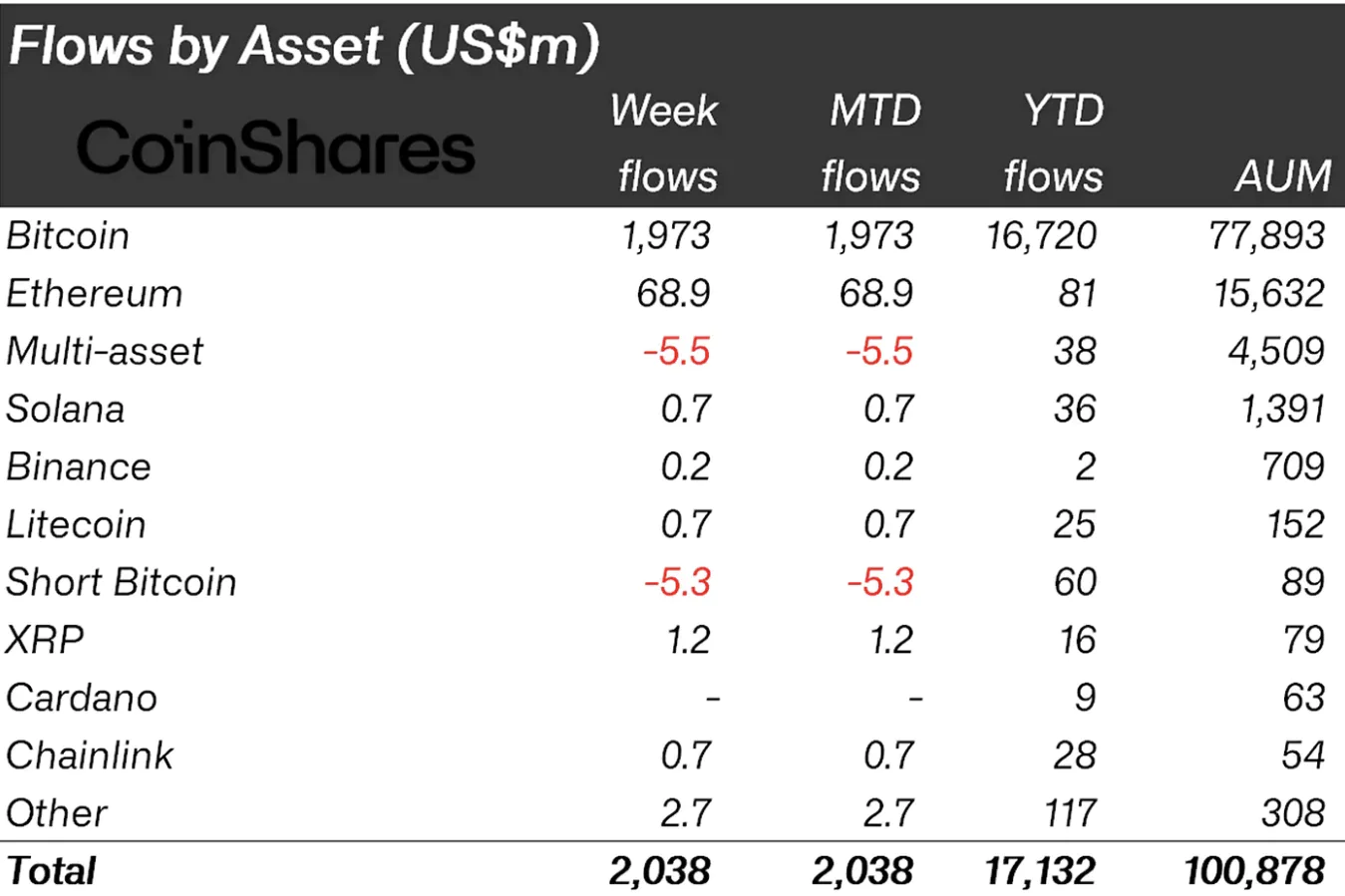

Bitcoin continues to trade within a narrow range around $69,000, displaying extremely low volatility over the past 24 hours. However, there has been a significant surge in capital inflow into cryptocurrency investment products. A staggering $2 billion was invested in cryptocurrency products last week, according to CoinShares. Their report indicates that around $1.97 billion of this was allocated to Bitcoin [BTC].

Ethereum [ETH] also saw substantial investment, with an inflow of $69 million. This marks the highest inflow for the altcoin since its peak in March.

