Bitcoin continued its downward trajectory last night, plunging to a low of $82,200.

Mounting economic uncertainty, Nvidia’s upcoming earnings report, and the expiration of large BTC options contracts are exerting significant downward pressure on Bitcoin’s price. This drop marks its lowest level since November 2024. Over the past three days, more than $1 billion in leveraged long positions have been wiped out. Analysts attribute the prevailing bearish sentiment primarily to growing fears of a global economic downturn. However, weakness in the derivatives market and lackluster corporate earnings are also keeping Bitcoin below the $90,000 threshold.

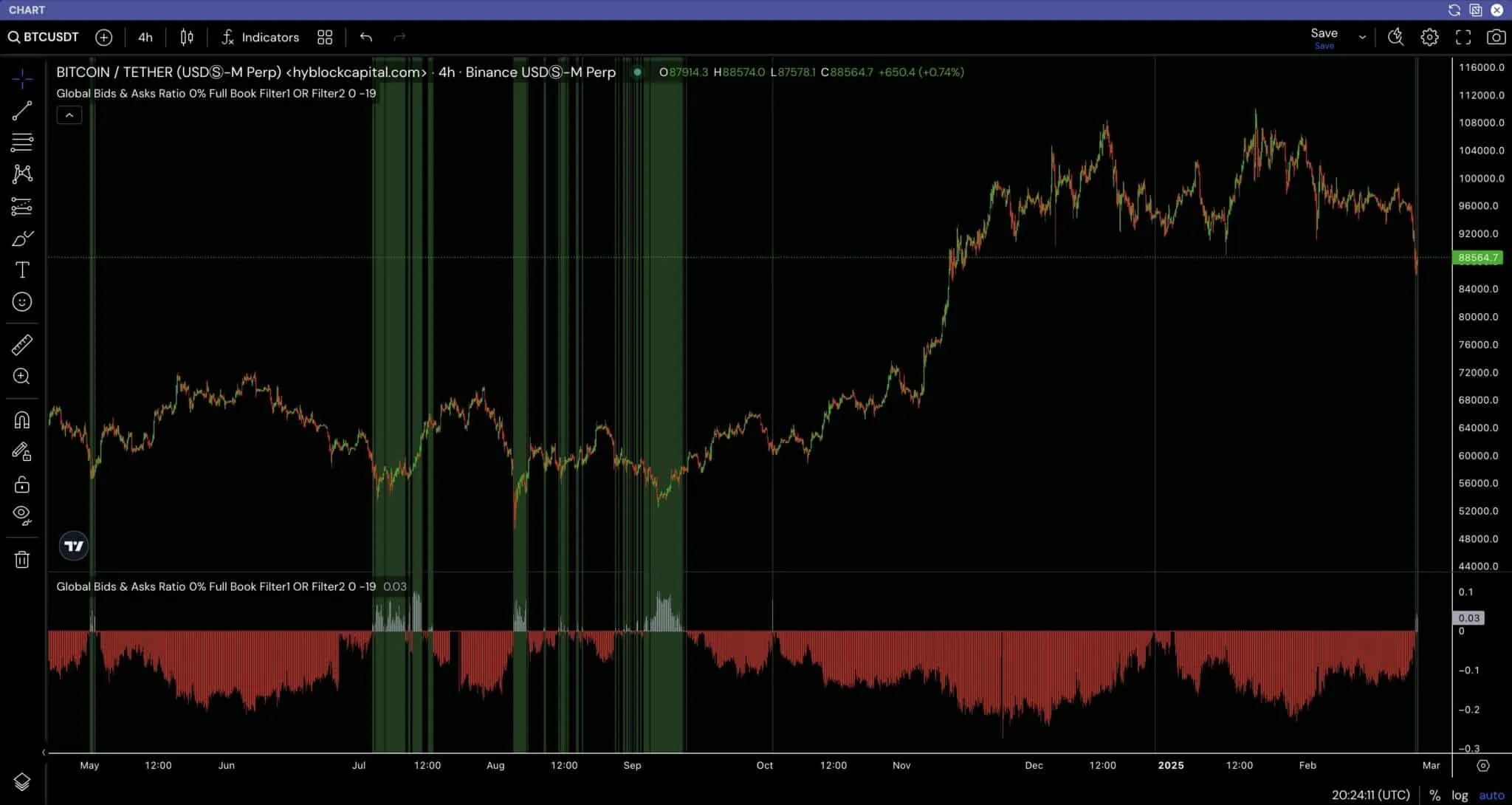

An analysis of key market metrics has revealed mixed sentiments among traders. The Global Bid-Ask Index, which aggregates data from over 1,400 cryptocurrencies, offers valuable insight into the prevailing sentiment in the spot market.

Recent shifts in the Global Buy-Sell Ratio indicate a potential market bottom, a pattern that often precedes a price reversal. Additionally, histogram data highlights a surge in buying pressure, contrasting sharply with the persistent downtrend seen between May and October 2024. This reversal suggests Bitcoin may have reached a crucial support level, sparking increased demand.

Short-term holders have displayed panic-driven behavior throughout Bitcoin’s decline. The Short-Term Holder SOPR chart shows a sharp drop below 1, confirming widespread sell-offs at a loss. This indicates that investors who bought Bitcoin at higher prices have been liquidating their holdings out of fear that the downturn will continue.

Bitcoin’s drop to $82,200 has intensified this reaction, mirroring previous sell-offs triggered by major market corrections. If the decline continues, further panic selling could emerge, exacerbating volatility.

However, experienced traders view this as a potential accumulation zone, capitalizing on market fear to establish long-term positions.