Bitcoin is currently trading at $67,200, maintaining low volatility over the past 24 hours. The rise in Bitcoin adoption has spurred investment interest from retail traders. While traditional and institutional investors have been a major contributor to the recent price surge, retail traders have also been catching on to the trend. Typically, retail investors follow the lead of crypto whales, benefiting during bull runs and bearing the risk of market corrections.

Retail Investors Increase Holdings

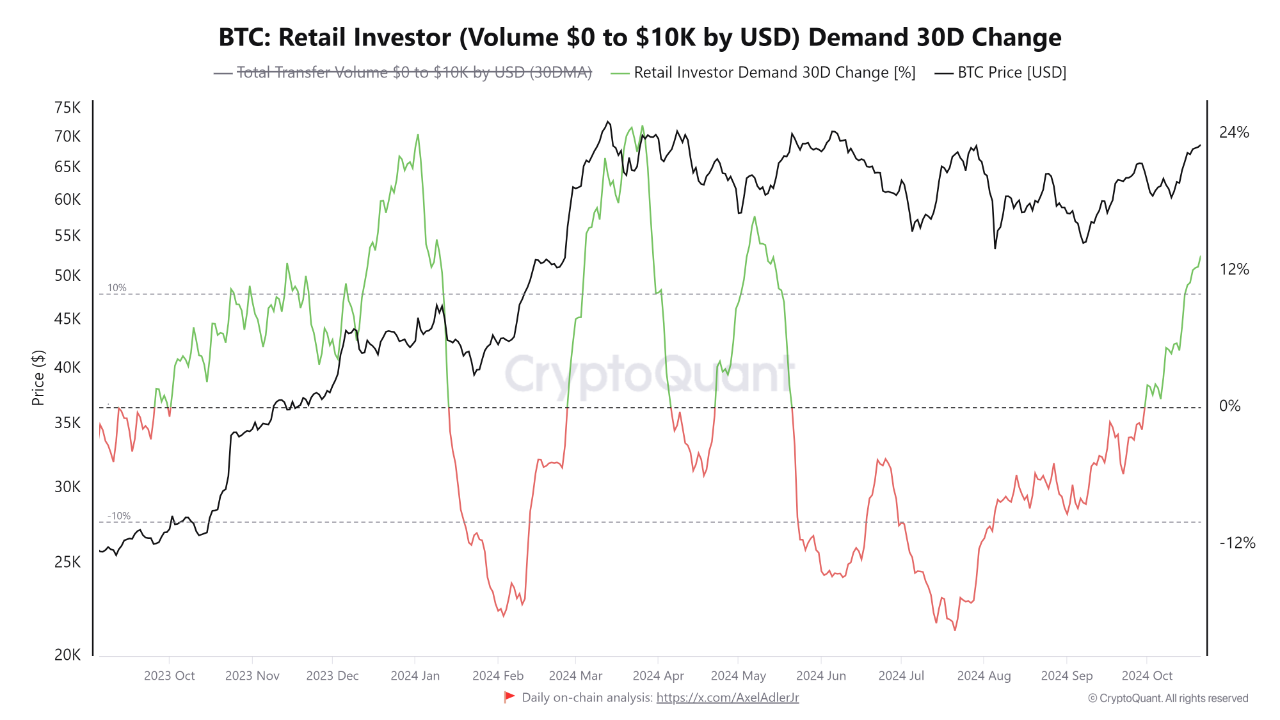

According to a new report from on-chain analytics firm CryptoQuant, retail trading activity has increased in the cryptocurrency market after four months of stagnation. Last month, retail investors increased their holdings of digital assets by 13% following the market’s price breakout. When the value of digital assets soars, retail investors are often quick to jump in, aiming to maximize profits.

This scenario only happened in March, and since then, the crypto industry has faced a correction as retail investors restructure their asset portfolios. The peak in Q1 2024, which attracted participation from investors of all levels, came from the US Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs. The influx of new money pushed Bitcoin prices past $73,000, while also increasing retail holdings.

The on-chain transaction volume up to $10,000 is a way to track retail investor activity, which reflects non-institutional market sentiment. This group’s trading activity is much more sensitive to sentiment and market news than fundamentals, but it still provides important information about capital flows on the network.