Bitcoin’s resurgence is not yet complete

For those unaware, CoinShares publishes a weekly report focusing on investments in digital assets, including cryptocurrencies. Last week, both Bitcoin and Ethereum garnered significant attention. With Bitcoin regaining its dominance, it appears investors are confident in the short-term and long-term potential of these cryptocurrencies.

However, James Butterfill, Head of Research at CoinShares, highlighted several reasons to focus on Bitcoin. According to Butterfill, positive macroeconomic data released last week played a crucial role. He stated,

“We believe this shift in sentiment is a direct response to weaker-than-expected macro data in the US, raising expectations for monetary policy rate cuts. The positive price action saw total assets under management (AuM) surpass the $100 billion mark for the first time since March this year.”

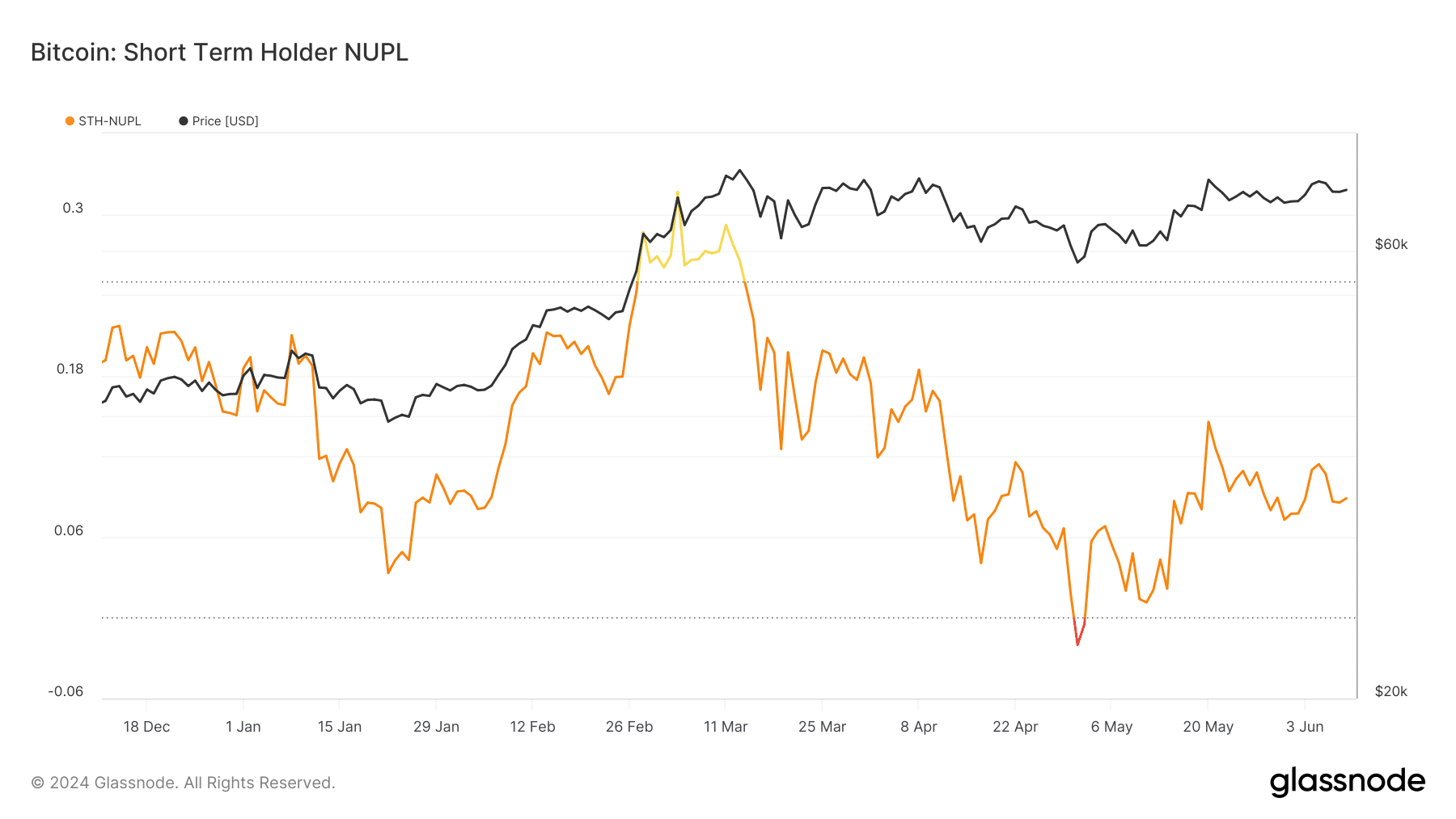

Despite the recent improvement, BTC has been trading sideways for most of the past week. At the time of writing, Bitcoin is priced at $69,373. Analyzing STH-NUPL to assess short-term investor behavior, STH-NUPL stands for Short-Term Holder – Net Unrealized Profit/Loss.

