Bitcoin Bull Cycle

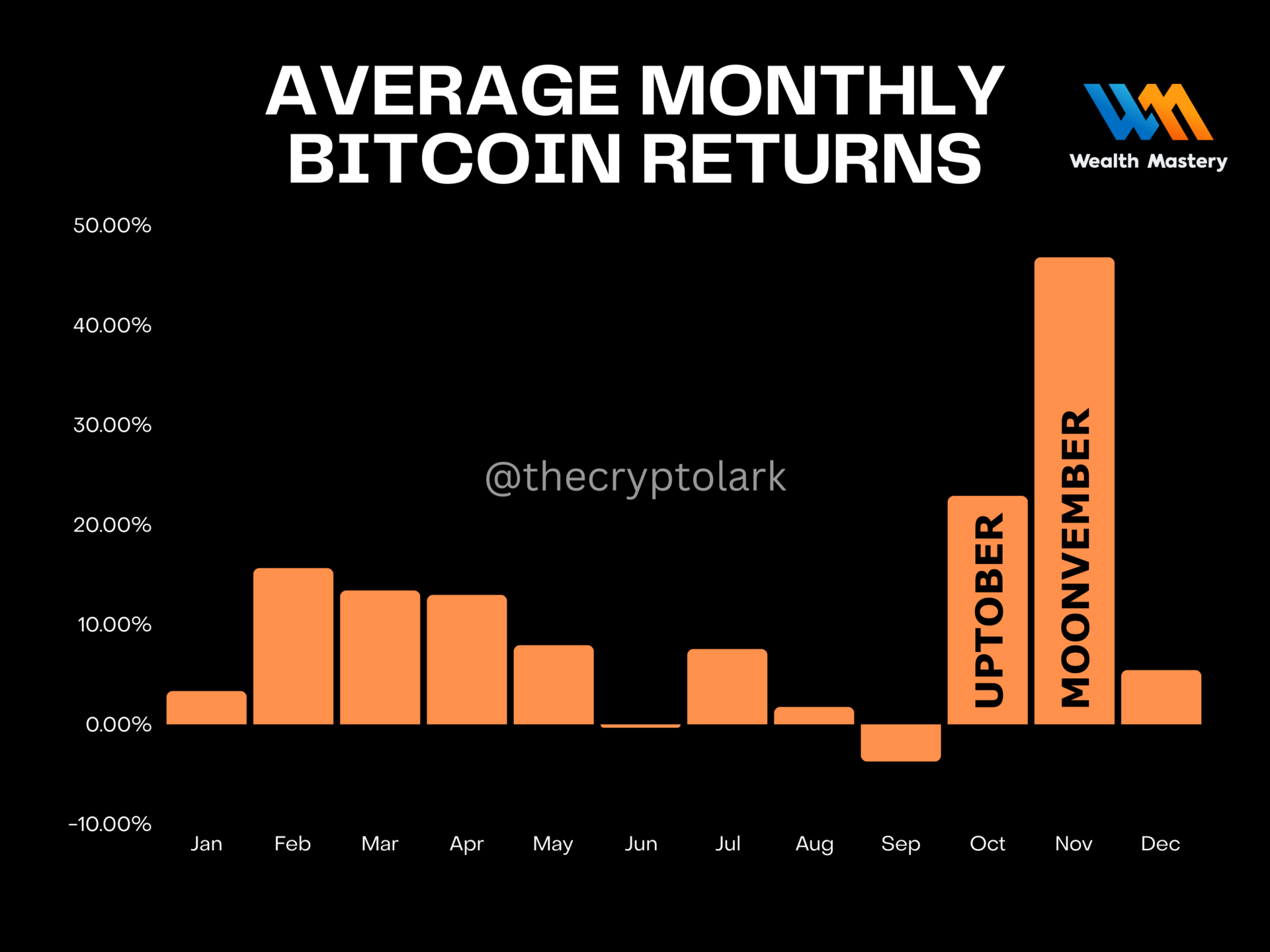

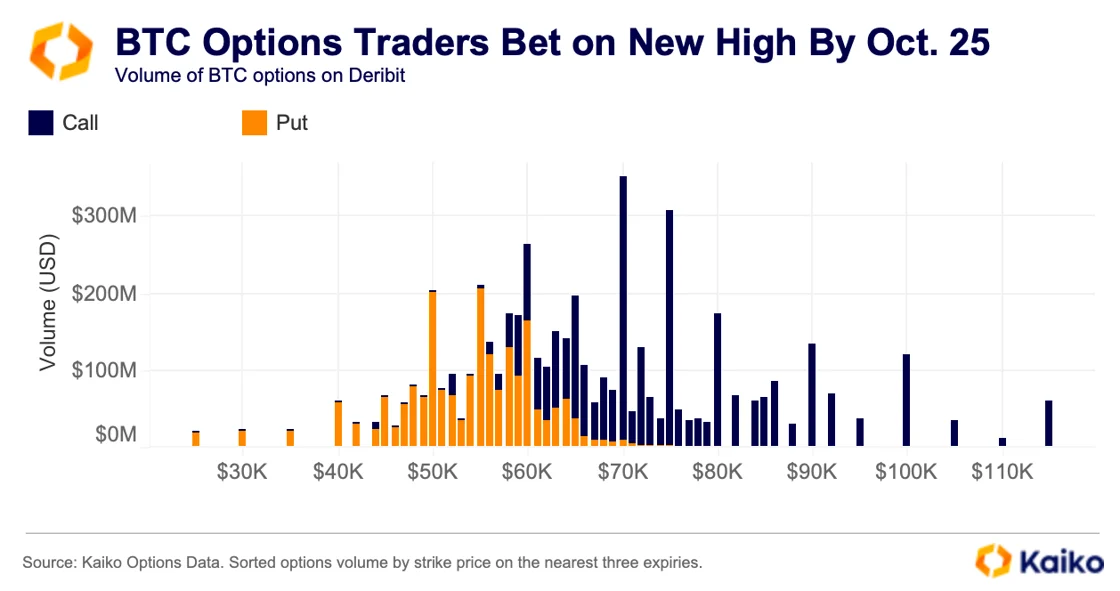

According to research, Bitcoin’s bull cycle usually starts 170 days after the halving event and peaks after 480 days. With the most recent halving taking place about 170 days ago, many believe this could be a sign of a strong Bitcoin bull run. Increased BTC options trading reflects investor optimism Recently, options trading volume has increased significantly, signaling that investors are adjusting their strategies to take advantage of market volatility. One notable trend is the sharp increase in trading volume for BTC options expiring at the end of October.

This shift reflects investors adjusting their strategies in anticipation of a large price move ahead. The increase in options trading activity coincides with the recent announcement by the US Federal Reserve of interest rate cuts, starting this month. The first 50 basis point cut brought optimism to the market, with many investors expecting further cuts before the end of the year. This has driven an increase in trading volume for contracts with strike prices above $100,000, especially for options expiring on December 27.

The impact of the weakening dollar and the Fed’s decision to ease quantitative tightening measures has yet to be fully realized. However, market sentiment is showing signs of improvement as traders begin to readjust their strategies.

2024 US Presidential Election

Political upheaval sparks Bitcoin debate as Trump and Harris endorse crypto The 2024 US presidential election has sparked a discussion about Bitcoin as both major candidates have expressed interest in crypto. Former President Donald Trump, once an opponent of crypto, has now turned to supporting digital assets. In May of this year, he began accepting crypto donations for his campaign, quickly gaining traction. By June, Trump publicly endorsed Bitcoin mining and wanted the domestic industry to capture the remaining Bitcoin supply, clearly affirming his pro-crypto stance.

