In a recent report, researchers from Kaiko examined how potential U.S. interest rate cuts and other significant economic events could impact Bitcoin. Four charts provided by analysts outline what to expect from BTC in the coming weeks.

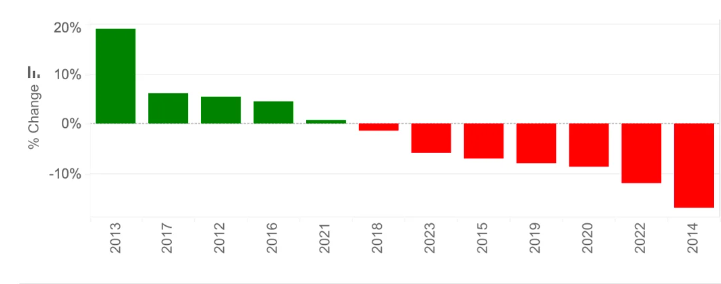

Monthly Bitcoin price changes in September

Historically, the third quarter has been a difficult period for Bitcoin and the cryptocurrency market, with September often yielding the worst returns. Kaiko noted that Bitcoin experienced declines in seven of the last twelve Septembers.

In 2024, this trend has continued, with Bitcoin dropping 7.5% in August and an additional 6.3% so far in September. As of this writing, Bitcoin is trading 20% below its all-time high of nearly $73,500, which was recorded over five months ago.

However, according to Kaiko Research, the upcoming U.S. interest rate cuts could serve as a catalyst for risk assets like Bitcoin. Alvin Kan, CEO of Bitget Wallet, echoed this sentiment.

“At the Jackson Hole meeting, Federal Reserve Chairman Jerome Powell hinted that it might be time to adjust policy, sparking expectations for future interest rate cuts. The U.S. Dollar Index responded with a sharp decline and is now hovering around 100. With a rate cut in September becoming a consensus expectation, the official start of rate-cut trading could enhance overall market liquidity, providing momentum for cryptocurrency assets,” said Kan.

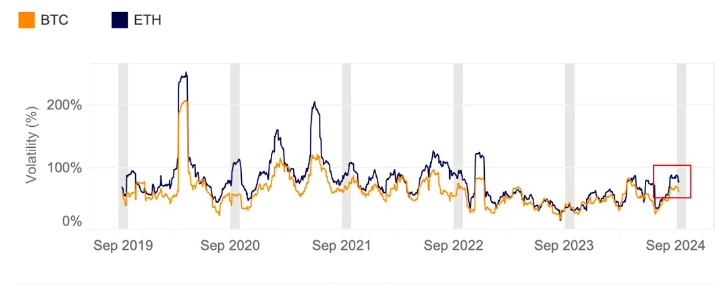

30-Day Historical Volatility

According to the report, September is likely to be highly volatile, with Bitcoin’s 30-day historical volatility soaring to 70%. This metric tracks the price fluctuations of an asset over the past 30 days, highlighting the significant price swings during this period.

Bitcoin’s current volatility is nearly double that of last year and is approaching the peak levels seen in March, when BTC reached an all-time high of over $73,000.

Ethereum (ETH) has also experienced increased volatility, surpassing both March levels and Bitcoin’s, driven by ETH-specific events such as Jump Trading’s liquidations and the launch of an Ethereum ETF.

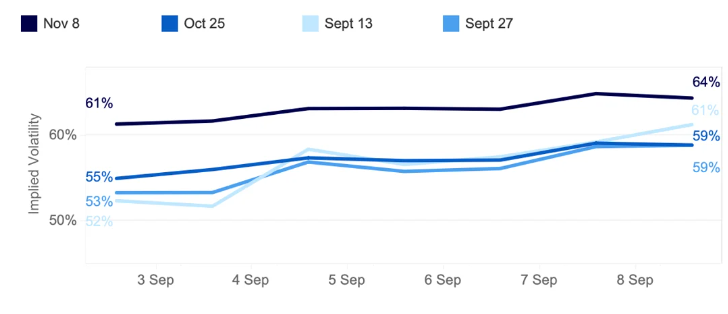

BTC Implied Volatility by Expiry Date

Since the beginning of September, Bitcoin’s implied volatility (IV) has risen after a dip at the end of August. The IV indicator measures the market’s expectations for future price swings based on current options trading activity. A higher IV suggests that traders anticipate more significant price fluctuations in the future, although it does not predict the direction of the movement.

Notably, short-term options nearing expiration have seen the most significant increase, with the September 13 expiry date rising from 52% to 61%, surpassing end-of-month contracts. For non-experts, when short-term implied volatility exceeds longer-term measures, it indicates heightened market stress, known as a “reverse structure.”

Risk managers often view a reverse structure as a signal of increasing uncertainty or market tension. Consequently, they may interpret this as a warning to reduce risk exposure in their portfolios by limiting investments in volatile assets or hedging against potential downside risks.

“These market expectations align with last week’s U.S. jobs report, which dampened hopes of a 50-basis-point rate cut. However, the upcoming U.S. CPI data could still shift the odds,” Kaiko researchers noted.

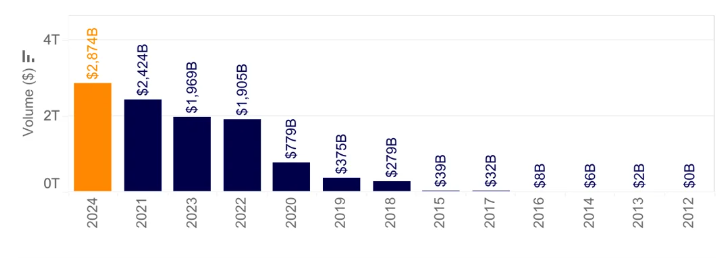

Trading Volume

The Bitcoin trading volume chart also underscores the current market volatility, highlighting increased trader activity. Cumulative trading volume is approaching a record $3 trillion, marking nearly a 20% rise in the first eight months of 2024, following the previous peak in 2021.

Traditionally, Bitcoin investors view interest rate cuts as a positive catalyst for the market. However, concerns remain about how the market might interpret a larger-than-expected rate cut. Markus Thielen, founder of 10X Research, warned that a 50-basis-point rate cut could be seen as an urgent signal, potentially leading to a pullback from risk assets like Bitcoin.

In a note to clients, Thielen stated: “While a 50-basis-point Fed rate cut may signal deeper concerns for the market, the Fed’s primary focus will be on mitigating economic risks rather than managing market reactions.”

Aside from speculation on interest rate cuts, other factors contributing to cryptocurrency market volatility include the upcoming U.S. election. As reported, the debate between Donald Trump and Kamala Harris is expected to trigger market fluctuations, particularly in Bitcoin and Ethereum.