Bitcoin is still hovering below $100,000, with minor fluctuations over the weekend. This key resistance zone continues to be a major challenge for bulls, as short sellers are fiercely defending the price. A breakthrough above $100,000 is crucial for Bitcoin to continue its upward momentum.

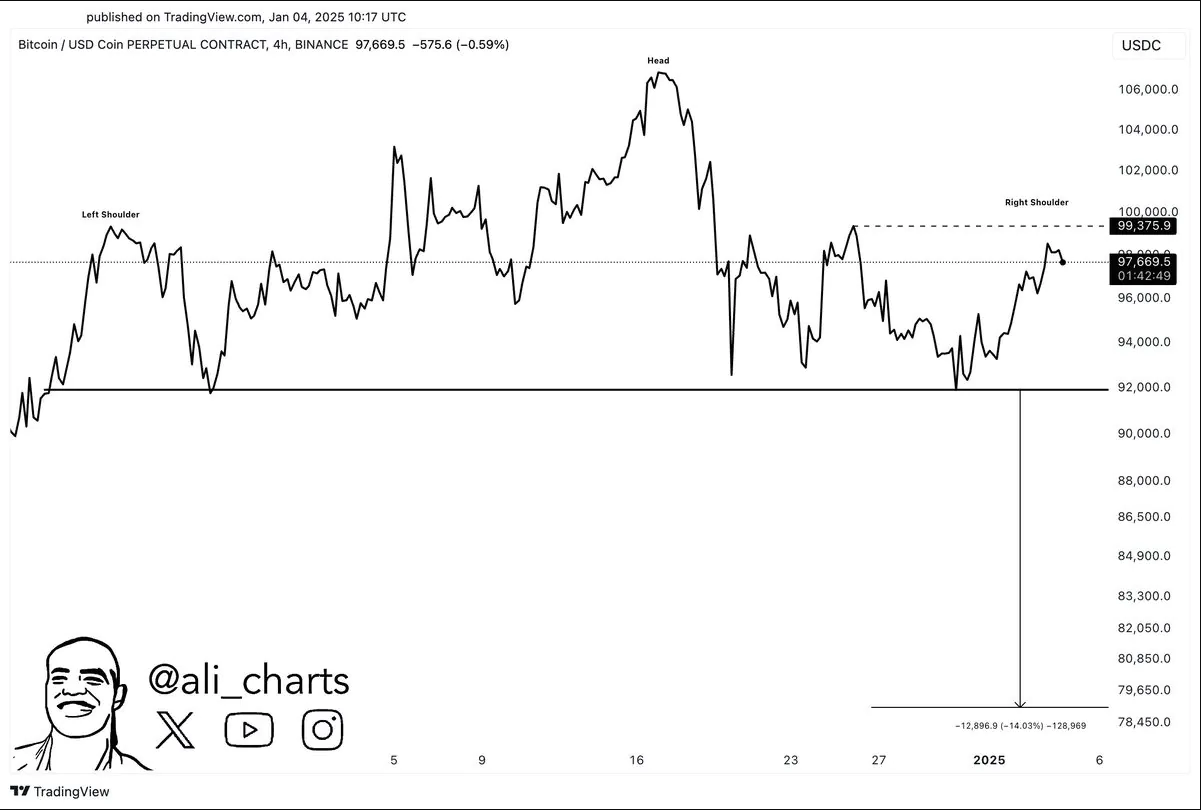

On the price chart, a head and shoulders pattern may be forming, signaling downside risk. However, if Bitcoin breaks above $100,000, this bearish signal will be invalidated, paving the way for a new bull run.