Price might remain flat

This metric evaluates the sentiment of BTC holders who have possessed the coin for less than 155 days. Currently, the metric’s value is 0.085, placing it in the hope zone (orange). This suggests that most short-term holders lack confidence in a near-term price increase for Bitcoin. Consequently, demand for the coin might remain low, indicating that the price could continue to trade sideways.

Related: A 41% Increase in XRP Will Lead to a “Legendary” Price Surge

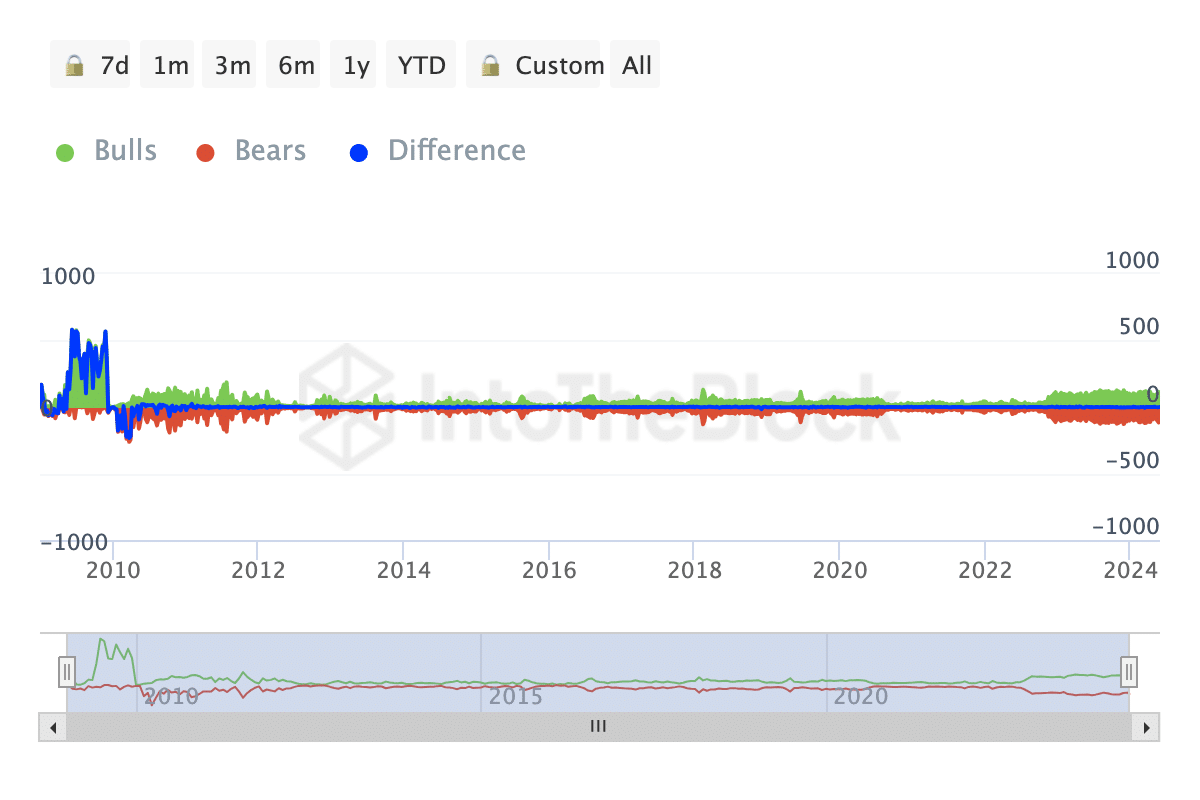

On the price front, the Bulls and Bears indicator from IntoTheBlock provides additional insights. This metric tracks the activity of addresses that have bought or sold 1% of the trading volume in the past 24 hours. If the result leans towards the bulls, it indicates that the majority of the volume comprises buy orders. Conversely, a bearish trend implies increasing selling pressure.

For Bitcoin, the Bulls and Bears indicator stands at 0 at the time of writing. This neutrality suggests that BTC might continue trading within a narrow range for the time being. Looking ahead, bearish market conditions could push BTC down to $68,000. However, if market conditions improve, the coin could potentially rise to $71,000 again.