Bitcoin hit a record high of $73,600 last night before pulling back slightly to its current price. Bitcoin is now well within striking distance of its all-time high set in March. Bitcoin’s market share has surpassed 60% for the first time since April 2021, and its market cap now stands at $1.44 trillion.

What do on-chain signals indicate?

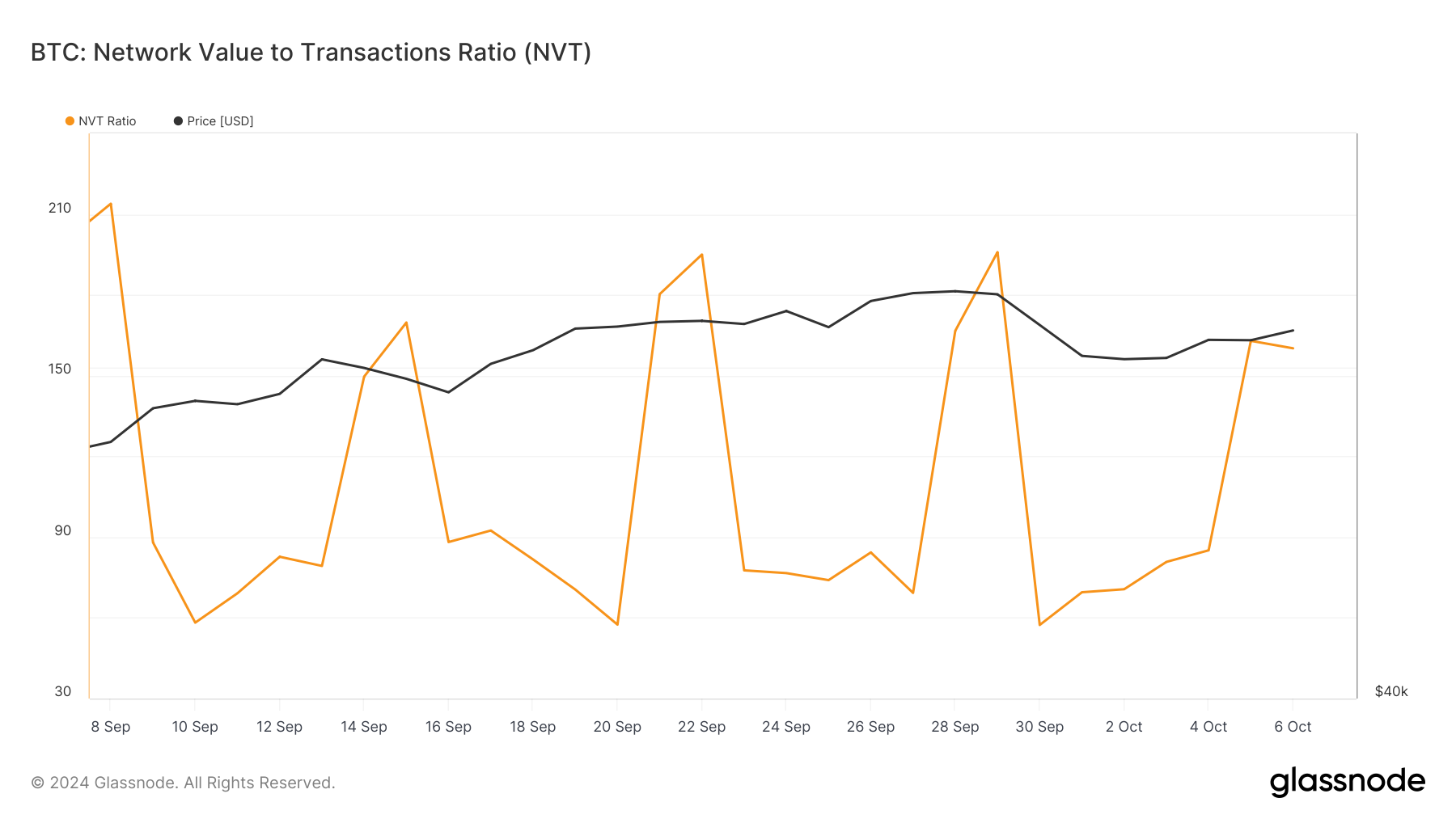

The NVT ratio — often referred to as Bitcoin’s “price-to-earnings” ratio — is a key indicator of whether Bitcoin is overvalued or undervalued based on network activity. Currently, the NVT ratio reflects a balanced and stable market, indicating that the Bitcoin network is able to handle increased demand without showing signs of overheating.

