Bitcoin and Ethereum prices are showing signs of recovery despite still facing strong selling pressure, especially when options on both currencies worth nearly $2.5 billion expire today. Volatility is increasing as Bitcoin’s halving event approaches, as investors predict a slow growth in the current environment filled with macro difficulties and selling pressure from “individuals”.

Bitcoin and Ethereum options worth $2.5 billion are about to expire

Before and after the Bitcoin halving event, the cryptocurrency market has still not found an equilibrium point. Analysts point out that sell-off sentiment is dominating this market, especially in the week with hot CPI reports and declining activity in the derivatives market.

Greekslive said that this month, short contracts have dominated and expectations for the halving event appear to be overblown. With the recent decline in ETF inflows and lack of renewed excitement in the market, investor sentiment appears to have become more negative. They suggest that selling in the medium term may be the more reasonable option, and that in the short term, investing may be worthwhile given the current sentiment surrounding Bitcoin’s halving event.

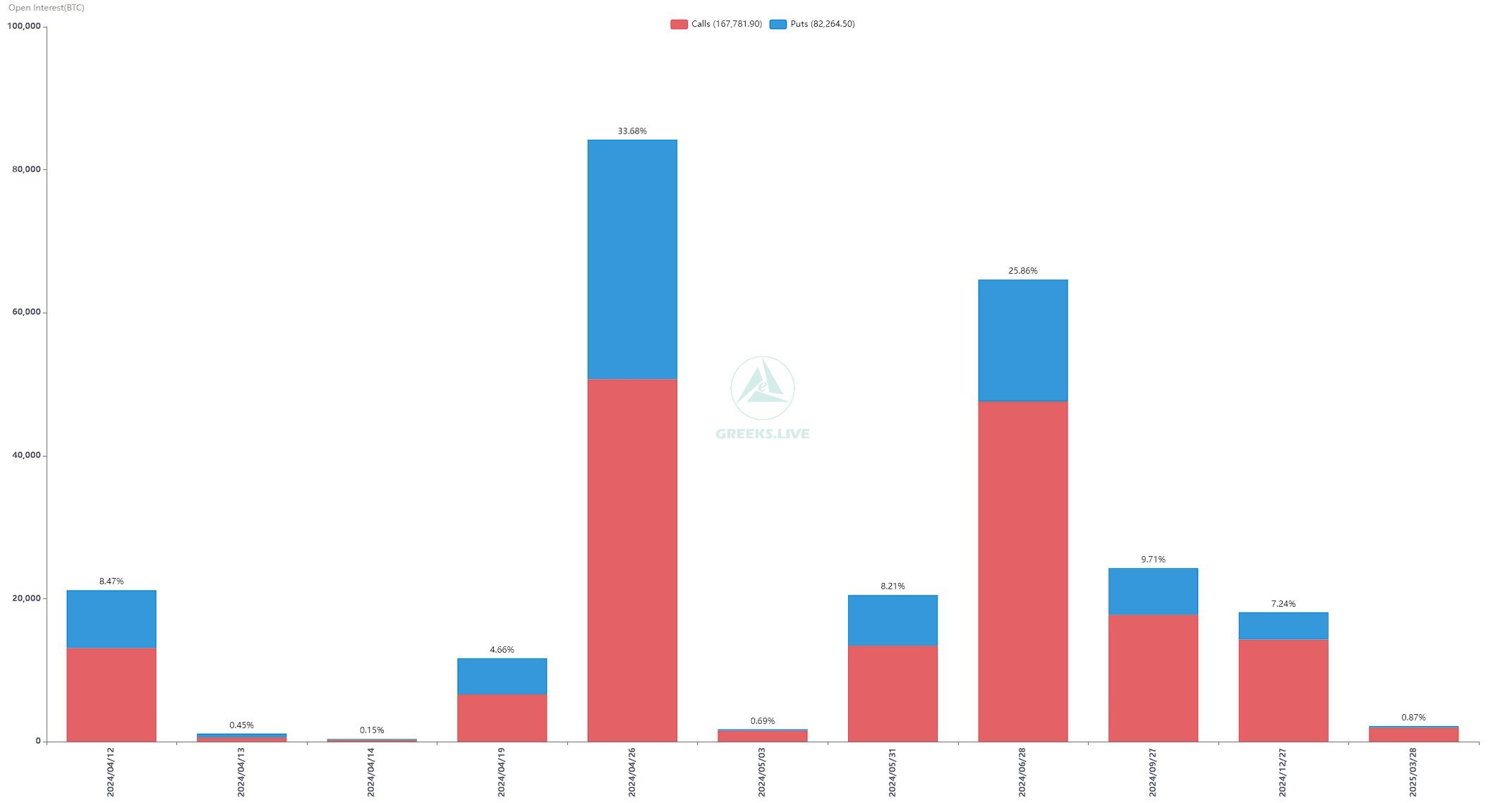

There are over 21,162 BTC options expiring, worth approximately $1.51 billion in notional value, with a put ratio of 0.62. The maximum pain point is at $69,000, suggesting that Bitcoin price is still under selling pressure at current prices. Implied volatility has dropped significantly across major futures, which signals instability in price movements that could drag BTC prices below $70,000.

