The dominance of Bitcoin (BTC), a metric reflecting its value relative to other cryptocurrencies, peaked at a yearly high of 57.70% on August 9th. This increase coincided with a rebound in BTC’s price after it had previously fallen below $50,000.

However, at the time of reporting, BTC.D—its common designation—has declined, sparking speculation that the altcoin season might be imminent.

Despite recent major events, Bitcoin’s dominance has waned. Altcoin season is a brief period during which 75% of the top 50 cryptocurrencies, excluding BTC, outperform it. For this to occur, Bitcoin’s dominance must decrease, and the TOTAL2 market capitalization must consistently rise.

TOTAL2 represents the total market capitalization of the top 125 altcoins. At the time of reporting, Bitcoin’s dominance has decreased to 56.95%, while TOTAL2 has risen to $890.18 billion.

Several months ago, numerous altcoins, spearheaded by Ethereum (ETH), experienced double-digit price increases. However, this rally was short-lived. Additionally, the launch of spot Ethereum ETFs failed to deliver the anticipated results, especially since the overall market capitalization remained below $1 trillion at the time of reporting.

More notably, Bitcoin’s price has dipped below $60,000 and is currently trading at $58,188. This decline has sparked widespread discussion, particularly on X, with many speculating that the altcoin season could be approaching.

For instance, cryptocurrency trader Zen suggested that this week might be bullish for altcoins as long as BTC trades within the $53,500 to $60,800 range.

“This week could be a bullish week for altcoins, at least relative to $BTC. For this scenario to play out, Bitcoin will need to remain stable within the 53.5-60.8k range,” Zen posted on X.

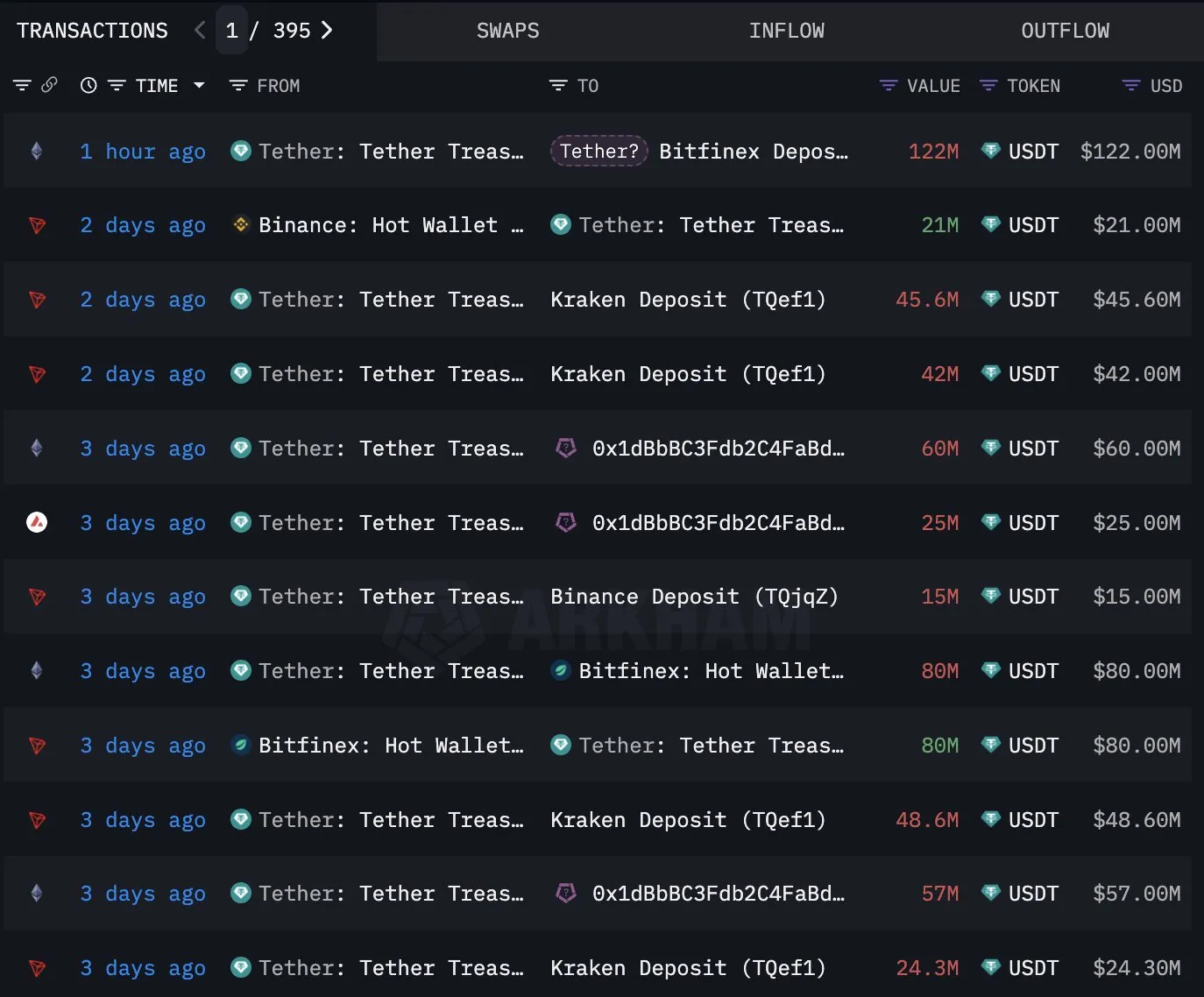

Moreover, recent developments suggest that Zen’s prediction might be accurate. According to Lookonchain, institutions with significant purchasing power in the Bitcoin market have refrained from buying the cryptocurrency. This restraint comes despite these institutions having recently acquired substantial amounts of stablecoins. If these entities continue to hold back on accumulating Bitcoin, its dominance could potentially decrease even further.

Will the altcoin season take the lead?

Meanwhile, the daily TOTAL2 chart indicates that the price is breaking out of descending trendlines. As shown below, the value has reached a series of lower lows (LL) from May to early August.

To clarify, lower lows occur when the price of a cryptocurrency dips to a new low below the previous one, signaling a continuing downtrend. However, at the time of reporting, the altcoin market has reached a lower high (LH), suggesting a significant upward trend could emerge if this momentum continues.

On the other hand, if Bitcoin bulls step in with another round of accumulation, the forecast could be invalidated, and the altcoin season might not materialize.