Traditionally, when the NVT ratio remains stable or low during a price increase, it is a sign of a sustainable rally. This suggests that the current rally is well-founded. With a positive NVT, it can be seen that the current rally is strong enough to support Bitcoin’s long-term uptrend.

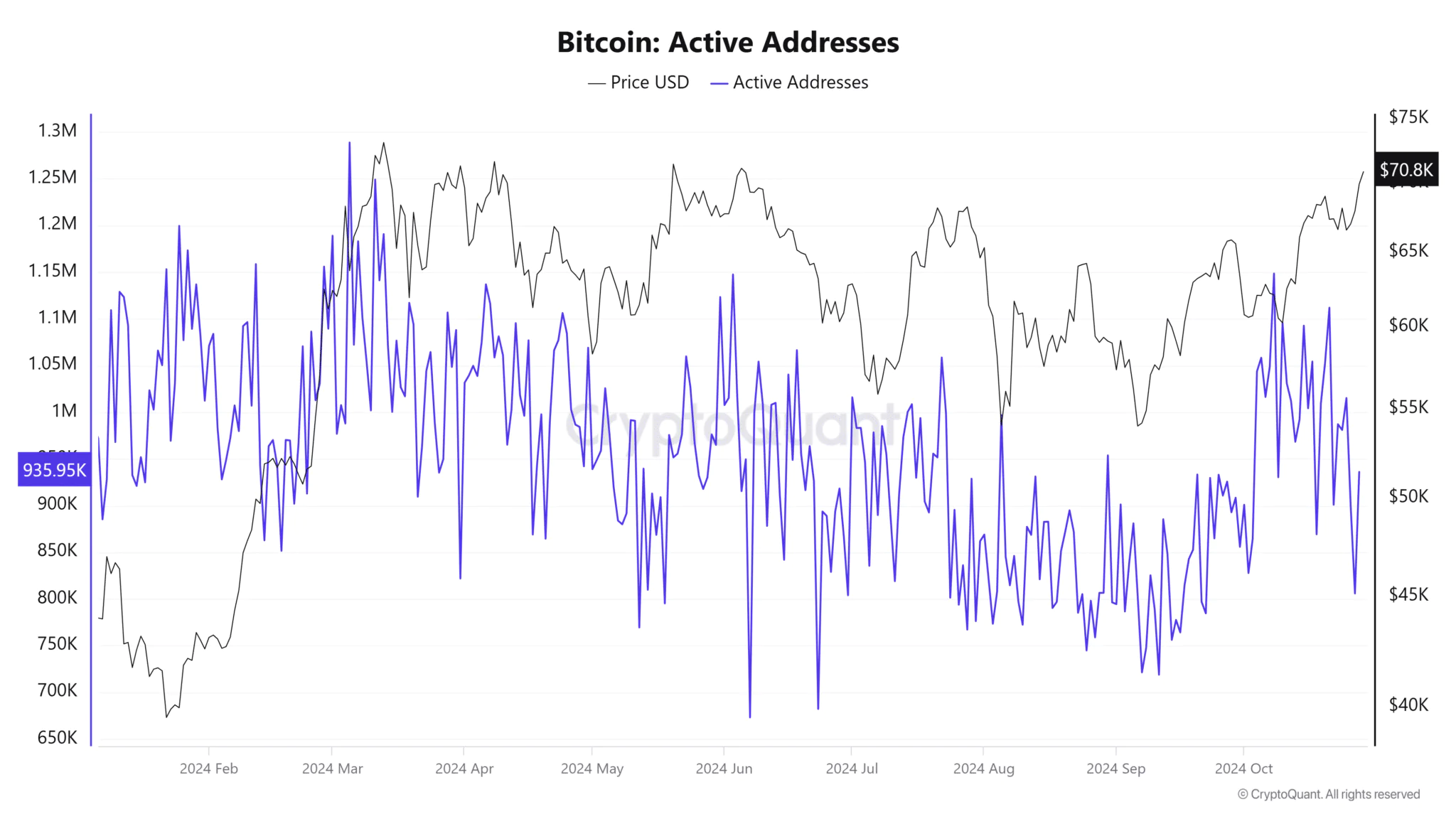

The recent increase in the number of active Bitcoin addresses is further reinforcing Bitcoin’s bullish trend. With over 935,000 active addresses, network activity is showing strong and sustained growth.

An increase in active addresses is often a sign of increased user participation, leading to higher demand for Bitcoin. This trend, which is often associated with price increases, can indicate renewed interest in the asset.

Read more: What is Driving Dogecoin Price Surge?

Therefore, the continued growth in active addresses is an important indicator that is fueling the current rally and further reinforcing the positive outlook for a long-term bull market.