President Donald Trump is expected to sign an executive order on his first day in office that would officially recognize Bitcoin as a US national reserve asset, according to Strike CEO and founder Jack Mallers.

The Bitcoin 2024 bill, proposed by Senator Cynthia Lummis, a strong cryptocurrency advocate, in July, calls for the Treasury Department and the Federal Reserve to buy 200,000 BTC per year for five years, accumulating a total of 1 million BTC.

This reserve would be held for at least 20 years, removing 5% of the total supply of 21 million Bitcoins from circulation.

According to Perianne Boring, founder of The Digital Chamber, Bitcoin’s limited supply could drive prices up significantly, especially if Trump succeeds in implementing his proposed cryptocurrency policies.

She highlighted the stock-to-flow model, which predicts that Bitcoin could surpass $800,000 by the end of 2025. If this happens, Bitcoin’s market capitalization would reach around $15 trillion, compared to its current valuation of over $2 trillion.

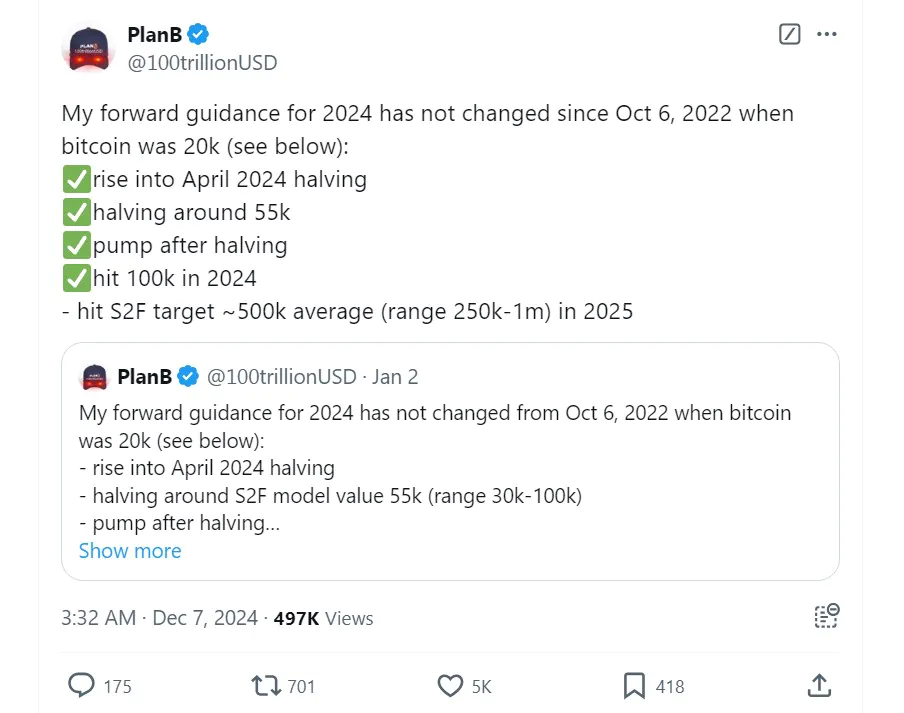

Meanwhile, PlanB, the inventor of the stock-to-flow model, predicts that Bitcoin will average around $500,000 by 2025. However, he is also optimistic that the price could hit $1 million.

The stock-to-flow model’s forecast is based on the assumption that demand for Bitcoin will continue to increase. In theory, the US Treasury’s accumulation of 200,000 BTC per year could bolster confidence in stronger demand in the future, as it could prompt other countries to consider building their own strategic Bitcoin reserves.

Read more: ETH Could Surge to $15K as ETF Inflows Hit Record Highs

BlackRock, a leading asset manager with over $10 trillion in assets under management, has recommended that investors allocate 1-2% of their portfolios to Bitcoin.

The total global reserve assets are currently valued at around $900 trillion. If this theoretical allocation of 2% of resources to Bitcoin becomes a reality, the price of Bitcoin could rise to around $900,000.