Bitcoin has surged to $98K, edging closer to the $100K milestone while maintaining its upward momentum over the past two days.

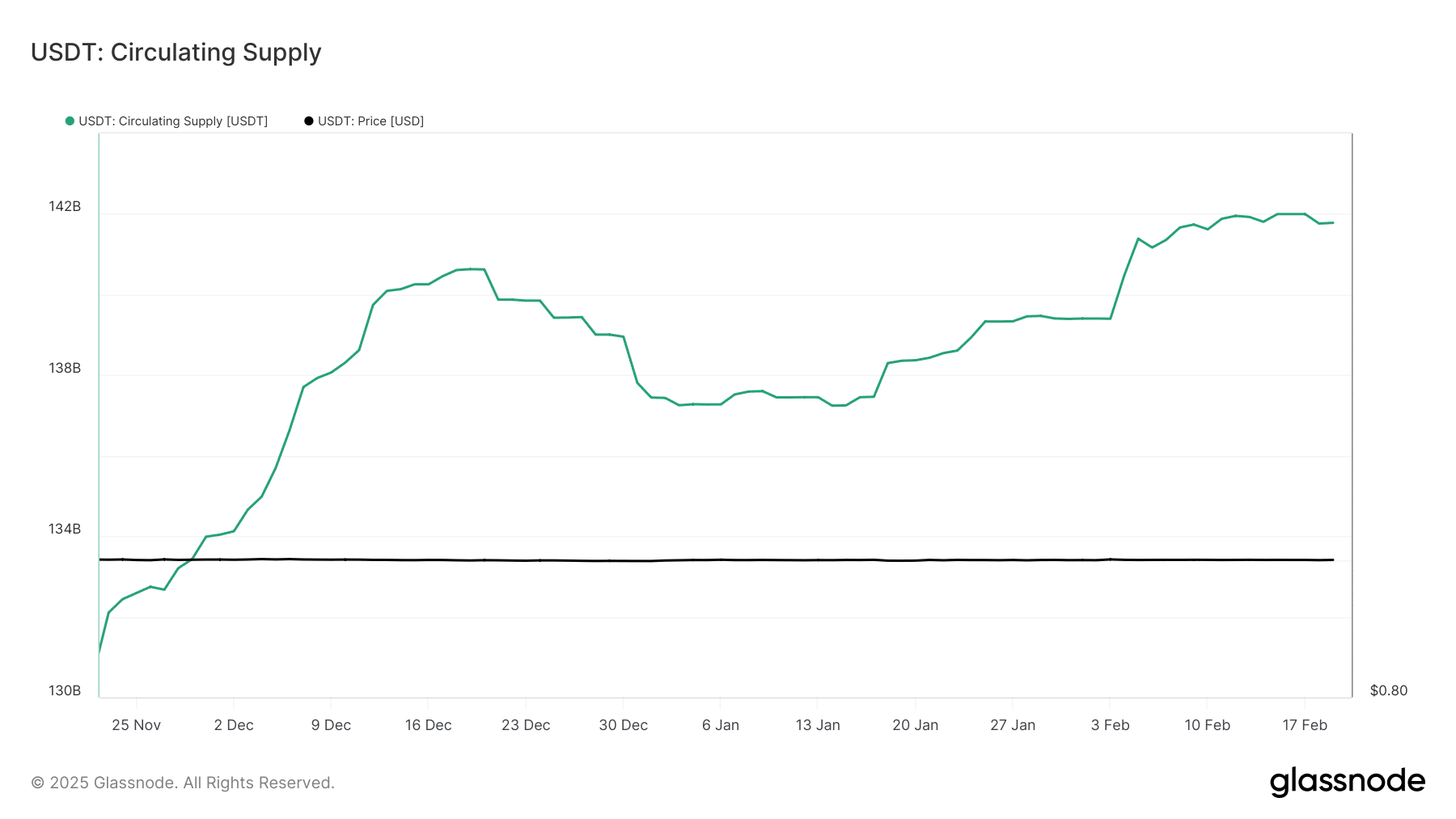

With $450 million in USDT flowing into exchanges in February, the rising stablecoin liquidity signals renewed risk appetite. Historically, BTC price movements have mirrored USDT supply trends. Back in mid-December, when BTC hit $108,000—its then all-time high—the circulating supply of USDT also peaked at $140 billion.

However, a shift in market dynamics saw BTC drop to $91,000, coinciding with a $3 billion decline in USDT supply to $137 billion, indicating risk-off behavior.

Notably, USDT supply has now surged to a fresh record high of $141 billion, accompanied by renewed capital inflows into exchanges. If this liquidity translates into Spot demand, BTC could break past the $100,000 mark.

However, if the majority of this capital fuels leveraged trading rather than actual purchases, it could create a liquidity trap. In such a scenario, prices may rise temporarily but lack solid support, leading to sharp reversals when overleveraged positions unwind.

Since BTC’s last attempt to breach $100,000, the Estimated Leverage Ratio (ELR) has climbed even higher. Meanwhile, BTC inflows into exchanges have outpaced outflows, suggesting weak Spot buying demand. With increasing leverage, BTC faces a higher risk of long liquidations if prices decline.

If leverage continues to rise while Spot demand remains weak, the likelihood of liquidation spikes increases, making BTC price action more volatile in the short term.