Bitcoin continues to fall for the third consecutive day, hitting $92,000. The correction has pushed Bitcoin to its lowest level since early 2025, wiping out all the gains accumulated over the past 10 days.

However, analysts remain optimistic, saying that Bitcoin has not yet peaked in the current cycle and predict that the price will recover soon. Analyst Mags said that Bitcoin is in a consolidation phase and is currently retesting a local bottom, which is a good opportunity to buy before a new rally. Similarly, Crypto Rover also predicted that a strong rally is imminent.

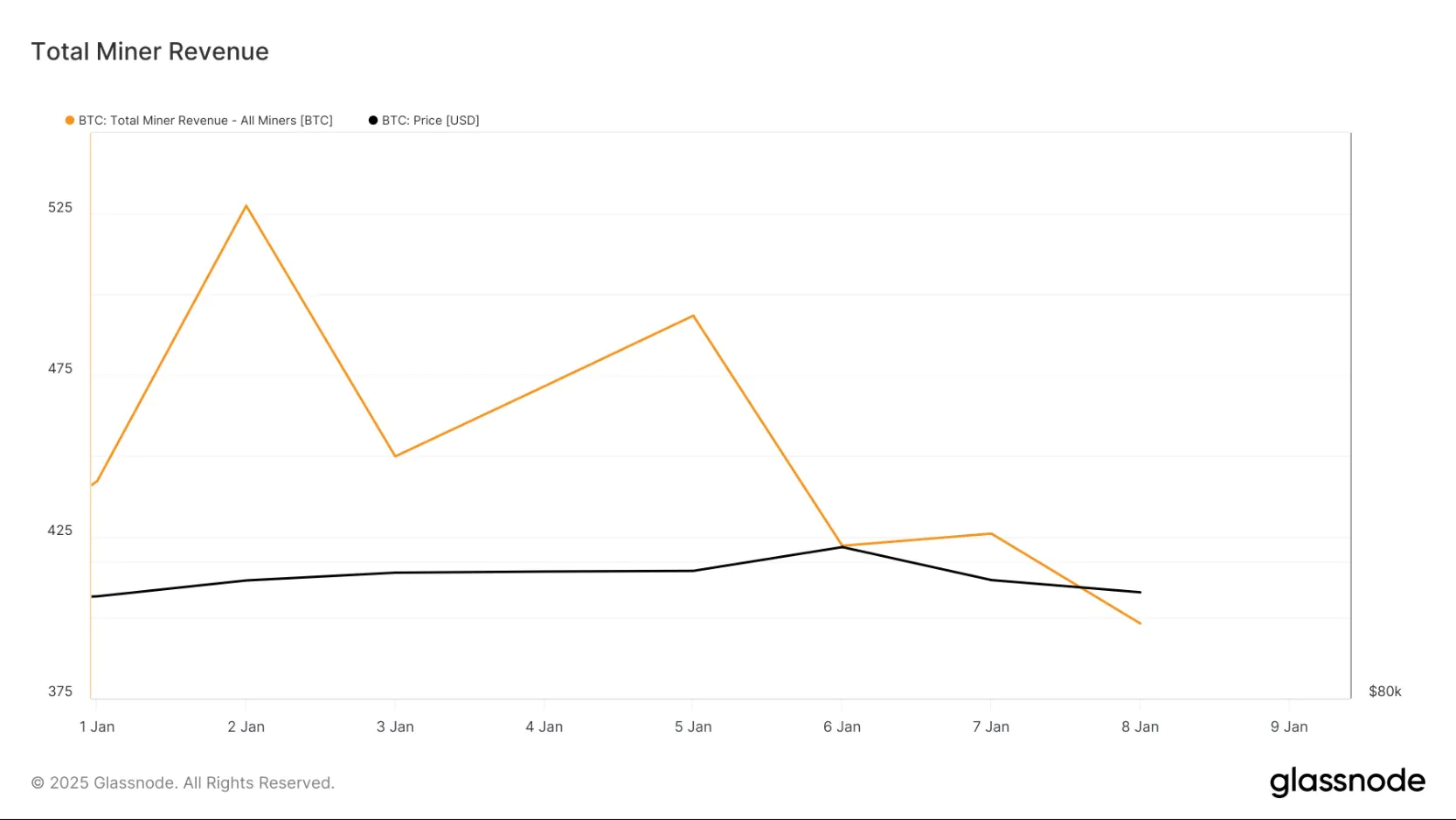

Since its peak of $102,700 on January 6, Bitcoin has fallen by nearly 10%. This decline has hit miners hard, with daily revenue on the Bitcoin network falling to its lowest level in the past 30 days.

As buying pressure wanes, Bitcoin is at risk of falling below $90,000, which could add to the losses for already financially struggling miners.

Miner revenue from transaction fees and block rewards has been steadily declining since January 2. According to data from Glassnode, total revenue is now just 398.2 BTC, down 24% from last week.

Read more: Thailand Pilots Cryptocurrency Payments in Phuket

This drop in revenue means that miners are earning less profit from validating transactions and maintaining network security. This is a common consequence of falling Bitcoin prices, which reduces the value of the rewards miners receive.

In addition, as many miners rush to sell Bitcoin to minimize losses, the amount of BTC held in miner wallets has been gradually decreasing. Currently, this figure is 1.79 million BTC, down 0.005% since January 2.