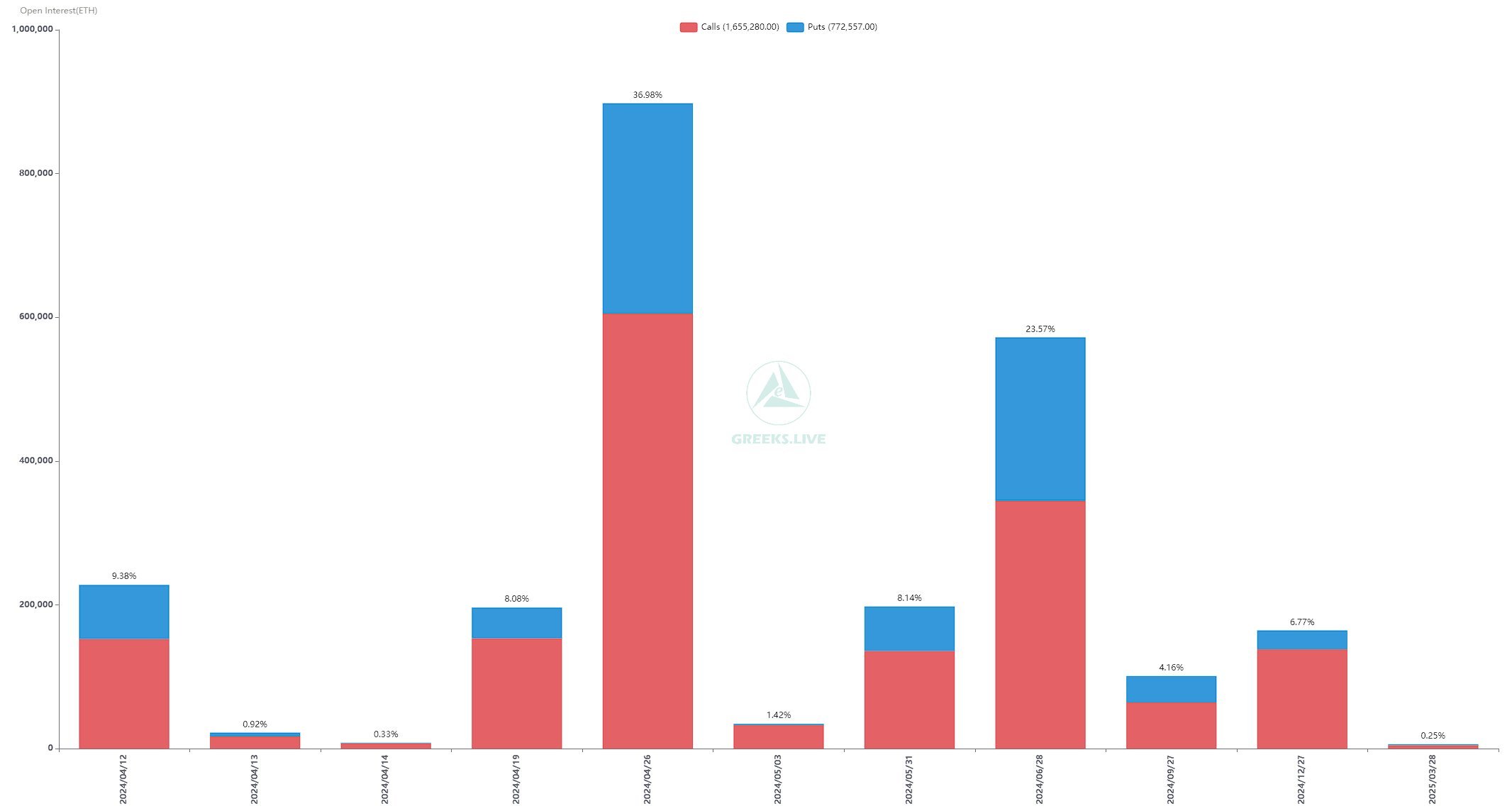

Meanwhile, the 227,785 expiring ETH options have a notional value of nearly $0.81 billion, a put option ratio of 0.49. The maximum pain point is at $3,425, below the current price of $3,535, which implies that traders may have an opportunity to trade at lower prices. Monitoring trading volume will be necessary to predict the next direction of ETH price.

Bitcoin future prospects

The outlook for BTC’s future is still a bright spot, although somewhat unstable. Currently, Bitcoin price is fluctuating around $70,888, with a slight increase of 0.50% over the past 24 hours. The trading range during this same period was from $69,571 to $71,256. Notably, trading volume has decreased by 22%, reflecting a certain indifference from investors.

The total value of Bitcoin futures contracts has seen a 2% increase in the past 4 hours, although it remains volatile over short periods of time. Meanwhile, the value of BTC futures contracts on CME decreased slightly by 1% in the most recent hour.

Related: Increasing Selling Pressure on Bitcoin at the $71,000 Level

Besides, Ethereum price is also under pressure, dropping 0.80%, reaching $3,539 in the most recent 24 hours. The lowest and highest prices during this period were $3,477 and $3,616. Ethereum trading volume also decreased by 16%, showing a lack of interest from investors.

The value of ETH futures contracts also decreased by 2% in the past day, but increased slightly by 1% in the past 4 hours, which shows the instability of the market before options contracts expire.

Hlw everyone🙏🙏