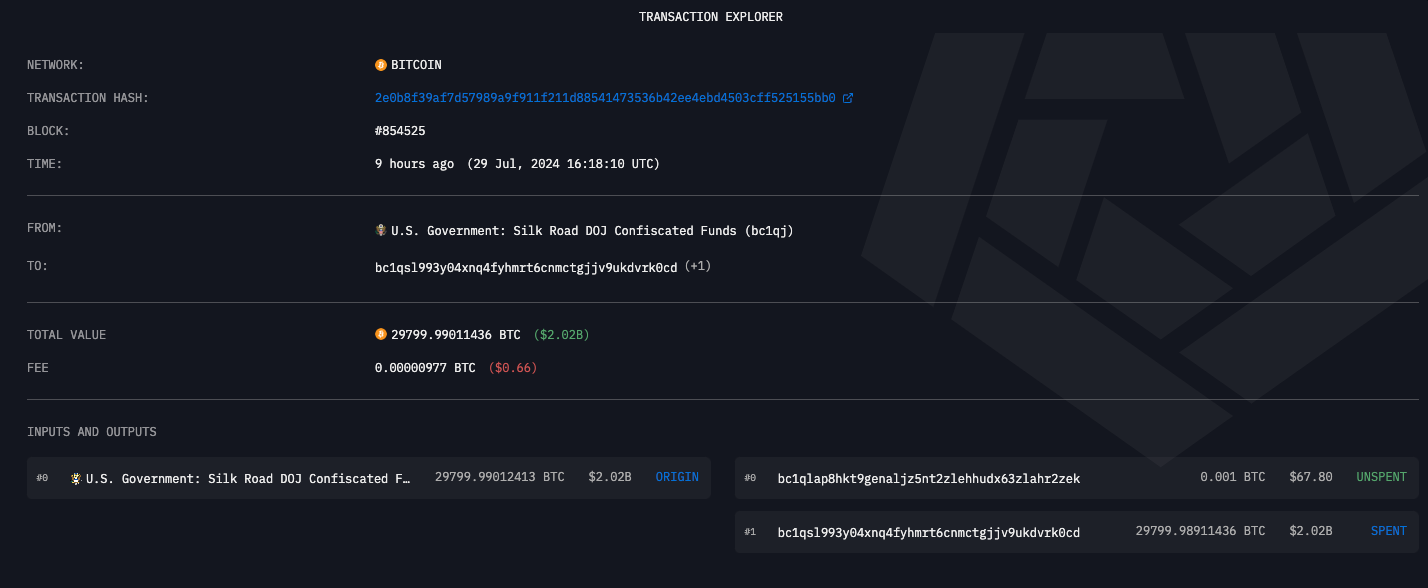

On July 29, the U.S. government moved $2 billion worth of Bitcoin, just two days after former President Donald Trump pledged to create a national Bitcoin reserve if re-elected. This transaction involved 29,800 BTC, which were confiscated from the Silk Road market in 2022. According to Arkham Intelligence, the Bitcoin was transferred from a government wallet to an unidentified address, and then to another address.

Trump and RFK Jr. Announce Bold Bitcoin Plans at Bitcoin Conference 2024

During the Bitcoin Conference 2024, Trump announced that the U.S. would maintain a Bitcoin reserve and proposed several pro-cryptocurrency policies. He stated his goal to transform the U.S. into the “crypto capital of the world,” including plans to replace SEC Chairman Gary Gensler. Trump’s remarks sparked discussions about Bitcoin’s role in U.S. financial strategy.

Independent presidential candidate Robert F. Kennedy Jr. has also shared his plans regarding Bitcoin. He proposed signing an executive order to transfer the government’s Bitcoin holdings to the Treasury and suggested purchasing 500 BTC daily until the U.S. reaches 4 million BTC. This plan represents a significant move towards increasing the nation’s Bitcoin reserves.

At the Bitcoin Conference 2024 in Nashville, Tennessee, Senator Cynthia Lummis introduced legislation to establish Bitcoin as a strategic reserve asset for the United States. She proposed that the government purchase 5% of the total Bitcoin supply, likening this initiative to the “Louisiana Purchase” of 1803. This proposal aims to hold Bitcoin as a Treasury asset, integrating it into the nation’s financial strategy.

U.S. Government Holds $12 Billion in BTC and Other Cryptocurrencies

According to Arkham Intelligence, the U.S. government currently holds over 183,000 Bitcoin, valued at approximately $12 billion. This makes the United States the largest holder of cryptocurrencies. In addition to Bitcoin, the U.S. also possesses 50,000 Ether, 121 million USDT, 40,000 BNB, and more than 10 million USD Coin in its cryptocurrency reserves.