Bitcoin has currently dropped to $56,750, a significant decline from its 24-hour peak of $59,600. This recent market correction presents a potential opportunity for long-term investors, with several key factors possibly driving Bitcoin’s price to $100,000 by year-end.

Matt Hougan, the Chief Investment Officer at Bitwise Asset Management, outlined his reasoning in a recent investor note on Wednesday, one day before the official U.S. inflation data showed a decrease in June.

He pointed out that inflows into U.S. spot Bitcoin ETFs, a supply shortage following the halving event, the launch of spot Ethereum ETFs, a reduction in interest rates by the Federal Reserve, and the shifting political landscape in Washington could help Bitcoin prices rebound.

Hougan commented, “The cryptocurrency market is currently experiencing a peculiar phase. All short-term news is negative, while all long-term news is positive. This dichotomy is creating an incredible potential opportunity for long-term investors.”

The U.S. Bureau of Labor Statistics reported on Thursday that the Consumer Price Index (CPI) decreased by 0.1% in June, following a flat growth in May. This marks the first decline in the index since May 2020.

“Tonight’s CPI release has caught everyone’s attention,” QCP Capital noted in a brief statement on Thursday. “This optimism has been reflected in the continuous rise of stock prices, but it has yet to be priced into the cryptocurrency market.”

Related: Silicon Valley Mogul Sends $50,000 in BTC to AI Bot

The drop in inflation could reinforce the Federal Reserve’s resolve to start cutting interest rates this year, benefiting risk assets like Bitcoin.

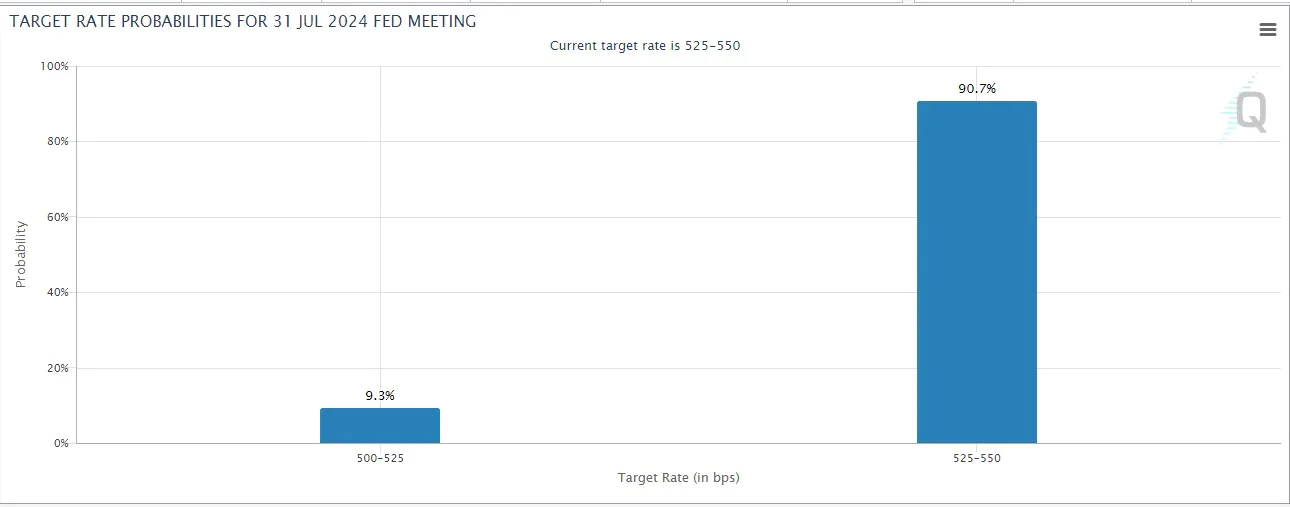

According to CME’s FedWatch Tool, this rate cut could happen as early as September, with traders predicting an 84.6% chance of it occurring. This timing could be favorable for investors, as Bitcoin’s supply continues to dwindle following the halving, forcing miners to capitulate due to the increasing difficulty of mining the asset.

While concerns from Mt. Gox creditors and Bitcoin sales by Germany have impacted investor sentiment, these factors are unlikely to have a significant effect in the face of strong ETF demand.

Since their launch in January, spot Bitcoin ETFs have amassed around $15 billion in new assets, though they have yet to gain approval from major asset management platforms such as Morgan Stanley and Wells Fargo.

Hougan stated, “When that happens—I suspect by the end of this year—we could see billions more flowing in.”