In late July, Trump made headlines when he attended the Bitcoin Conference in Nashville as a keynote speaker, where he proposed the idea of establishing a national strategic reserve fund using Bitcoin. On September 16, he further solidified his position in the crypto world by introducing “World Liberty Financial” – a decentralized finance initiative he initiated.

Vice President Kamala Harris, on the other hand, is also moving closer to the crypto industry, albeit with a more cautious attitude. After a period of silence, she has begun to speak out, showing a growing interest in the field. Recently, Harris’ team released a policy document, pledging to “encourage the development of innovative technologies such as AI and digital assets,” marking a recognition of the importance of cryptocurrencies like Bitcoin.

Analysts Predict Bullish Trend Despite Bitcoin’s Recent Drop

According to data from CoinMarketCap, a “long squeeze” in the perpetual futures market caused the price of Bitcoin to drop more than 3% in the previous day, resulting in $49 million in liquidations from long positions. CryptoQuant also pointed out that the futures market has become overheated with open interest surpassing $19 billion, a condition that Coinglass says typically leads to BTC price declines.

As Bitcoin enters October, many crypto experts and macro analysts have weighed in on what’s coming next. One of the main themes they’ve focused on is the increase in global liquidity, which is seen as a key driver for Bitcoin. Julien Bittel, Head of Macro Research at Global Macro Investor, highlighted that the global money supply (M2) has started to increase again, which has historically been a positive sign for Bitcoin.

Julien believes that Bitcoin tends to react quickly to such liquidity injections. Given the current macroeconomic environment, he predicts that we may be approaching “the last opportunity to buy before the Banana Zone really kicks in.” Crypto analyst Michaël van de Poppe also has a very optimistic target for Bitcoin, predicting that BTC could reach between $90,000 and $100,000 by the end of 2024.