Bitcoin just dropped to $90,000, but still maintained its bullish momentum with a third consecutive weekly green candle.

According to CryptoQuant, BTC prices are likely to “cool off significantly” before breaking out to $100,000. CryptoQuant analyst BaroVirtual believes that Bitcoin could fall to $70,000, with the two moving averages (MAs) currently being nearly 20% apart.

“The positioning of short-term and long-term investors (7-day MA and 30-day MA) shows that the current buying pressure is very strong and healthy, which is a positive signal for the market,” BaroVirtual shared.

However, he also warned that the 19% gap between the two MAs could lead to two scenarios:

- Bitcoin trades in the $87,000-$93,000 range for a while before breaking out to $104,000-$120,000. A similar scenario occurred during the period from February to March 2024.

- Bitcoin corrects to the $71,000-$77,000 range, which is a “healthy cool-down” for the market before the uptrend resumes.

The accompanying chart shows the breakout of BTC prices over the past week, especially with the record daily candle of $9,000 on November 11 alone.

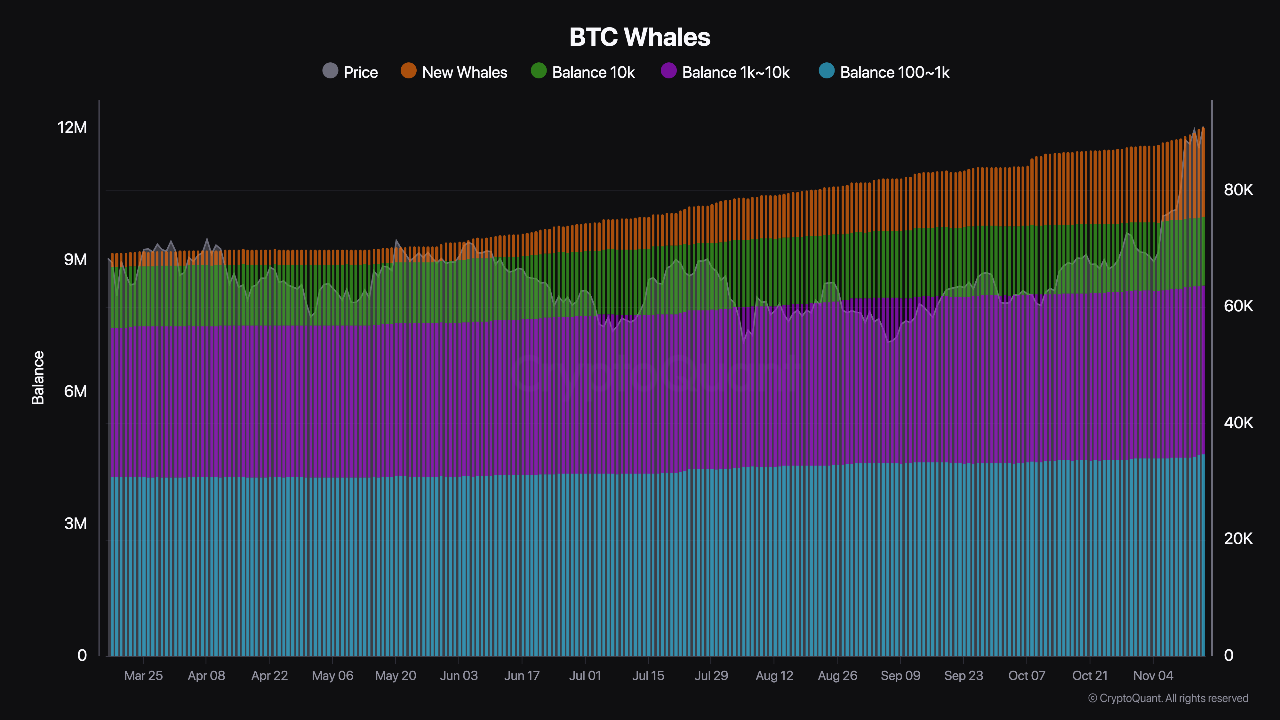

To explain why the rally may have temporarily stalled, CryptoQuant compared it to previous rallies that led to all-time highs. However, on-chain data still shows strong investor confidence, especially as whales are accumulating BTC at new record highs.

“It’s remarkable to see the number of new whales increasing rapidly, indicating that more large investors have been entering the market recently,” said analyst Darkforst. “Even when BTC was around $90,000, they continued to accumulate and largely did not sell. This is a clear sign of strong confidence in the market trend.”