Bitcoin has seen notable price fluctuations in the last 24 hours, dipping to $80,600 before rebounding to its current level of $83,500. Selling pressure remains, though the most intense phase of the sell-off may have already passed.

On-chain data suggests that the whale transaction ratio on Binance is showing signs of decline. This metric measures the proportion of inflows from the 10 largest addresses relative to total exchange inflows. A high value typically indicates increased selling pressure from large holders.

Since November 2024, this ratio had been steadily rising but has recently started to decline, offering a glimmer of hope for the market. However, Bitcoin is still trading about 11% below its January peak of $92,000.

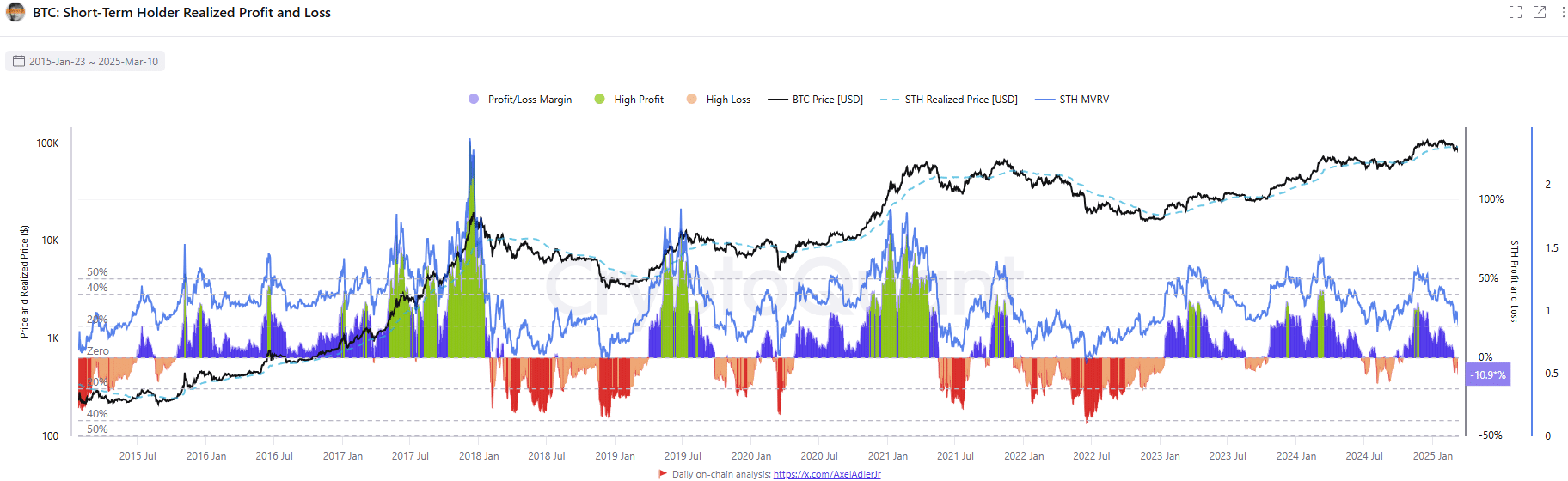

Another key factor to consider is the adjusted profit/loss ratio of short-term investors. Currently sitting at -10.9%, this figure mirrors past sideways periods, such as June–August 2024 and August–October 2023. Historically, Bitcoin has tended to bottom out within two months during similar phases before entering a prolonged accumulation period lasting two to three months. If history repeats itself, BTC could consolidate around the $72,000 mark in the near future.

Read more:

The “Volume Racing” Event of BingX: A Chance to Win 50,000 USDT!

How to Participate in the Newton Airdrop

Additionally, the supply-adjusted Coin Days Destroyed (CDD) metric—used to gauge the movement of long-held coins—is also trending downward. Since December, its 7-day moving average has consistently formed lower highs, reflecting a decline in selling pressure from long-term holders.

These indicators suggest that the worst of the sell-off may be over, paving the way for an accumulation phase. While selling pressure still lingers, the market could soon enter a more stable period.