In line with the 0.6% forecast probability from the CME FedWatch Tool, the U.S. Federal Reserve announced on June 12 that it would keep the benchmark interest rate unchanged.

Following a two-day Federal Open Market Committee (FOMC) meeting, members decided to maintain the rate at 5.25% – 5.50% for the seventh consecutive time. Notably, this decision aligned with Wall Street’s expectations. Commenting on this with a hint of criticism, Anthony Pompliano recently stated, “It’s arrogant for the central bank to think they can set interest rates… the market is the real rate setter.”

After the announcement, the cryptocurrency market experienced a significant downturn. As of June 14, Bitcoin had dropped to $66,000, its lowest price in two weeks.

Only one rate cut expected by the end of 2024

FOMC members have revised their projections for the number of anticipated rate cuts this year. Initially, in March, the FOMC forecasted three rate cuts by the end of 2024. Now, they have reduced this expectation to just one rate cut.

The revised forecast indicates that the FOMC now predicts only one 0.25 percentage point rate cut before the end of this year. This announcement surprised some analysts who had anticipated more aggressive rate cuts. A few analysts believe the Fed may need to reconsider and potentially adjust this forecast in the coming months if economic conditions change.

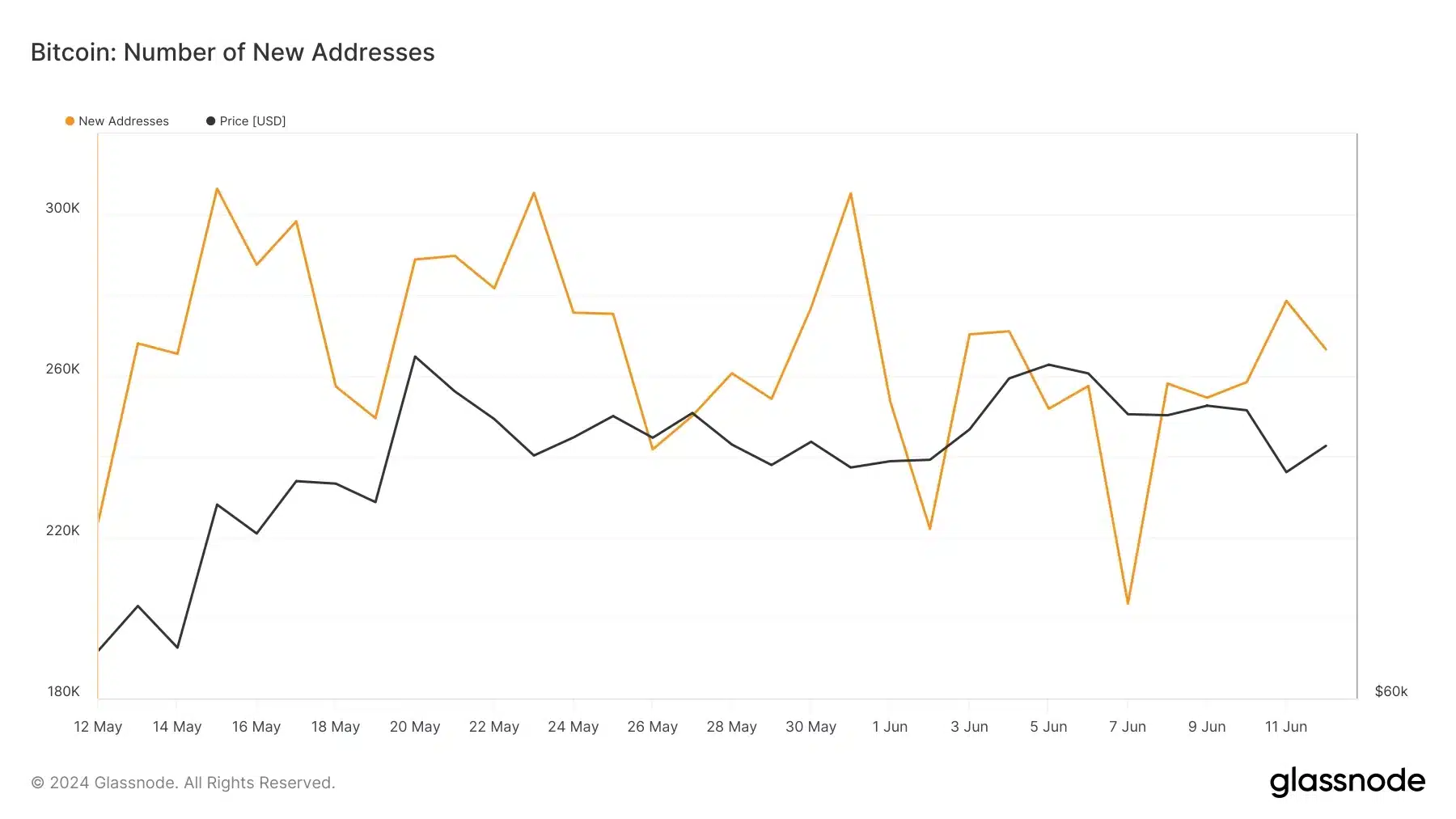

Amid all this, Bitcoin is experiencing a decline in the number of new addresses, according to Glassnode’s analysis.

