Bitcoin has fallen sharply to $59,000 in the past 24 hours, before recovering above the key support level of $60,000.

Bitcoin is at a key sentiment turning point, based on historical data from CryptoQuant. This price zone is often where traders become bullish or bearish, depending on the profitability.

The market is currently trending up, but if the price falls below this zone, sentiment could change.

Historical data shows that when Bitcoin is in this range, the market usually continues its uptrend, reinforcing the possibility of a price increase.

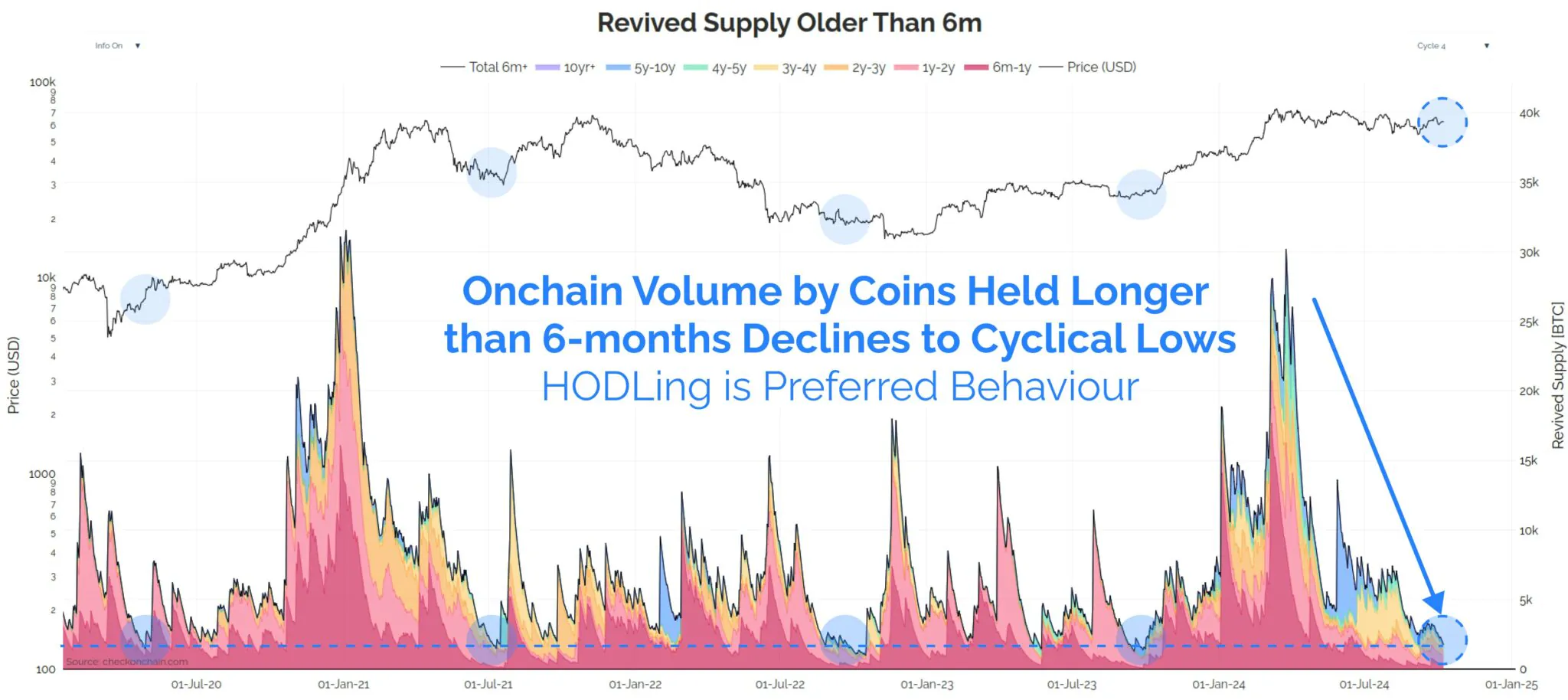

Further analysis shows that most investors holding Bitcoin are in a “HODL” state, showing confidence despite the volatility.

There is a possibility of a major sell-off, leading to a temporary drop, followed by a strong recovery as profit-taking returns. Bitcoin holders, especially those who have owned the coin for more than six months, remain bullish, showing confidence in the recovery.

However, a minor correction could push BTC to $60,000, where the price could bottom out and reverse, signaling that a rally could be imminent. The price action suggests that Bitcoin is still testing lower levels in the current downtrend.

BTC is expected to hold this level, but any correction due to negative market sentiment (FUD) could see the price fall below $60,000 before recovering.

When combined with technical indicators, the outlook for a rally remains strong as Bitcoin consolidates in a support zone, preparing for a potential breakout.