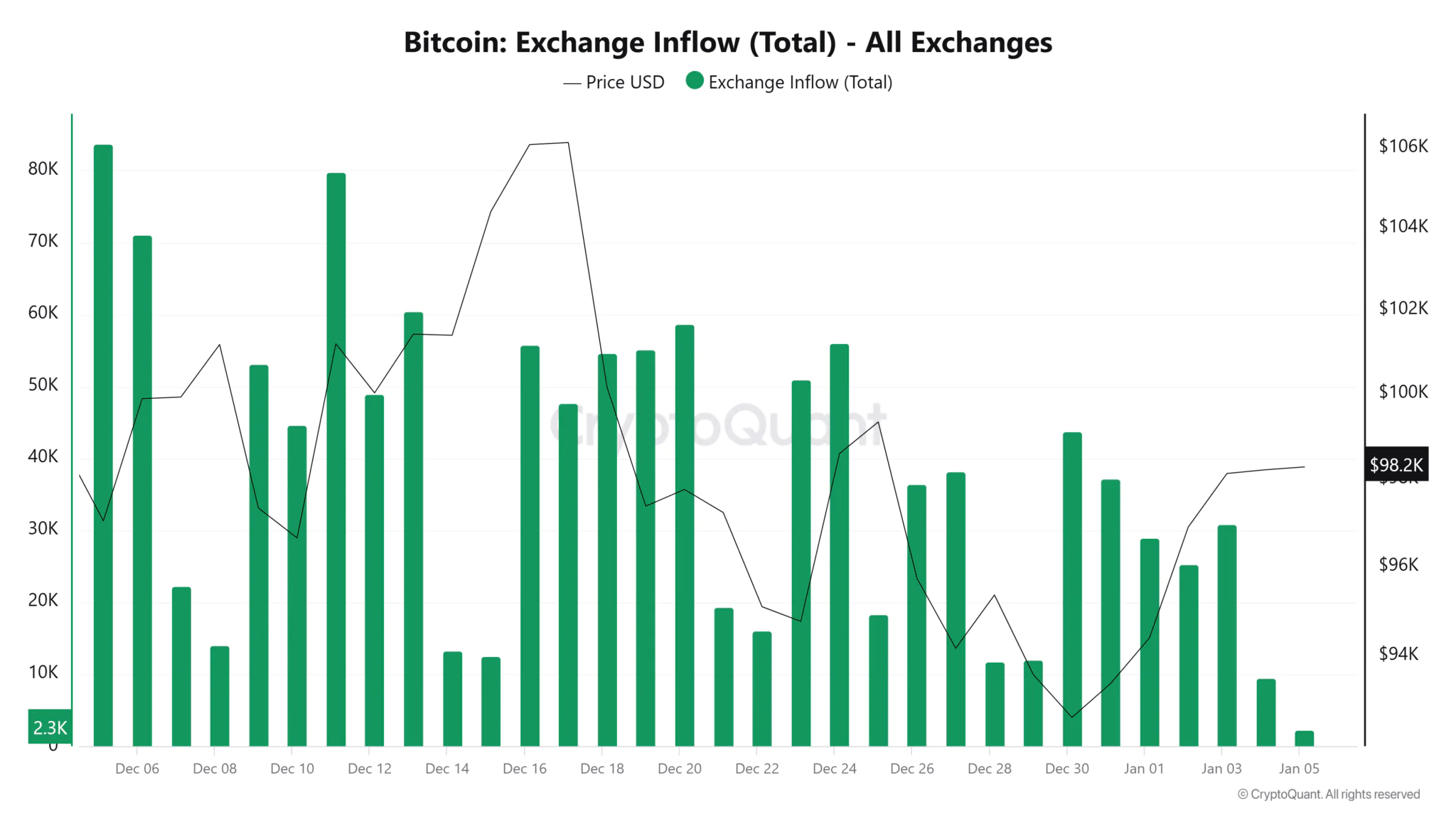

Meanwhile, on-chain metrics paint a more positive picture. The amount of Bitcoin reserves on exchanges has been steadily decreasing recently, indicating that Bitcoin is becoming increasingly scarce. This reflects bullish investor sentiment, as they tend to hold assets rather than sell, thereby reducing selling pressure in the market.

Furthermore, the inflows to exchanges – a key indicator of potential selling activity – have also been steadily decreasing since December 30. The decrease in Bitcoin transfers to exchanges continues to reinforce the positive outlook for Bitcoin prices.

Read more: Trader Earns $1.25 Million in 8 Minutes with BUZZ Tokens

Overall, Bitcoin’s next move will largely depend on its ability to break above the $100,000 resistance level. If successful, this will not only mark an important milestone but could also trigger a stronger bullish wave in the future. Conversely, if it fails, Bitcoin may face correction pressure in the short term. In the volatile cryptocurrency market, investor sentiment and macroeconomic factors will still play a key role in shaping Bitcoin’s trend.