Bitcoin remains resilient

Despite Bitcoin’s recent price drop, not all metrics point to a negative outlook. According to Santiment’s data analysis, there has been a notable spike in the Social Dominance metric.

Related: Many OKX Users Lose Funds Due to Identity Theft

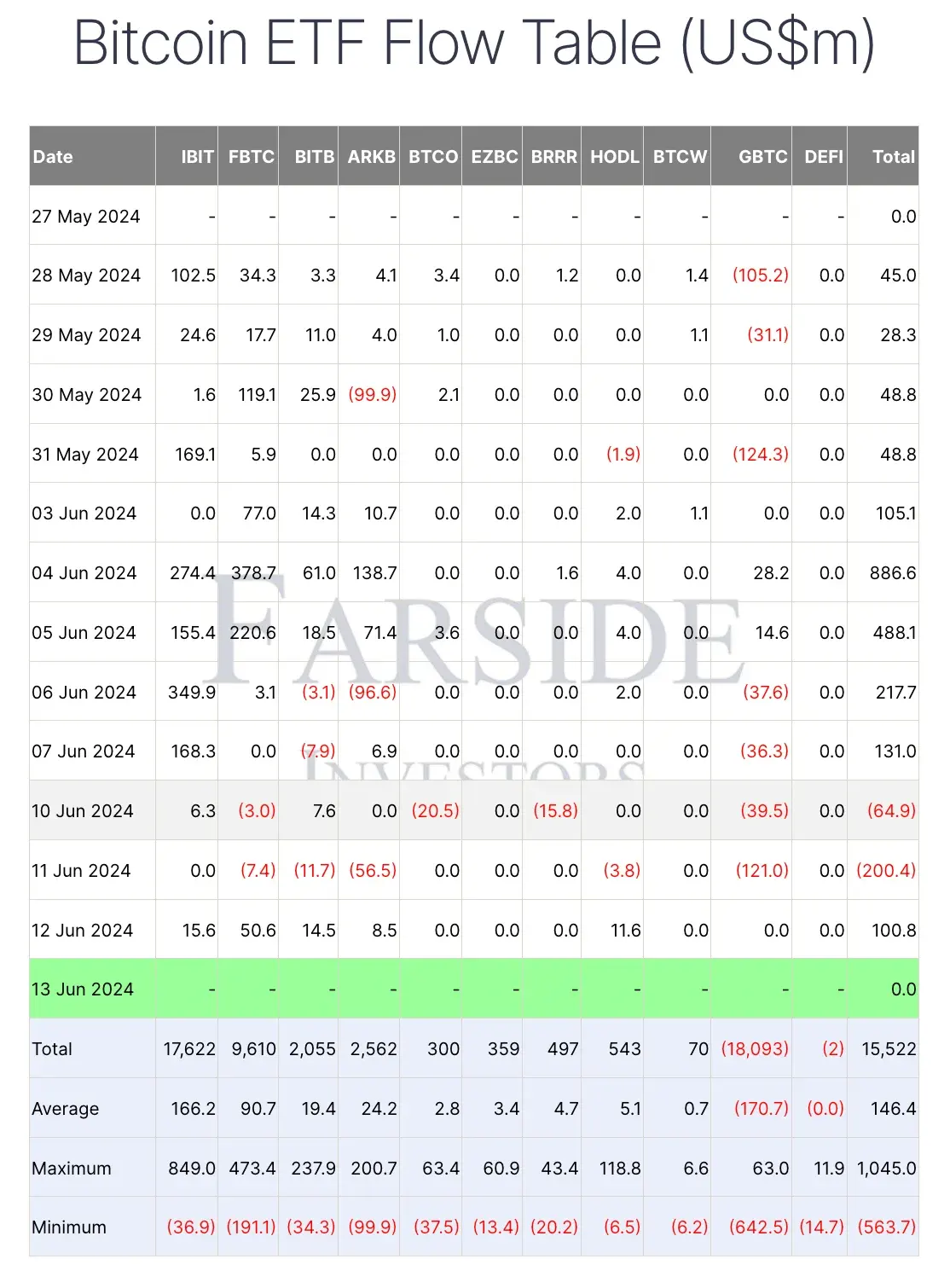

Additionally, the Relative Strength Index (RSI) has not yet indicated any clear signs of buying or selling pressure. Moreover, Bitcoin’s spot Exchange-Traded Fund (ETF) saw an inflow of $100.8 million, marking a shift after two consecutive days of outflows. Pompliano aptly put it when he said, “Bitcoin is the only asset I know of that inherently has the potential to outperform inflation.”