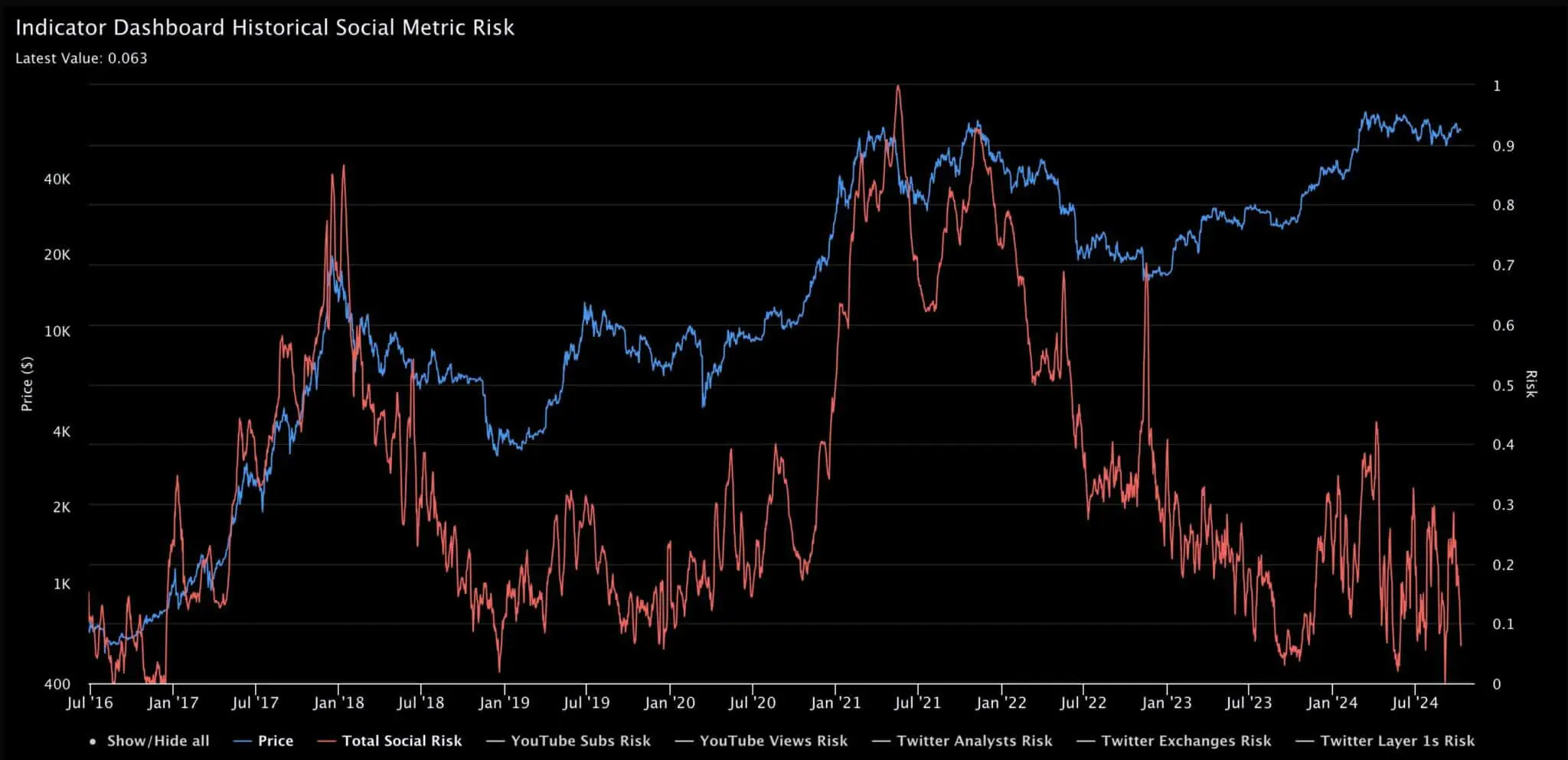

BTC Social Risk

Finally, social sentiment plays a major role in Bitcoin’s price action. Public opinion and community engagement greatly influence market activity, and social sentiment for Bitcoin recently hit its highest level since the approval of Bitcoin ETFs.

This increase may be related to recent speculation about Bitcoin’s founder, which has further increased public interest. The positive social sentiment, combined with the low social risk at these prices, suggests that Bitcoin is preparing for a strong move to the upside.

Traders are waiting for this potential breakout, which could mark the start of a new bull cycle.

Bitcoin’s current price level has the potential for a rally. With historical data, technical indicators, and social sentiment all pointing to an uptrend, BTC appears poised to break out. Investors can consider this as a good time to monitor the market to capture the upcoming price increase opportunity.