically outperformed other asset classes following major events, demonstrating resilience despite current market pressures.

On September 17, BlackRock released a report titled “Bitcoin: A Unique Diversifier,” which highlighted that Bitcoin’s fundamentals are different from traditional assets. The asset manager specifically noted Bitcoin’s scarcity and decentralization, and recommended that clients consider it as a “safe haven option amid geopolitical concerns.”

Geopolitical Tensions Rise

Tensions in the Middle East have increased after Iran launched ballistic missiles at Israel on October 1. According to CNBC, the attack was in retaliation for Israeli ground forces entering southern Lebanon to attack an Iranian-backed militant group. US National Security Adviser Jake Sullivan reportedly described Iran’s recent actions as “a significant escalation.”

The market volatility, which has negatively impacted Bitcoin prices, has been compounded by the upcoming US presidential election in November. Democratic candidate Tim Walz and Republican JD Vance took part in the vice presidential debate on October 1, but according to Reuters, the event did little to change the complexion of the already tight race.

In addition, investors became more cautious after Tesla reported lower-than-expected third-quarter deliveries, sending its shares down 4%. However, it should be noted that Tesla shares have risen 20% over the past 30 days, fueled by expectations for its “robotaxi” event on October 10 and positive sales figures from China, according to Yahoo Finance.

Bitcoin Derivatives Remain Resilient Despite Price Drop

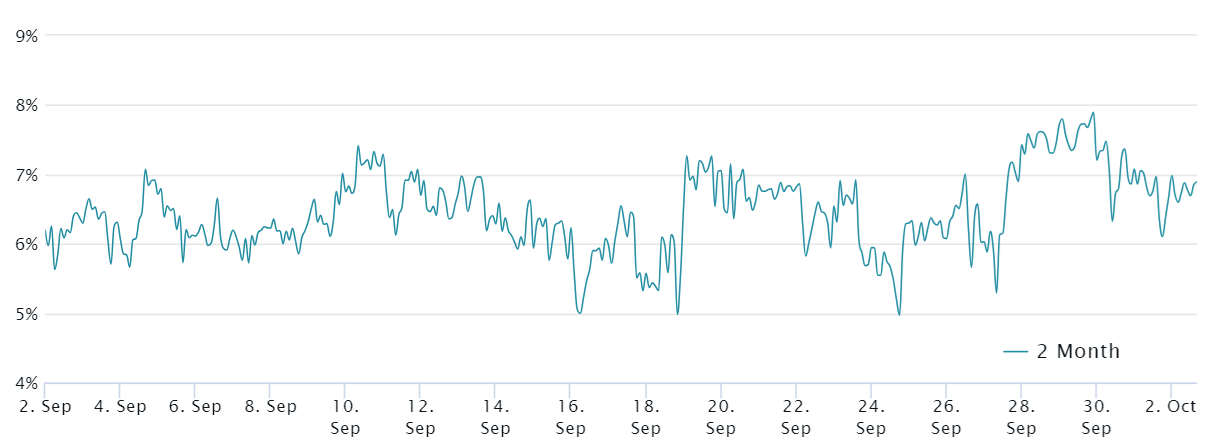

In this context, one might expect Bitcoin investor sentiment to deteriorate. To gauge the position of whales and arbitrage desks, one can compare current leverage demand with the previous week.

Whales and market makers favor monthly Bitcoin futures contracts because they do not have funding fees, allowing these instruments to trade at a 5% to 10% premium over the spot market to compensate for the longer settlement period. As of October 2, the two-month Bitcoin futures spread remained at 7%, up slightly from 6% last week but still within neutral territory. Furthermore, traders were less bullish on Bitcoin on September 24, when the index fell below the 5% threshold after Bitcoin rejected the key $64,000 level.

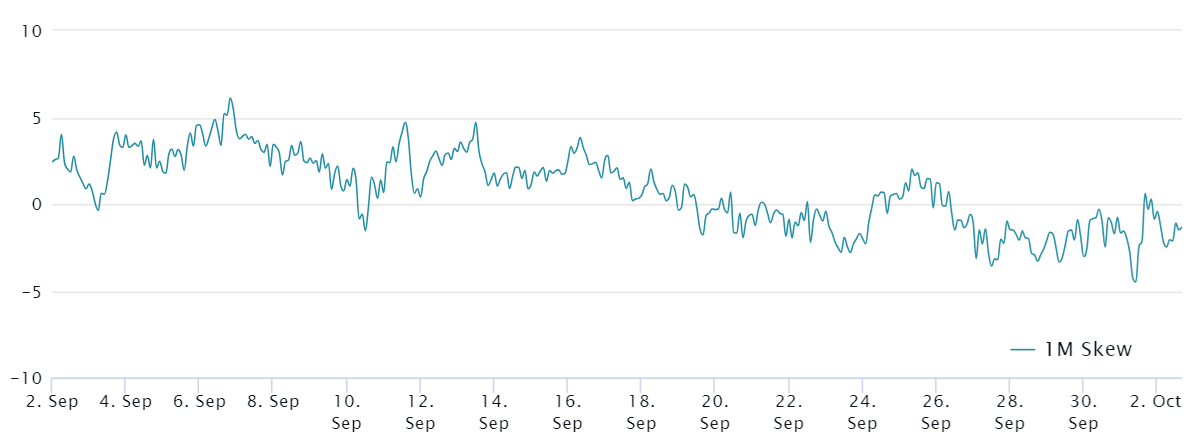

To determine whether this sentiment is limited to the futures market, it is necessary to further analyze Bitcoin options. The 25% delta skewness measure measures the difference between the premiums of call and put options. A skew above 7% indicates significant downside risk, while a value between -7% and +7% is considered neutral.

Over the past seven days, the delta skew of Bitcoin options has remained neutral at -1%, indicating stability despite the 3% drop in Bitcoin price during this period. This data is consistent with the neutral sentiment observed in the Bitcoin futures market, suggesting that traders are taking a cautious and balanced view.

Currently, there is no clear sign that Bitcoin traders are turning bearish, despite the economic and political uncertainties. The persistence of Bitcoin derivatives suggests that traders are comfortable with current prices, while also implying that bears are hesitant to bet on further price declines.